Investment Advice for Surplus Moony

Hi folks, Noob here I have surplus money laying around in bank and FDs.

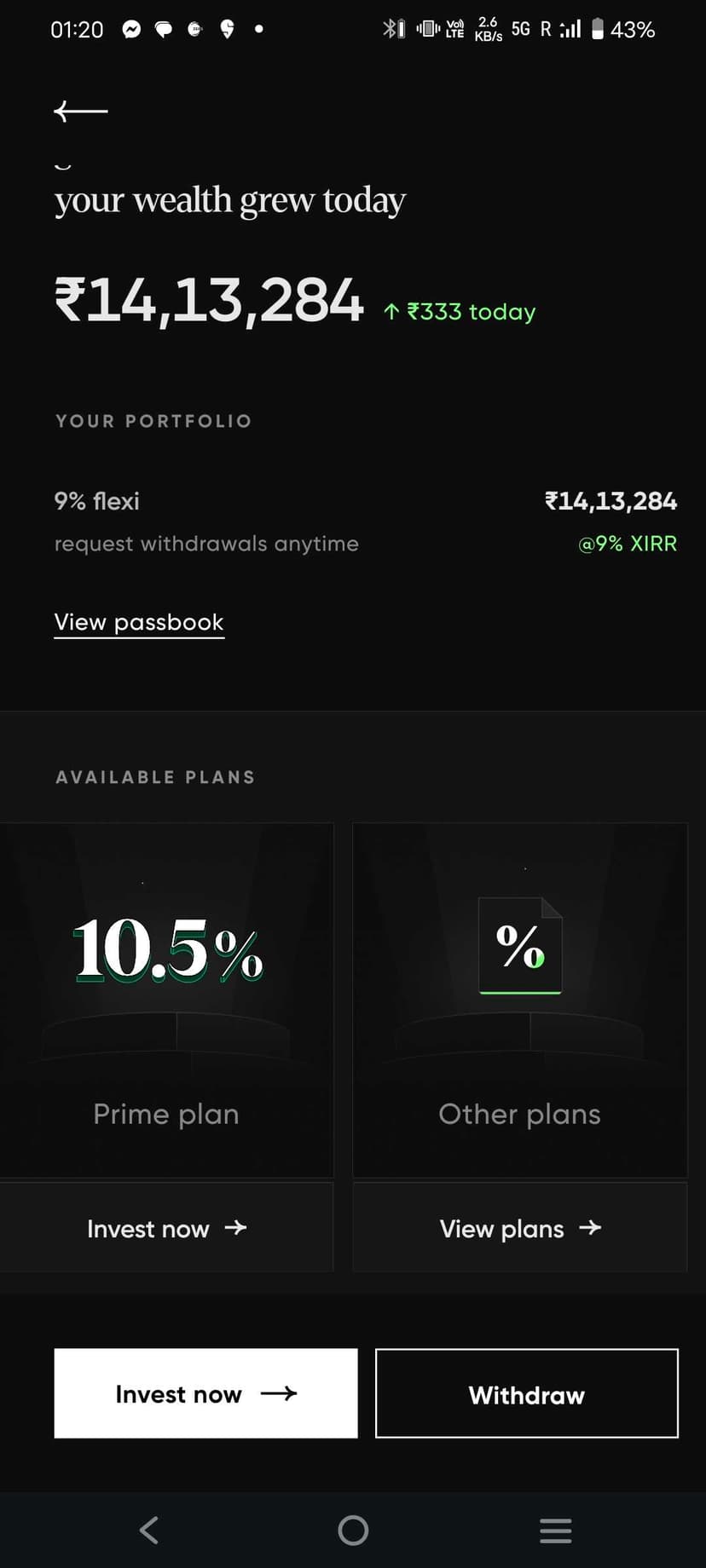

Total ~ 19L Bank: 7L (extra didn't account for amount which I will hold in bank) FDs: 12L( This could be an Emergency fund?)

- What should be the ideal split in ...