[Thread] Why 2024 is going to be a massive hit for the ecosystem?

As we bid farewell to the challenges of the past, let's delve into why 2024 is poised to be a game-changer for the Indian Startups! 🚀

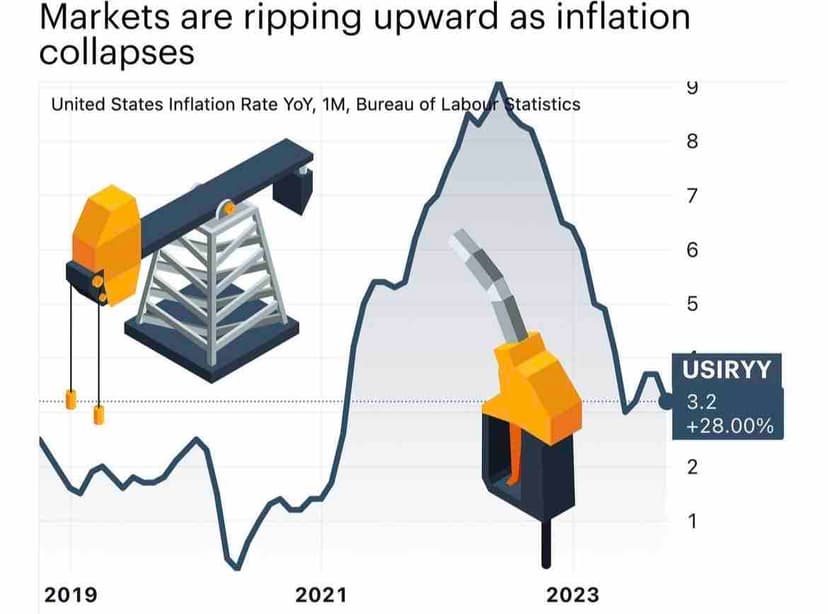

In 2020, the world weathered the storm of COVID, followed by unprecedented quantitative easing. We ...

Reads like an year end address from the company MD before the employees realize there are going to be no increments t...