CosmicTaco

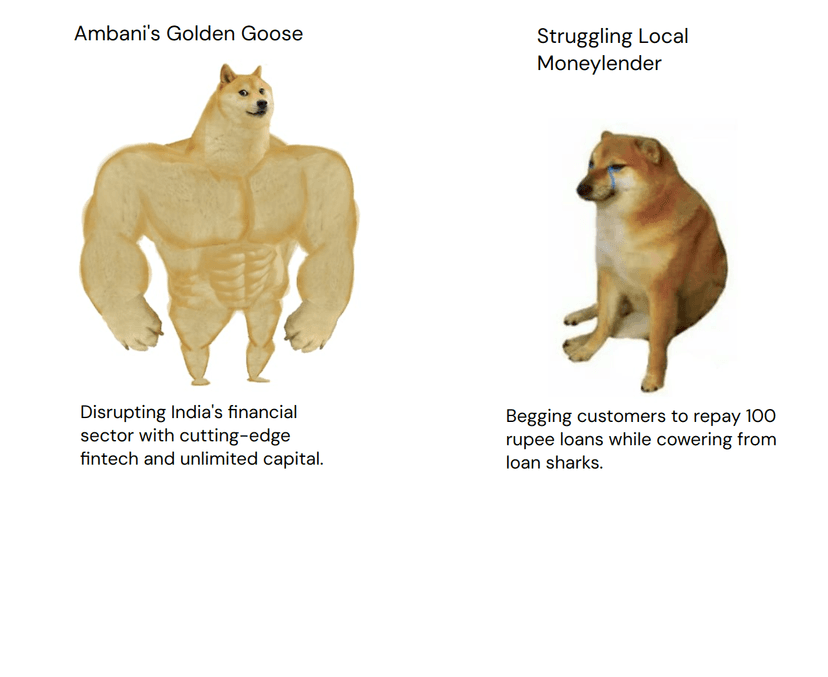

RBI Approves Jio Financial Services' Conversion to Core Investment Company

- The Reserve Bank of India (RBI) has approved Jio Financial Services Ltd's conversion from a non-banking financial company (NBFC) to a core investment company (CIC).

- In November 2023, Jio Financial Services applied to the RBI for this conversion, aiming to meet the criteria of holding at least 90% of net assets in group companies' equity shares, bonds, and loans.

- CICs are designed to support the financial stability of their group companies without posing systemic risks and must register with the RBI if they accept public funds.

- Last month, Jio Financial Services launched the 'JioFinance' app in beta, integrating digital banking, UPI transactions, bill settlements, and insurance advisory features.

- Jio Financial Services, spun out of Reliance Group, has seen stock rallies since August and announced a joint venture with BlackRock in April to offer wealth management and brokerage services in India.

Source: Your Story

5mo ago

Find out if you are being paid fairly.Download Grapevine

DerpyQuokka

Infosys5mo

That being said, buy Jio shares at all the dips

Discover more

Curated from across