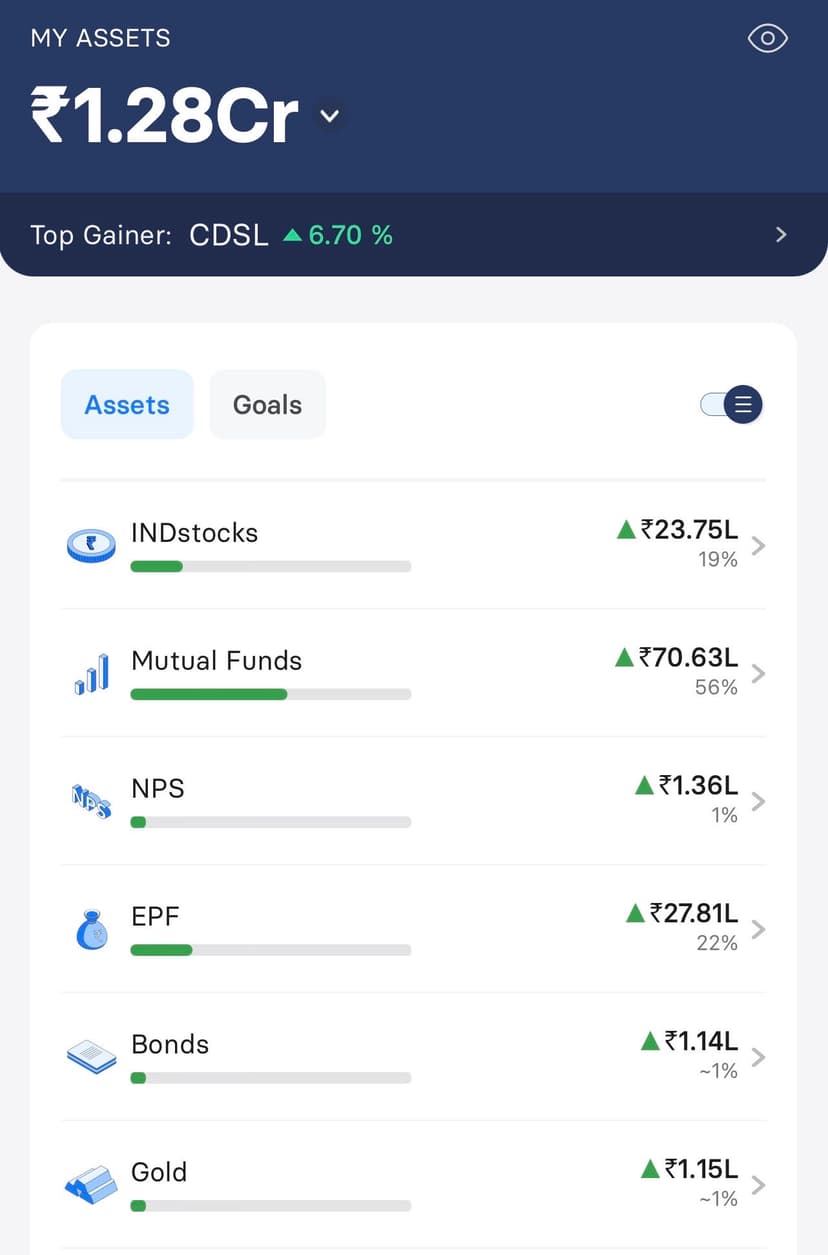

Seeking Advice - Portfolio Check

Age - 33 YOE - ~ 10 years in Marketing

Zero exposure to US stocks. Zero exposure to Crypto. Have a house (~45 lacs) for parents in a Tier 2 city which I haven’t added here. No liabilities (finished an education loan and a home loan)

Recently started investing in NPS and will continue to do (~1.5 lpa) and accumulating SGB (~2.5 lacs, the screenshot doesn’t capture gold correctly) from the past 6 months.

Question - is there merit in talking money out of EPF and reinvesting in Mutual Funds? What is the general view.

Open to any other suggestions. TIA!

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

What was your return on mutual funds and stocks? Invested value vs Present value?

Portfolio looks great, will not suggest taking out money out of PF, it's good to have debt exposure as your portfolio is equity concentrated, by the time you retire, your PF and NPS can cover your retirement expenses.

PF can be withdrawn when you plan to buy a house for yourself, otherwise good to have it.

How do you handle the panic when nifty is 300 points down .

No panic :). The market always bounces back. Sit tight or buy more in case of liquidity.

Wait how much is your emergency fund and in your savings account besides this?

Not related but If anyone is looking to stake your crypto assets check out this exchange https://fintechcatalysts.com/u/signup?r=passiveman . You can join the group chat below: https://t.me/+nRdvoh-H0hU4ZjMx