Silver Moving , Buying frenzy in the market, Locking profits, Next opportunities..

Check comment for update on silver & next sectors.

A lot of things have happened since my last update. I was caught in election volatility & booked out 50% of my positions. I was hoping for further slippages in the market, but prices started recovering the next day & eventually, I built everything back in the next 2 days.

Currently from last week i have started booking out profits from my positional trades. 1 day before the election my portfolio for this FY was up around 26% & due to election volatility it came down to about 9 %. It is back again to the previous levels, a bit above.

I wont sell my top 2 stocks but i am booking out the rest gradually.

Now the rationale behind locking profit is that, in the last month, the portfolio fluctuated from 26 - 9 - 29. If markets go into trouble, I don't want to give back 20% twice to the market in 1 month. If I have 100 shares, I book out 5-10 every day, so that I can get a good average if the price keeps moving up. I have already booked 50% of my total positions. This process is called BOOKING OUT ON STRENGTH. I am taking advantage of the parabolic move. Us markets are currently thinning out & a handful of stocks are taking it higher, soon our market will experience the same. As of now there are no triggers in our market. But it just takes 1 session for the sentiment to change.

Now, I cannot let my money sit idle in my account, that would be foolish for a trader. What I am doing is getting into sector ETFs of Banks, It , Auto. ETFs are less volatile, if the market is going to move 5-7% more from here until Budget, my returns will be in tune with the market. I am fine if I don't outperform the market for the next 5-7%. After budget i will reasses the situation and will get back again into equities.

It is also a good feeling to book out & bring that money home. Whenever opportunities arise in subsequent quarters I can hit it hard & go full throttle since I have a good cushion.

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

If someone wasnts me to tag them out. Let me know.

@salt @TheOatmeal @Ambani007 @OblongFlood @Ironman30 @S077 @President_Trump @LowTeapot @AITookMyJob @YourManager @SarjapurDon @GallonMusk @RichDadsPoorSon @HugeCougar36 @FineReason @BinaryBillionaire @UsefulTailor @LosingmakesnoCents @ModiMeloni @InsidiousBruh @roct @Greyhat @Elon_Musk @AlphaGrindset @Lootmaster @ChhotaBheem @ShinyGrey90

1 kind of structure that i trade, i used to get it 3,4 times a month at most. Now I am getting 1-2 stocks everyday. This is nothing but pure desperation from market participants. I can see a lot of greed on the streets. Nobody can catch the top to the T but spacing out my exit in 4-6 weeks can help me in averaging.

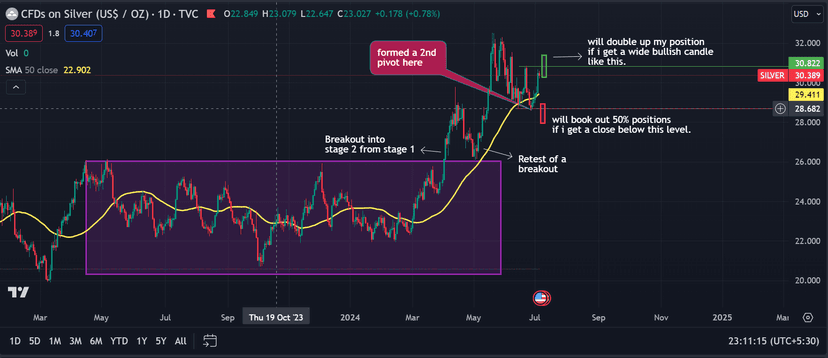

I have built positions in silver using silver minis (1 lot = 3kgs). My average buy price is 89775 (Sept FUT). I have explained my trade plan in the photo. If I exit 50% below the red level, I will wait for an opportunity again. Silver is in a strong uptrend, it will move. I am not bearish on the market, I am just using common sense. I had picked up Dixon (can check in the link above) around 7250, and it is currently trading at 12,654. How much more steam might have left in it before it tests the 50 DMA? Maybe 10-12%.

Even when I am booking out from stocks, my net exposure is going to be 130-140% since I am building positions into silver using FUT. It's just that I have taken an ETF route until major events .ie. Budget gets over. I just want myself to not be susceptible to a lot of risk.

As for the next opportunities, I have my eyes on banks, IT, and FMCG. They have currently moved, but they are still underperforming sectors. If they have to step up like Auto, Defense, Realty, and Infra for the next 2 odd years, it will happen over 1 or 2 quarters. Now that they have shown willingness to move, it's after the pullback and the quality of it that I will make a decision if I want to get into them. They will offer plenty of opportunities to build positions. Most probably IT & FMCG will setup for the next few years. FMCG is already on the move.

Its wait and watch for now.