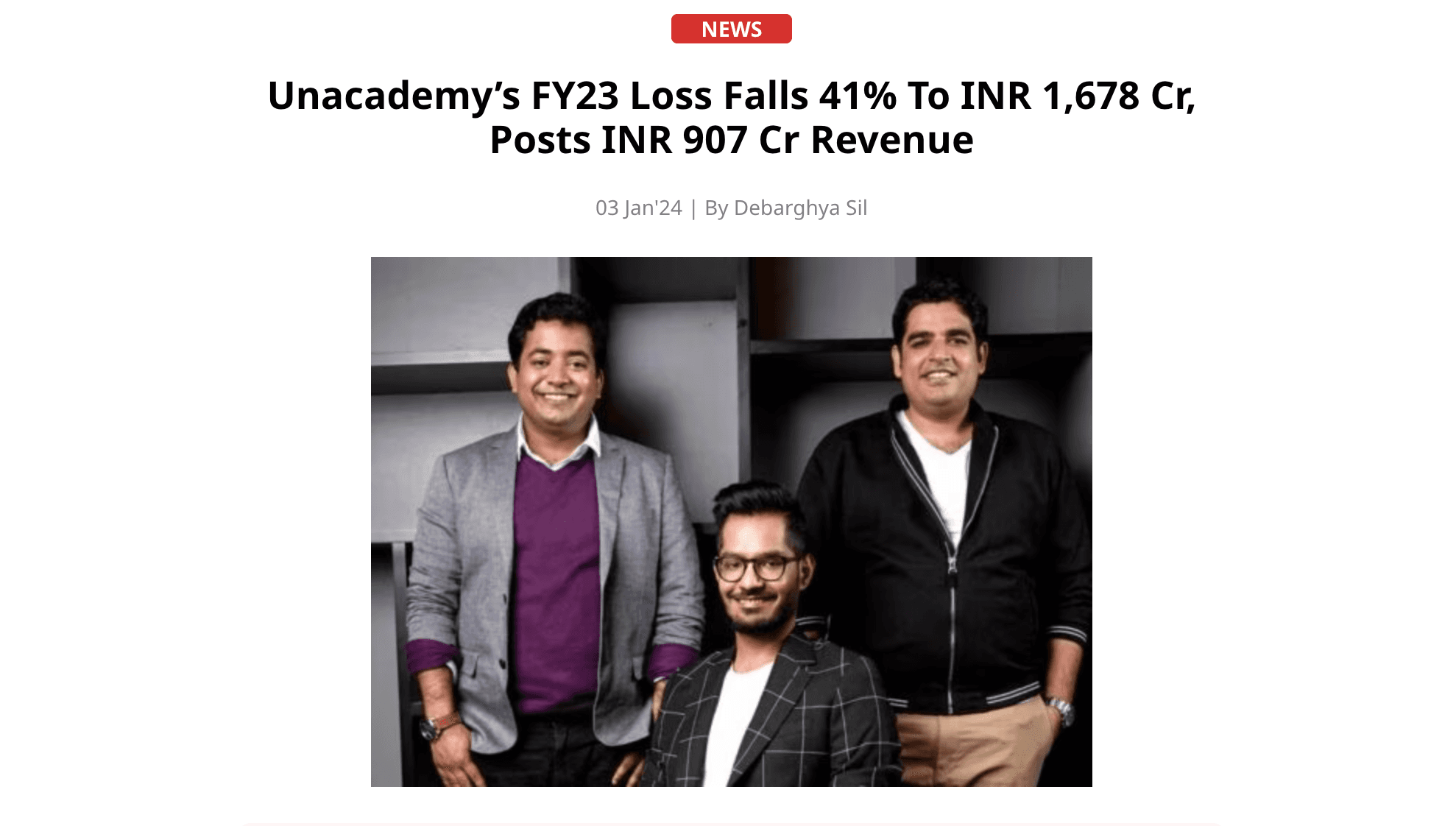

Unacademy’s Loss Falls 40% FY2023

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

Someone got fired

So just about a 100mil topline, last round price from 2021/22 was 3.5 billion (yes, the one with a B). With no online moat and a fairly crowded offline market that they sought to disrupt or replace in the first place, why would someone pay a 35 times multiple on a loss making (3:1 spend to revenue ratio) business with next to no moat.

Sure if they turn around and become a profitable enterprise they will need to reach half a bil in revenues to grow into its price. All of this sans the glamour of "disruption" or change or impact.

What the above means for them? Grow at 50% each year (for four years) while improving economics. Next few years will show if they can earn money or make money.

@DFV Real valuation should be $200 Million max

I would say even lower, nothing more than 1x. Lot of sector risk, plus no moat. For context when Blackstone acquired 37.5% in Akash Education, it was approximately at a 4x revenue multiple. And that is a legacy, profitable business which has shown it can grow multifold in revenue over the years. Unacademy has no moat left, is loss making and been around long enough to make money now and not just earn it.

They've laid off some many people silently. Losses had to come down. Unacademy is in deep shit because of their struggling businesses

They have a runway of 4 years. Can tweak stuff and be just fine

All these edtek startups will burn to ground by the end of this decade