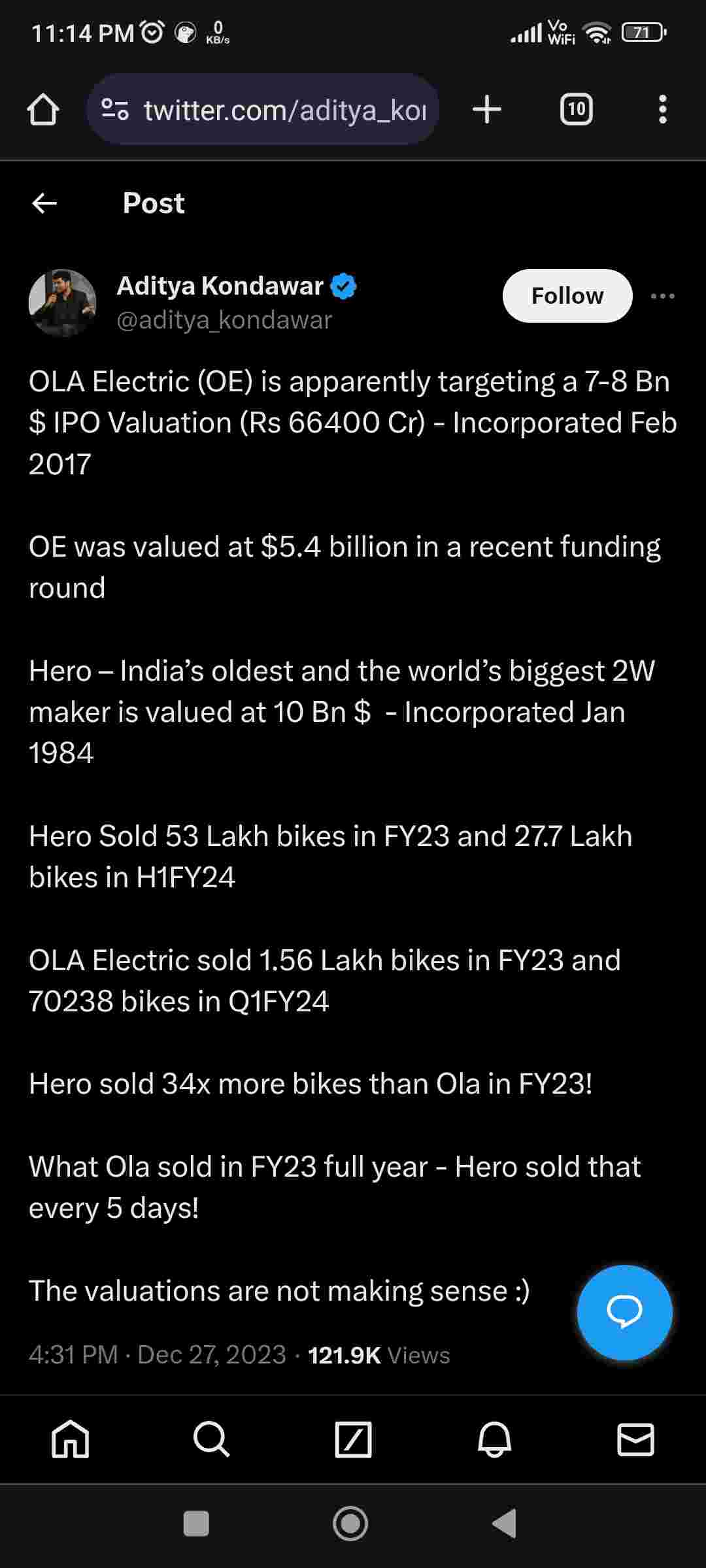

Hero has revenue of Rs. 35,000 crore & profit of rs. 4000 crores.Ola Electric has revenue of Rs 373 crore and loss of Rs 784 crore... OLA Electric (OE) aims 7-8 Bn $ IPO Valuation while Hero has 10 Bn $ valuation

Soneone explain rationale here !

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

" but ola has innovation" , " kya matlab founder ke IIT se hone se valuation multiple jayada nhi hona chahiye" , " ola full indian saar. Support ola IPO saar. Lose your money while investors and founder make a lot saar" , " bro but ola founder ne Sanskrit waala chatgpt banaya hai. He sapports indian culture. So higher multiple to Banta hai" .

Prepare to hear this in coming days

No other word for this, but desh me ye sab bolne vale chutiyon ki kami to nahi hi h

I have read that adding digital in front of any traditional business makes it worth a lot more and the PE of digital businesses is much higher than that of traditional businesses due to exponential growth potential of internet as per investors. Thats why so much difference

9/10 founders recommend putting AI also somewhere in the startup name for higher valuation. Even if you are just using if else statements in your code

Ah yes, my Ola Electric bike will be a good vehicle to surf through the exponentially growing internet. But I get what you are saying. The inflow of VC money from the US and their mathematics behind valuations is nowing sipping into IPOs

More direct comparison would be Ather which is at 4x revenue/sales multiple ($900mn/$225mn)

Even giving Ola Electric an 8x multiple (best case, mass-market EVs), the valuation should be only $3bn

Company’s valuation is not only based on their current situation, but their future potential. I am not here justifying or supporting ola, but this valuation is mostly due to

- Majority of the market is seeing EVs as the future.

- For India. Market that future is in EV two wheelers as compared to four wheelers.

- Though there has been many EV players has been in market for long, but ola quickly surpassed them all in a short amount of time. So speed of scale compared to other EV OEMs

So the higher premium

If we compare it with Hero. Hero is a 40 yrs old company with 20+ active products to reach this scale. Where as Ola has reached this scale within 5 yrs (remember for OEMs lot of time goes in R&D and setting up factories as well, so not actually 5 yrs of selling) and is growing at much faster pace as compared to Hero

It's a bubble. Don't you think Hero can't make two wheeler EVs? Ola themselves used a Nordic country design initially with stiff suspension. What investors don't realize there's magnitudes of difference in R&D costs for ICE vs EV? You can ride in the short wave for sure if you want to but keep in mind it's easy to come up with OE competition that way similar to Mamaearth.

Also, you are forgetting about Ather which does higher revenue. OE is trying to maximise revenue and scale but not profitability. How are they handling stoppage of Fame 2 subsidy?

By bubble you mean Ola Valuation or EV market? Hero can and they are actually doing it. But they still lack the conviction to go full throttle on EVs. That is why they keep investing in Ather to keep their options open but still plag safe.

Yes I know the company OLA acquired to get their product and R&D but then except Ather who didn’t? Some of them are actually buying scooters from china and selling in India with their brand name. Also if you will check statista report on EV market share, Ather is at 5th position with 11%. Ola, okinawa, hero electric and Ampere is ahead of them. With Ola 21% market share, nearest to ola is Okinawa with 13%. So you see Ola is dominating the market. And the key is distribution. Ather has super scooter, i love them. But they lack marketing and distribution. Whereas Okinawa, making china sourced rebranded poor quality scooters, is selling more than Ather because of distribution. That is why Ola becomes obvious choice for investors, if they want to invest in EV OEMs in India.

Tesla at its peak share price was worth more than all American auto companies combined . By the way people should realise ola wants to raise as much money as possible that is their goal , that is why it's doing an ipo . IPO is not done so that we can buy company shares at the correct price. Let's see if they have made a good assumption based on price setting supply and demand. I think a bull run is incoming might just be great timing

Does not matter IPO will be oversubscribed anyway because of FOMO

Ola Electric has higher valuation because of growth potential. It's a growth stage company. Going by the sales figures you've shared, it's already growing at 2x YOY.

Hero is largely stagnant.

Agreed but its easier to do 2x of ₹10 as compared to doing 2x of ₹10 lakh. Once Ola's sales grows they will hit the stagnation ceiling too. And atleast for the next 5 years I don't see EV taking over ICE in 2W segment. And topping it with Ather valuation & the fact that Ola EVs are still catching fires (though rare incidents) this valuation makes no sense. Still the IPO will be oversubscribed because a lot of young investors have the risk appetite to invest in startups from a brand perspective than a valuation perspective.

Iska matlab ola me gaana bajte to valuation toh high mang sakte h 🤣

Having used EV products from both companies extensively, I can tell you that both are shit-tier companies with garbage products. However, in an IPO, the actual product is not as important as people think.