Silent Layoffs in Jar

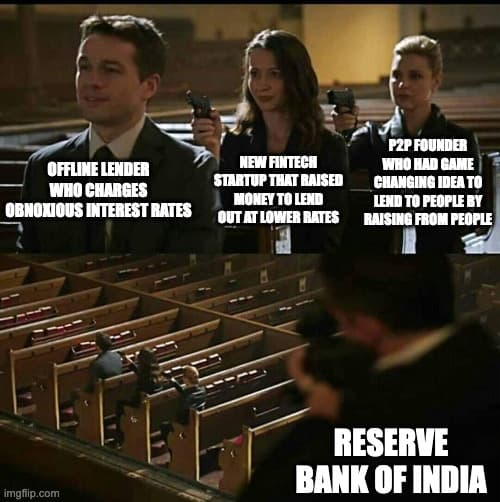

Heard from a few employees in Jar that they are reducing their headcount silently and asking employees to move out. They recently lost their biggest NBFC partner Appollo, is Jar facing financial issues?

Heard from a few employees in Jar that they are reducing their headcount silently and asking employees to move out. They recently lost their biggest NBFC partner Appollo, is Jar facing financial issues?

Have been a part of the VC ecosystem for a while now, and have been a first hand observer of how Stride Ventures has been operating (vis a vis other Venture Debt players that have been around for ~15 years+).

Typical playbook:

I got some friends at Jar and got to know in their lending business their only nbfc partner has backed out and for sure they are gonna cut cost, got my other friends offer revoked in tech, product managers are leaving and now even the fu...

I went to a tarot card reader and asked if I would make it to any of the Consulting firms during my SIPs in a B School and they said Yes.

Lol I made it to a Conglomerate's NBFC.

I want to know the growth trajectory I should follow in the Finserv (NBFC) area as I would be joining Aditya Birla Capital as a Generalist.

When is the ideal time to switch jobs here and what are the growth opportunities here?

Hi Friends,

We are three founders launched android app for personal loan last month.

To start we have tied up with a small listed NBFC for a 2cr program we have disbursed 40L started 1-Aug-24. 2cr is the max limit from this Lender.

W...

We all are in this together, this too shall pass!

For better understanding - Tap here