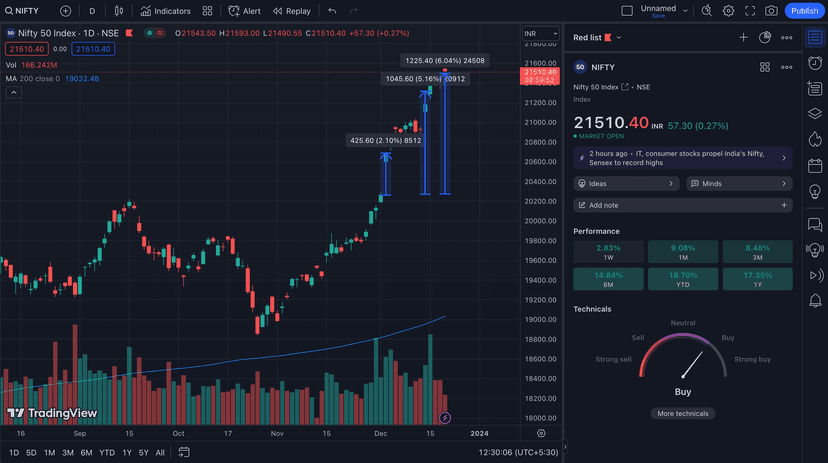

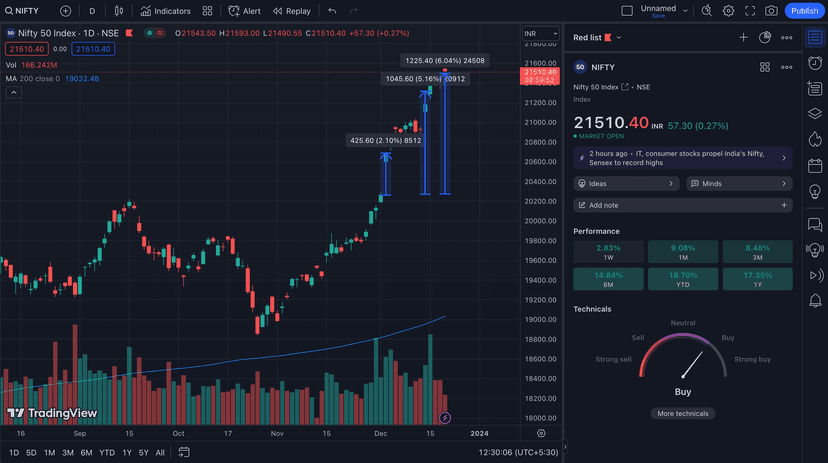

NIFTY50 is again at an All Time High. Are you guys selling/ holding/ buying? 📈

We are so back. 🚀🚀

We are so back. 🚀🚀

Bhai Salt, finance utna chamakta nahin Can you suggest 3-4 stocks that you recommend out of your portfolio? I'll then research on them separately, but it'll really be helpful to know your thoughts.

Buy and hold. Index will go up even after the elections. Wouldn't understand why anyone would want to sell unless they can logically lay out the reasons behind the supposed 'weak' fundamentals.