ZoomyDonut

Unlocking Exit Strategies in India's Startup Ecosystem

Blume Ventures just released a report on startup exits in India. Here's the breakdown:

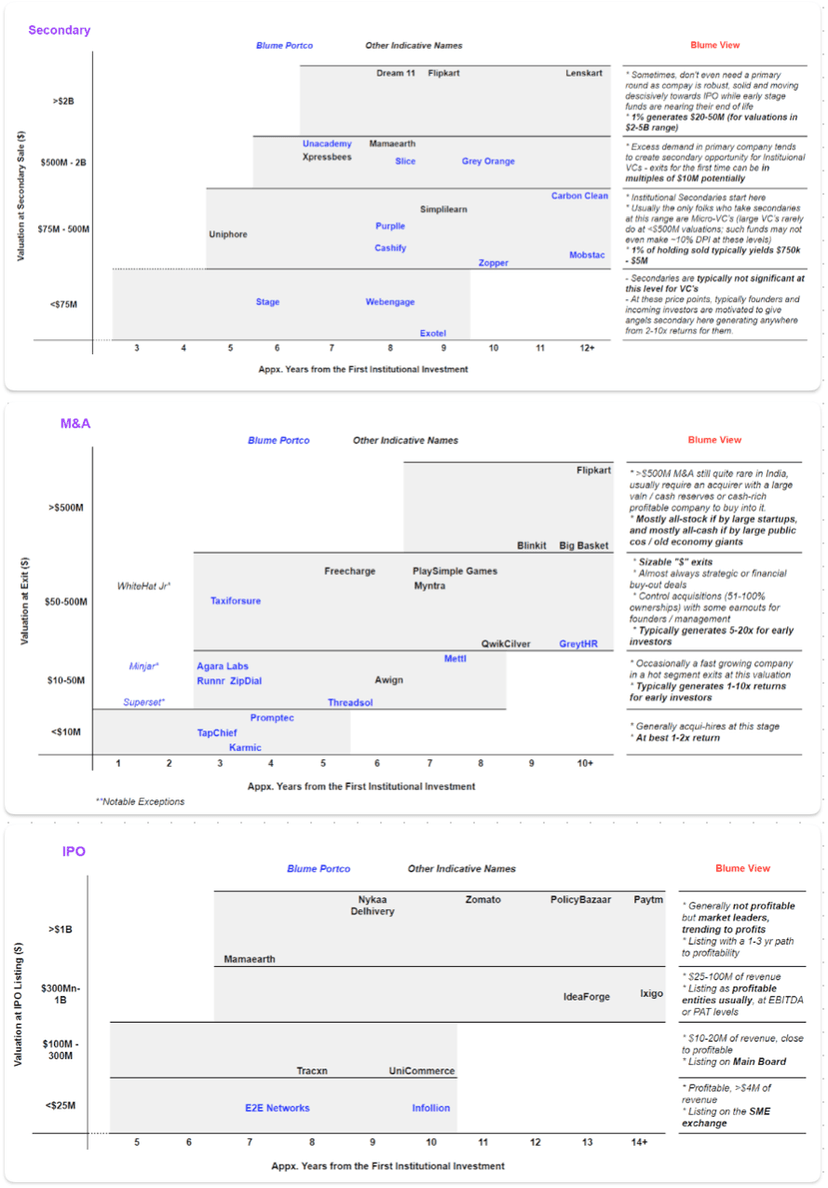

Exit Strategies: 3 Main Types

- Secondaries: Quick Cash Options

- Angels exit first, typically under $75M

- Micro-VCs target $75M-$500M range

- Large institutions aim for $500M+, usually 7-8 years in

- M&A: From Small Buys to Big Deals

- Under $20M deals are mostly for talent

- Real returns start at $50M+

- $500M+ deals are rare, need major buyers

- IPOs: The Big League

- More accessible than thought: Even $10-20M revenue companies can list

- SME exchanges offer options for smaller players

- $1B+ listings reserved for top players, usually after a decade

Key Points:

- Patience matters: Big exits often take 7-12 years

- Profitability is crucial: Markets reward it

- IPO boom expected: Projections show 5x increase by 2025

In short: India's startup scene is maturing. Exit options exist, but require strategic long-term thinking. For founders and investors alike, understanding these patterns is key to long-term success.

Full report: https://blume.vc/commentaries/decoding-exit-patterns-in-the-indian-startup-ecosystem-blume-ventures-perspective

15mo ago

Jobs

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑+322 new users this month

You're early. There are no comments yet.

Be the first to comment.

Discover more

Curated from across