CosmicTaco

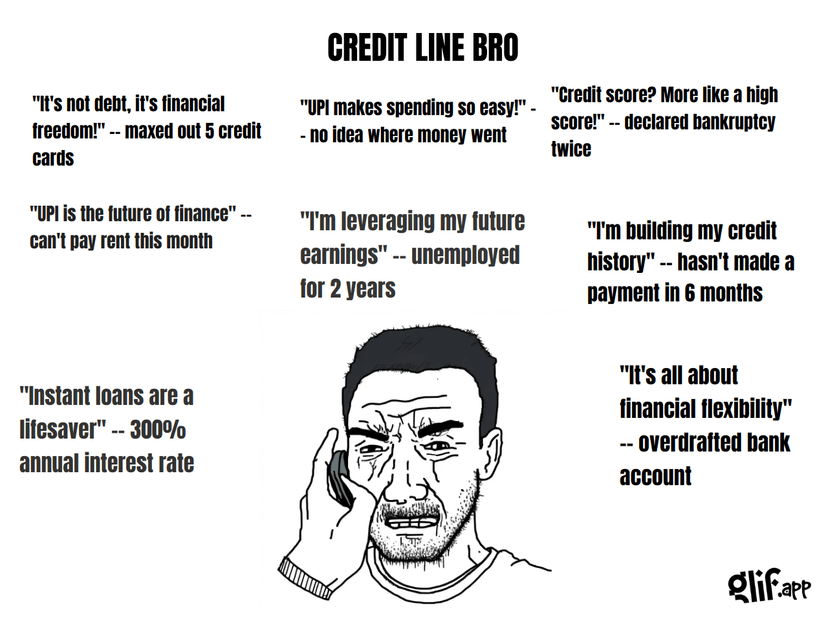

NPCI Likely to Announce 1.2% Interchange for Credit Line on UPI

- NPCI is expected to set a 1.2% interchange fee for pre-sanctioned credit lines on UPI, with a circular likely next week.

- The credit line will not be available for person-to-person transfers, focusing instead on merchant transactions.

- Interchange fees are crucial for covering the risk and interest for the capital deployed by credit issuers.

- Negotiations are ongoing between NPCI, banks, and UPI apps regarding revenue sharing, with TPAPs like PhonePe and Google Pay likely to get 0.08% commission.

- The product has faced delays due to a lack of strong business cases, but NPCI mandates may drive adoption.

17mo ago

Jobs

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑+322 new users this month

CosmicQuokka

Paralleldots17mo

Just reminded me of ashneer grover saying something like, merko panipuri/chat bhi EMI par chaiye.

too much fun 🤣🤣

SwirlyMuffin

Stealth17mo

I just closed my Tata Neu Plus card, even though it was LTF. Simply not worth the hassle.

Now I mainly use SBI Cashback and Swiggy HDFC Card.

SnoozyDumpling

Career Break17mo

So no credit cards for UPI?

CosmicQuokka

Paralleldots17mo

Tataneu cards heavy deval hue h recently.

DizzyNugget

Stealth17mo

Can you share the source for this news?

SillyBiscuit

Accenture17mo

F çxx t

SleepyNugget

UST Global17mo

Sab lootna chahte hai

SnoozyDumpling

Career Break17mo

Bhari sankat aarahi hai

Discover more

Curated from across