[Learnings] Analyzing airlines stock price volatility during COVID-19 pandemic through internet search data

Extremely interesting take on analyzing tock volatility through internet data. Here are some of my insights from this:

-

The approach is quite novel as it utilises custom metrics from social media and search trends as predictors in a GARCH model. It is a fairly unique way of determining the impact of public sentiment on financial markets.

-

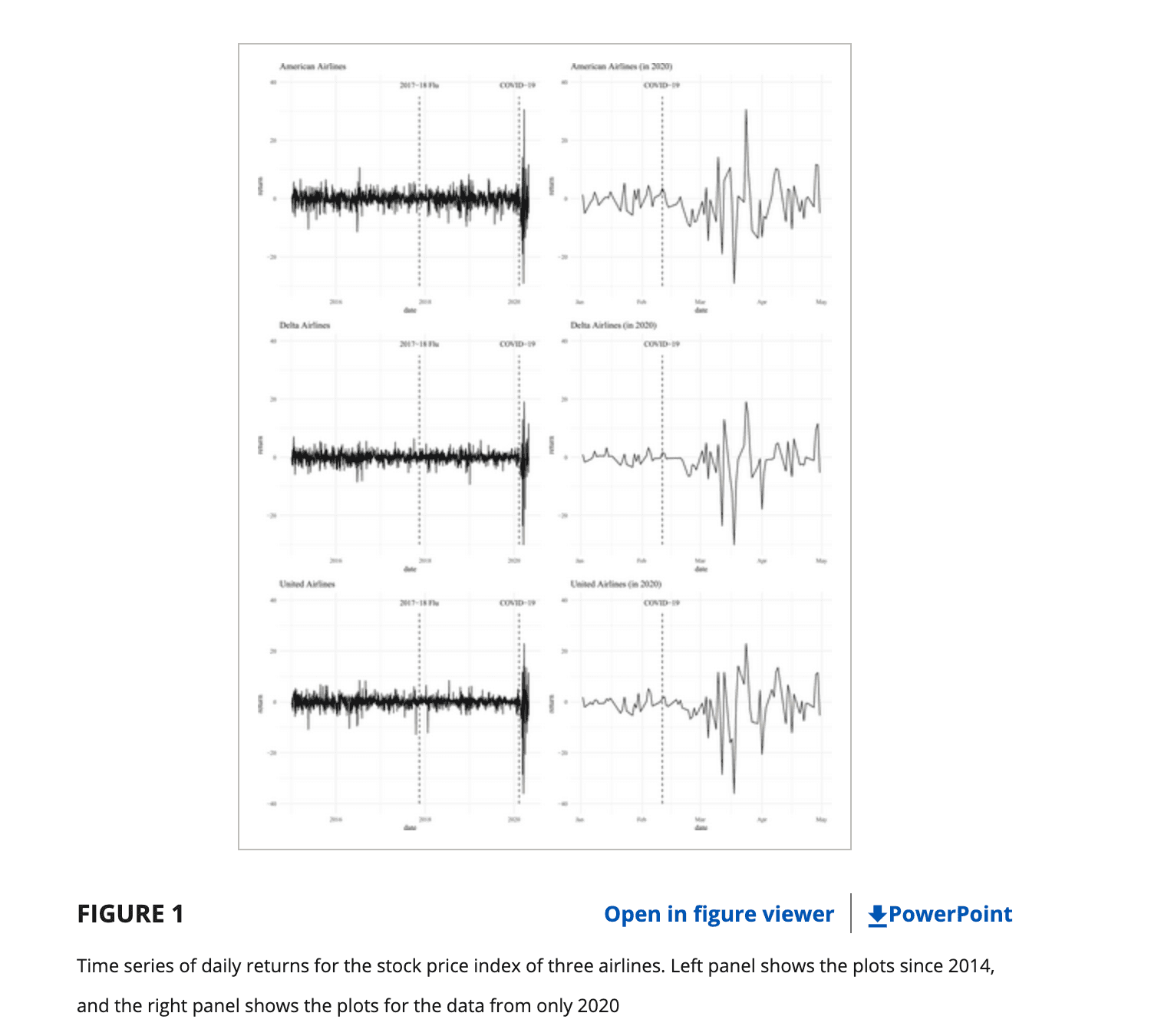

It is quite relevant as the impact of COVID-19 pandemic on the stock market is clearly agreed upon, with severe correction in airline stocks.

-

The ideas are quantitatively rigorous since ARMA-GARCH is a known econometric model and furthermore Granger causality tests makes me more confident of these findings.

-

The flexibility of this model is also excellent as this approach allows for additional predictors and can easily be adapted for other industries or sectors. Hence, the potential for wide application is prominent.

Although I would've loved to see GARCH-MIDAS being used here, where mixed data sampling makes the model more robust. Here, MIDAS regression involves using different sampling frequencies in the independent and dependent variables.