CosmicTaco

RBI’s New Rules for P2P Platforms: A Net Positive for Lenders and Borrowers, Say Experts

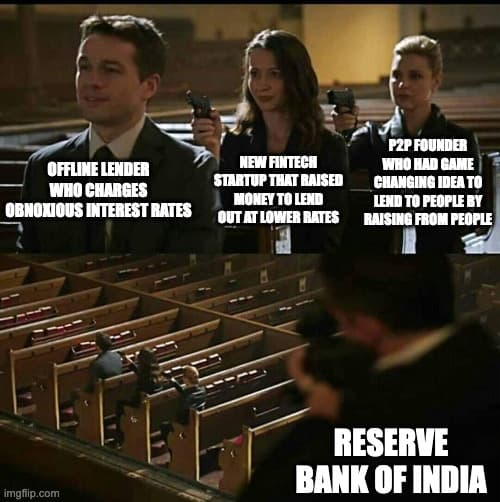

- The Reserve Bank of India (RBI) has issued amended guidelines for Peer-to-Peer (P2P) lending platforms, aiming to enhance transparency and curb irregular practices.

- The new rules prohibit NBFC-P2P entities from assuming credit risk, ensuring lenders are fully aware of the risks involved and responsible for any losses due to borrower defaults.

- Stricter guidelines for escrow accounts mandate that funds be transferred within one day of receipt, ensuring timely processing of transactions.

- Restrictions on cross-selling products, except for loan-specific insurance, aim to reduce conflicts of interest and focus platforms on their core function of matching lenders with borrowers.

- Monthly disclosures of portfolio performance and non-performing assets (NPA) will help lenders make more informed decisions, with a call for standardized formats to facilitate easier comparisons across platforms.

Source: Moneycontrol

4mo ago

Find out if you are being paid fairly.Download Grapevine

You're early. There are no comments yet.

Be the first to comment.

Discover more

Curated from across