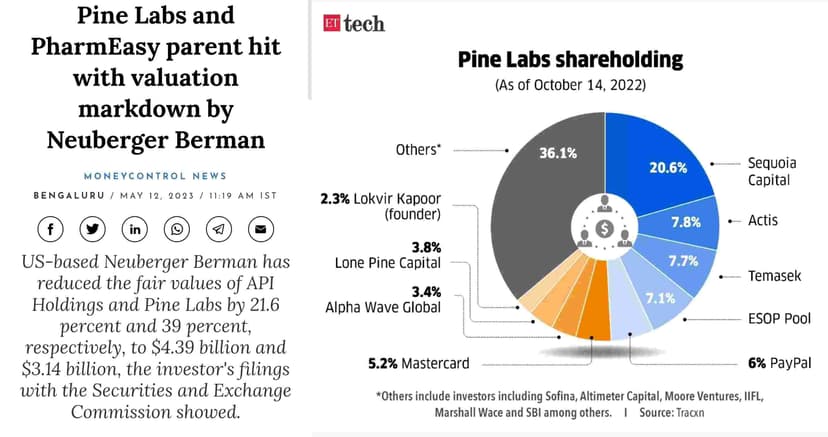

[Need help] I have 3 lakhs of Pine Labs ESOPs each year. Got this news yesterday where Neuberger berman has reduced Pine Labs valuation by 39%. Does this mean when I try to cash out 3 lakh ESOP, the actual value would be 39% lesser?

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

A small nuance here..

ESOPs granted are split as vested and unvested.. Assuming a 4 year annual vesting cycle.. You'd have ESOPs worth 12 L already granted on day 0.. These 12 L worth of ESOPs get translated into number of options basis share price on day 0..

1/4th of these options get vested to you every year.. And the count of options being vested under this grant doesn't change

During a liquidity event.. The share price gets determined basis the most recent valuation of the org.. Which could be in line with the reduced valuation determined by Neuberger.. But it is not necessary and would depend on what the valuation of the company is on that day..

You may notionally assume that your esop options under the current grant have lost 39% of their value.. However what you will cash out would be dependent on the valuation of the company around the liquidity event..

Ok. Thank you. Also recruiter told me that I can sell the ESOPs to any of the investors like Mastercard, Paypal, SBI etc after an year. Do you if the purchase value of the ESOPs would be same across different investors of Pine Labs?

*do you know

U can only vest esops when pine labs goes public So either ways it's of no use right?

As per recruiter, I can cash out every year. IPO not needed

Cashing out esops is way different than rsu's If the company is ready to buy back from u and has given u in written then it's fine Or else u need to find brokers who will either buy esops or will make other ppl buy ur esops which is a rare case unless ur company is about to go public within 6 months like cohesity,in all other cases it's use less Happened to me in a startup new street tech where i was given 15 l esops (5l each year) but had to reject ut

Valuations are set when startups raise rounds. So Pine Labs were to buy back your ESOPS rn, it would be at the last valuation.

These are indicative measures and if your org has enough money to ride this downturn, valuation might not go down

Considering the market situation and also Pine Labs having positive EBIDTA I don't think they will go for fund raising anytime before March 2024. So doesn't trust mean I will get whole 3 lakh ESOPs if I cash out in March 2024? Also for ESOPs when we cash out, 30%(I am in this bracket) tax would be applicable, right?

Plainly put, you'll ESOPS will be worth according to the latest fund raise, It they raise at higher valuation, then value of your ESOPS will also go up.

Yes 30% tax is applicable. If you have conviction in the business growth and if you are allowed to hold ESOPS for a longer time, then maybe do that.

Read your ESOP grant letter for these details.

Yes. ESOP is nothing but share in a company.

If company's valuation is cut, your esop values also go down by the same %.

From what level, Pine Labs grant ESOPs? Any idea.

I am new to this ESOP thing. Recruiter told that after every year I can cash out by selling ESOPs to any of Pine Labs investors like Mastercard, SBI etc