CosmicTaco

Start-up Failures Surge by 60% Amid Post-Boom Challenges

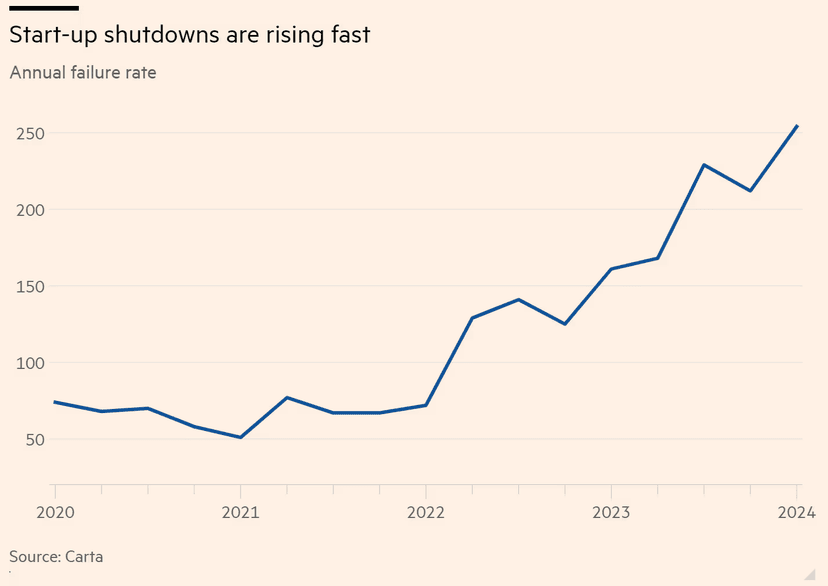

- Start-up failures in the US have surged by 60% over the past year as founders deplete funds raised during the 2021-22 tech boom, risking millions of jobs and potential economic spillover.

- Data from Carta shows a sharp rise in start-up shutdowns, with 254 venture-backed clients going bust in Q1 2023, a rate over seven times higher than in 2019.

- High-profile casualties include Tally, Caffeine, Olive, Convoy, and WeWork, all struggling to secure necessary funding amid a challenging financial environment.

- The rise in bankruptcies is attributed to inflated valuations and misaligned incentives during the boom years, with VC investment and venture debt plummeting post-Silicon Valley Bank collapse.

- Despite a bleak outlook for many sectors, investment in AI start-ups is booming, with three-quarters of Kruze's $2bn raised in 2024 going to AI ventures, highlighting a shift in VC focus.

Source: Financial Times

16mo ago

Jobs

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑+322 new users this month

You're early. There are no comments yet.

Be the first to comment.

Discover more

Curated from across