[Rant] Here's why someone usually ends up f'ed over, for a startup to get successful in India

There are essentially four parties in the startup economy:

- The Consumer

- The Enabler(read, Startup)

- The Service Provider

- The Investor

Now let's look at Game Theory motivations:

-

The Indian Consumer wants to minimise money spent per unit value extracted, the Western Consumer wants to maximise value extracted per unit money spent. (There's a massive difference.)

-

The Startup depending on the stage wants to maximise User Growth and Free Cash Flows.

-

The Service provider wants to maximise financial incentives.

-

The Investor is wants to maximise the XIRR of their fund. For this they need to reach a multibagger liquidity event.

Now let's look at what happens when:

- The Consumer gets f'ed over:

The startup attains pricing power through deep competitive moats allowing for monopolisation. They can jack up the prices to ensure nice FCF, greater rewards for Service Providers and great returns to their investors. (Think, Uber can charge anything to you now)

- The Startup gets f'ed over:

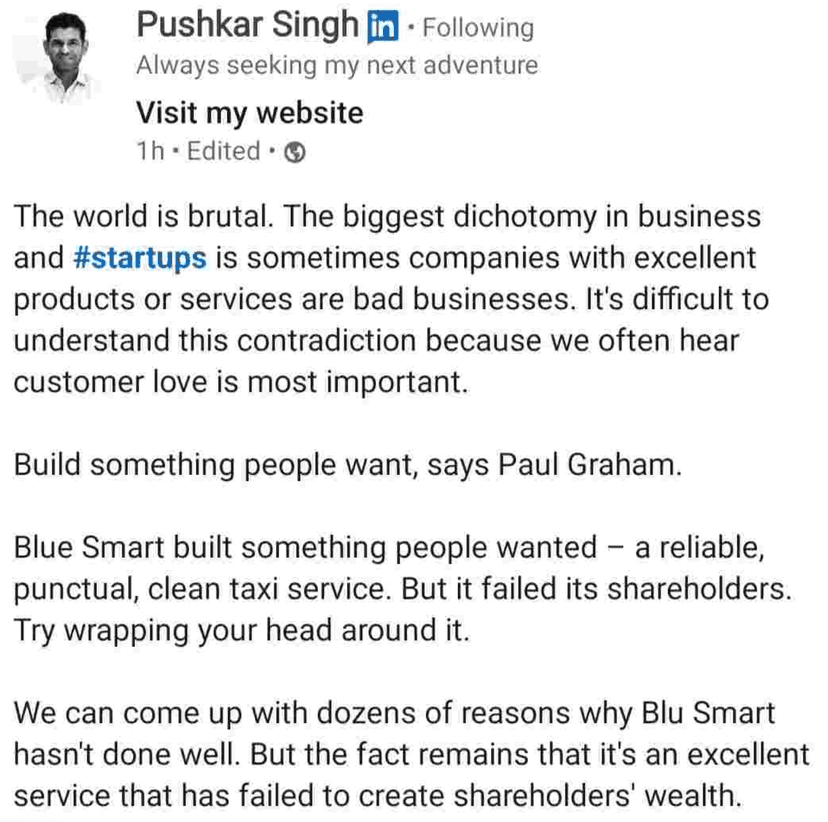

The users get bang for their buck, the service providers get good incentives, the investors push for higher growth but unfortunately the startup does not have enough capital to service their Cost of Operations through their unit economics, so they will either run out of cash or investor patience. Either ways, they are doomed. (Think every legit startup that failed)

- The Service Provider get f'ed over:

This is the likeliest scenario as they have the least power in this dynamic. Rewards will be reduced over time or made harder to achieve. They have no option because they got no option for sustenance. (Think any on-demand service providing app)

- The investor gets f'ed over:

Now imagine there is a startup that can balance the act very well. They have a service that users are willing to pay a margin on. They pay their service providers fairly and have decent unit economics. Now, the investor will do halla about destruction of shareholder value from little growth. (Is this the case with BluSmart?)

Maybe that's why building in India is tough.