Is the Market Offering an Opportunity to Go Long?

A few months ago I wrote about how i caught 100% + returns in the Counter - Inox wind. It has set up again. Here is the link to the Inox wind post.

https://share.gvine.app/sugCF7MjAeSSFkvh6

Accumulation has been happening in Inox Wind for the last 6 months, and now it has started to move up with a wide-range upthrust bullish candle and a rise in volume. I wrote in my post that it would absorb all the selling and then move up again. This is a new entry opportunity, and I have doubled my quantity from the last time. This is how we can catch multi baggers by increasing the quantity every time it sets up. I have converted my trading position into an investment now, and I will start reading about the company, and start getting involved beyond charts. This is one example of technicals and fundamentals that can be combined. Even though this is an investment for me, I have a stop loss level ,nothing in the market I do without a stop loss.

Here is a link to my last Post. https://share.gvine.app/nFW8z2BvpgCpejMWA

I had updated here that I am 65-70% cash and will be deploying money only into sector ETFs like Auto, PSE, CPSE, Midcap 150 and would wait for stability to return for equities.

Now Nifty has given an opportunity to go long on Friday. Whatever happened in the last 15 days was a pullback as of today. I have started to build positions in equities now.

A lot of things are happening currently in the global scenario, from wars, rate cuts, to US elections. We could be prone to a lot of pullbacks and shakeouts. One should not expect short-term profit kinds of trades to work out. It is entirely possible that we could break the recent low of 23,900 on Nifty, and another down leg can follow. What would I do? I will simply follow my risk management rules and will get out if 23,900 breaks on Nifty and will wait for another opportunity to arise.

Sectors where i am keen to build positions are - Nifty Consumption , Nifty service sector ,Nifty Large mid 250.

Generally, I scale positions in two ways: one time scale-in or 50-50% after each confirmation. The market currently is not conducive for a one-time scale-in. I will explain this with a recent example.

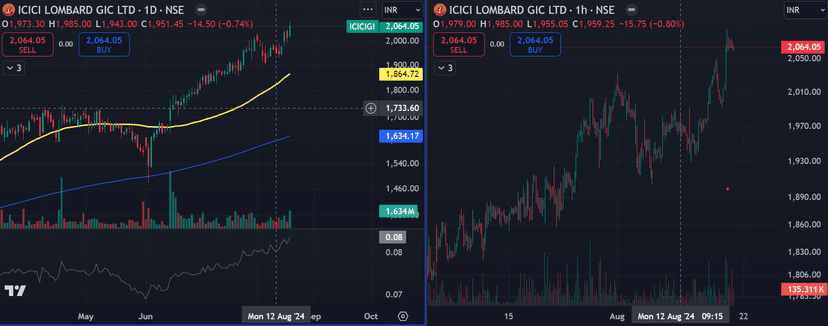

I got into ICICIGI on Friday around 2010. I entered this with the pullback framework that I follow. Initially I got in with 50% only, and after a mini pullback on the hourly TF, I entered again today around 2015, and now I am fully scaled in. I will cut 50% if it breaches 1990 with a wide-range bearish candle with volume expansion and will cut another 50% after the breach of 1930. As the price keeps going up, my stop losses will keep moving up. If the stock moves 7% or more, I’ll make my risk zero, meaning if it reverses from +7%, I will simply cut it out at cost.

Why this aggressive approach? I screen 450-500 stocks and then make a watchlist of 30-40 names, and from there, I enter or scale into 10-12 names. I enter one of the strongest stocks in the market, and such stocks generally don't exhibit massive weakness.

It is entirely possible that I would cut ICICIGI around 1950-60 and then stock might set up again in a few days, which has happened many times in the past. I would get back in again after confirmation. I am very nimble in building back positions if i am stopped out. I act quickly to get back in, but I am strict about not risking my capital. When I am wrong, I want to be wrong with the smallest of margins, and when I am right, I will just sit and hold, e.g., Inox Wind.

Sister stock movement .i.e stocks from sector moving together, is happening in Insurance space. SBI LIFE , ICICIPRULI, ICICIGI are exhibiting strength. I will get into 2 stocks from these 3. Such a sister stock movement increases the probability of trade working in your favour a great deal.

A few more names that are in my watchlist and i may enter them.

- NAVKARCORP

- SBI LIFE , ICICIPRULI (Today)

- NAUKRI

- RAMRATAN

- GODFREYPHILIP (Gave opp yesterday)

- ETHOS

- SHAILY (Gave opp. on friday, undergoing mini pullback) etc.

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

@steppenwolf do you document these anywhere else? I would love to learn some of the basics as well. Also what tools do you used and which broker etc - if you can provide a brief about which and why those, it will be of great help.

I want to start writing from the basics, but I don't have much time at the moment. I will probably begin in a few months. The broker I am using is Zerodha. When you mention tools, do you mean indicators or something else ?

@Toph56 @cantthinkofagoodname @Whitefang @Mast_Melon @GrowthHacker @boredcorporate @Userfirst @GruesomeTonality @salt @TheOatmeal @Ambani007 @followthemoney @OblongFlood @YaboiMarley @Ironman30 @S077 @President_Trump @LowTeapot @AITookMyJob @YourManager @SarjapurDon @GallonMusk @RichDadsPoorSon @HugeCougar36 @BinaryBillionaire @UsefulTailor @LosingmakesnoCents @ModiMeloni @InsidiousBruh @Greyhat @Elon_Musk @AlphaGrindset @Lootmaster @ChhotaBheem @ShinyGrey90

Add me as well.

Also a lot has been going in Asia Pacific markets for the past few months especially India and Japan. Saw data where the number of derivative executions is one of the highest this month compared to a few years ago, this trend might continue in the near future as well with signs of the fed rate going to be cut and all.

Better to buy shares now than in future when the market is high.

Good stuff.

🙏🏻

Good insights as always.

Thanks.

@Ambani007 Thanks. I will keep these points in mind while going through the data. Things can remain overvalued and still keep moving up like the recent eg of Railway sector stocks like irfc, Railtel which are setting up again.

I have stop losses in place for stocks even if i have converted them into investments. I would not sell until price gives me an exit or break recent pivot which is currently at 161 for Inox wind. I will book out after the breach of this level.

@steppenwolf Inox wind looks fundamentally overvalued. I understand 100% net profit growth, but I think this is not sustainable in the medium to long term in a capital intensive sector. Further I expect FIIs to pull out once the rate hike happens.