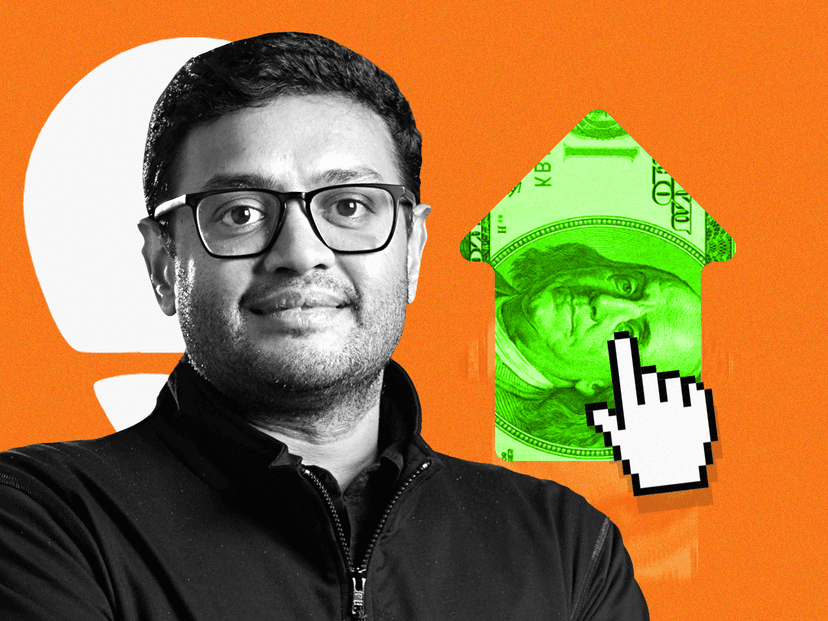

Swiggy IPO: A Windfall for Elevation, Accel, and Prosus

- Swiggy's IPO has resulted in major returns for investors Elevation, Accel, and Prosus.

- The IPO process, initiated in April 2024, saw shares worth at least $1.6 billion being sold by existing investors.

- Prosus, the top stakeholder...