TRADING UPDATE : Sector Analysis, Trades, Outperformance of my Portfolio

Below i have given links to my last few posts go through them to understand what i have done in the last 20 odd days.

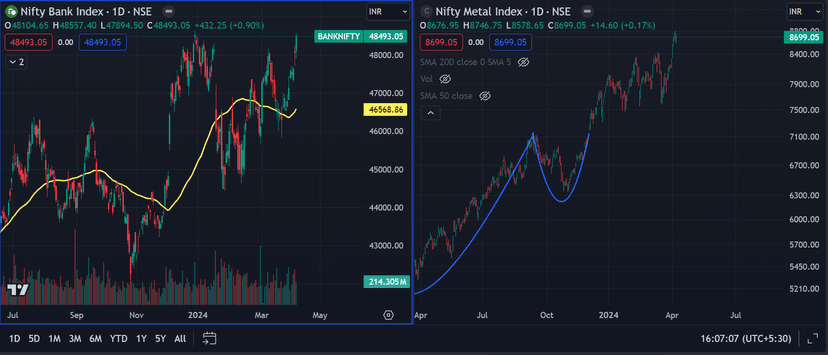

I was mentioning it from the month of Feb that Banks, FMCG , Metal are the sector where Risk : Reward lies in the market. Check it here -

- https://share.gvine.app/GiMiy13zbhGLgrT97

I did give out stocks i am going behind for this cycle. Check it here - 2. https://share.gvine.app/cpfpbGgLVp441B2D8

I did go long in Bank Nifty FUT around 47100 Check it here - 3. https://share.gvine.app/8aJtMzoHxdWv7hPv5

I built my positions in Jindal S , Tata S , COLPAL, ABB , SIEMENS , ICICI B , BANK NIFTY FUT , Nifty FUT and SBI.

From my entry point :-

Jindal - +14.51% (Entered at 805) ABB - +14.35% ( Entered at 5880) COLPAL - +3.45% (Entered 2650) SIEMENS - +15.75% (Entered at 4880) ICICI B - +1% (Avg price is 1070) TATA S - +16% (Well i am holding Tata S from 115 levels i picked it up on 25 July 23. But i have entered again as a new trade around 140 on Feb 24 )

BANK NIFTY FUT - Long at 47100, till now have captured 1550 points. Picked up 2 Lots

Nifty Fut - Picked up 1 Lot at 22,220, captured 300 Points

Go through the links, i have mentioned above, i have updated everything here in real time. I did not explicitly post for each trade for that i will have to post on a daily basis. But i did mention where i am looking and where the opportunities lie with RISK : REWARD. Again risk : reward is of utmost importance for me.

I don't like to talk about numbers but i will do it this time to show you that simple things work very well in the market.

From 18th March - NIFTY 500 - +4.5 % Bank Nifty - +3.72% Nifty - +2.05%

My portfolio is up 8.72%.

I have outperformed every benchmark index by a margin. And this outperformance will continue because i have gone behind the leaders of this upleg. Now i expect all of these stocks to pause a little and absorb the supply before moving ahead.

What next ? Check comment.

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

Waiting for your top 30 list

Above update is just regarding large caps. For small accounts like us true growth lies in a small cap mid cap, I will post a list of 30 small-mid cap names that i have shortlisted and that will be my universe for the next cycle.

Catching these moves was not Rocket Science. I identified 3 sectors that were offering Risk: Reward and i was waiting patiently for the last 2 months to build positions. One just needs a focused approach. No complex tool or algo is required to make money

Create your universe and then go behind when opportunities get confirmed. Make peace with it that you cannot capture every move in the market, so whatever was moving apart from these sectors/stocks I was not looking at it.

Moving ahead i wont be doing anything, no jumping from one stock to another, wont look for next opportunities. Whatever i wanted to build i have done it. Now i will hold tight and sit patiently, and mark the level on my stock chart that i am holding.

That is why getting in at the right time is so crucial, later you can weather out all these shakeouts.

In bull market money is made by buying and sitting tight, not jumping from 1 stock to another. I will not be selling anything unless any stock give me a reason to sell on the chart.

Maruti and Dixon are the two names where i wanted to build new positions, if i get a risk: reward i will go behind 1 of them.

I am also open to adding into my previous holdings like TATA S , Can Bank , PNB(Entered on friday).

Whatever you do stay away from 5-15-30 min TF in this cycle. Switch to hourly and Daily for sometime. The market will gradually move up it seems but with lots of shakeouts, like happened on 28 April.

The market will reward Positional participants , short term participants will get whipsawed and punished.

There is still a lot to explain but there is not much i can do in the text format.

Happy Trading :)

Happy Trading :)