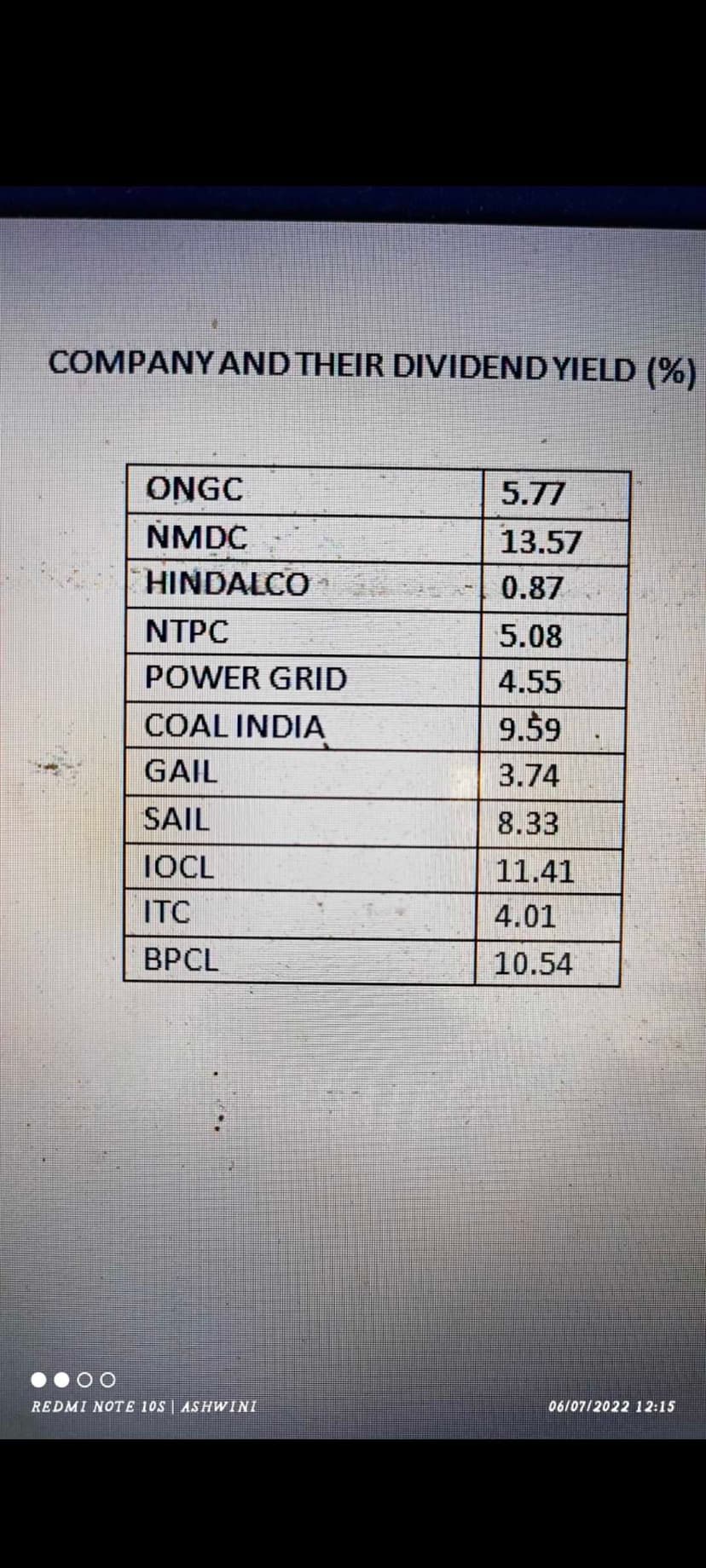

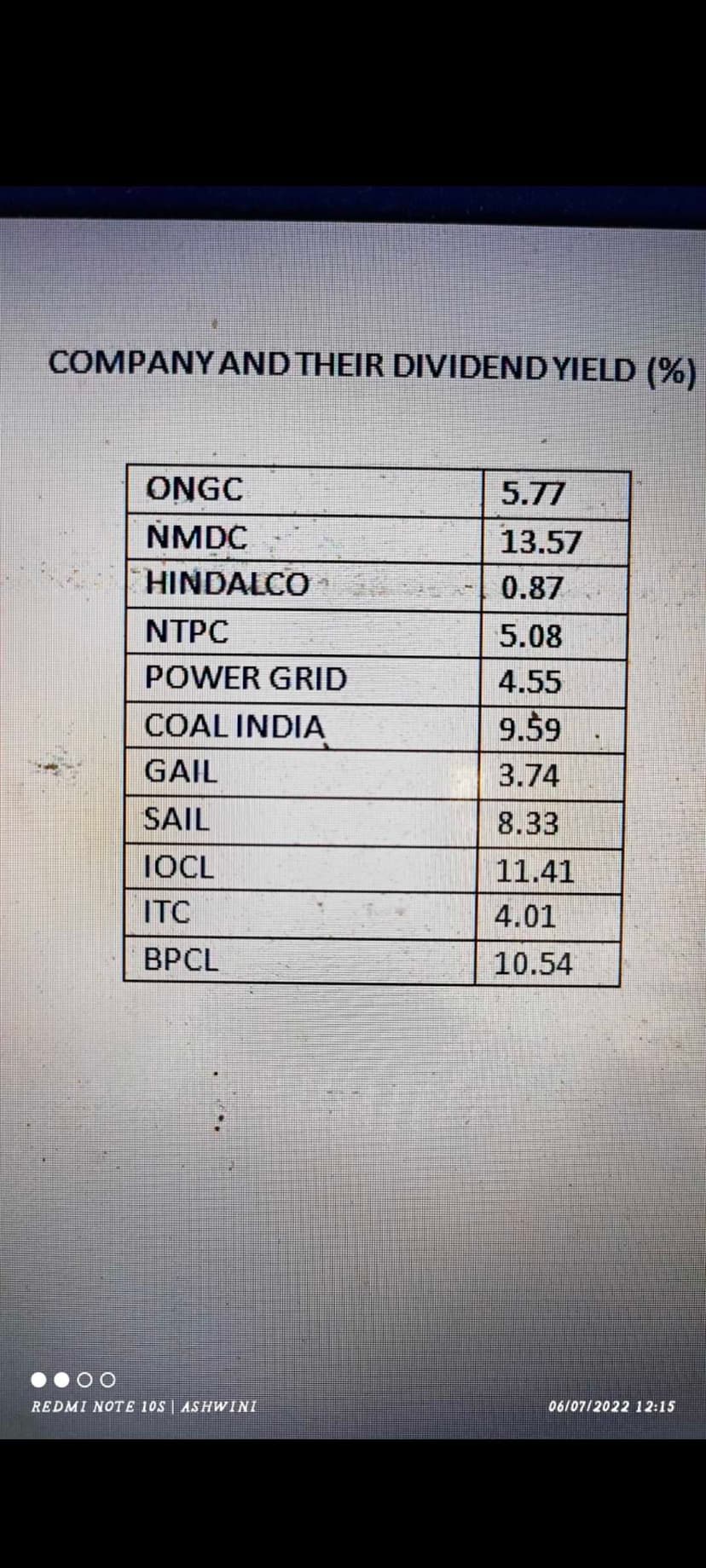

High Dividend Paying Stocks List

Average of below stocks can beat FD.

Any other recommendations except below (PFA) ?

This went almost 5x in 7 months. Anyone with DD/Analysis on this?

Many factors have worked for Suzlon, some of which are..

There are some technical factors also which I don't think I should write here.

Not going to lie, your answer is kinda of insane. Really appreciate the DD on this.

It makes sense that the prevailing tailwinds has led this rally.

Are you holding this stock? If yes, what is your entry and target levels?

Thanks, bro.

Well, no doubt renewable energy market will grow in future too but the growth of these companies will also depend on Carbon credits market which is still a voluntary market, and according to Nirmala Sitaraman, they are not going to obligate this market in india atleast before 2026 (To be very honest, many startups working in this field have shut down in the last 6 months after this statement). So, I'm quite skeptical about the near future. I'll wait for it to surpass 80 rupees. It might either collapse before 80 to 100 rupees or it might never go down.

Average of below stocks can beat FD.

Any other recommendations except below (PFA) ?

What are the stocks you are betting on for next 3 to 5 years and why. Stocks less than 3 years since ipo? Or names you don't hear from big investors.

Please do not add the blue chip stocks or brand stocks just for the sake of Commentin...