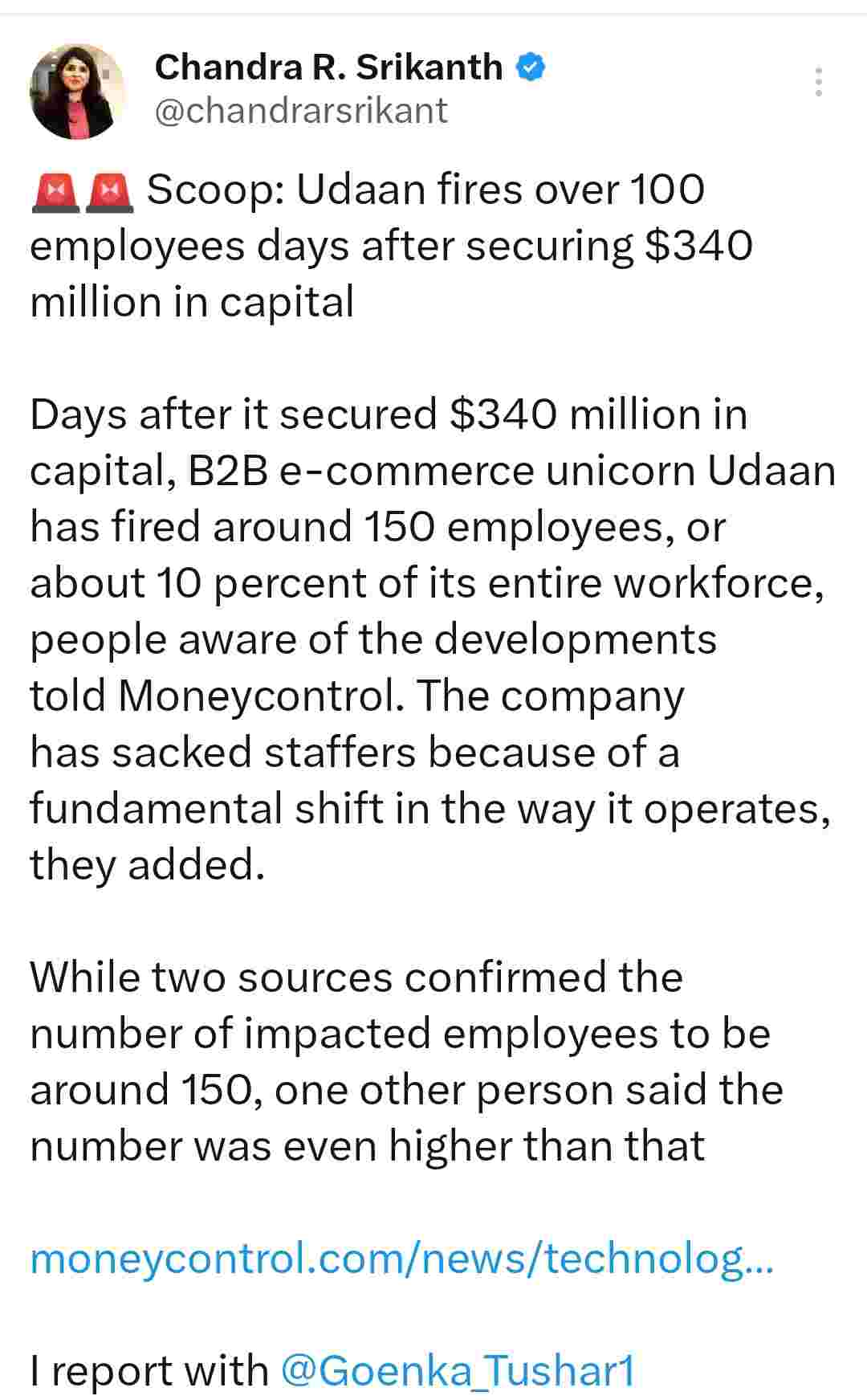

Rant on Indian Startup

I am Thankful to the funding winter it has revealed true colors of so called Founders, who would not stop talking about culture, Growth, scale etc on Twitter and LinkedIn

Take Byjus, for instance, they claim to be revolutionizing educa...