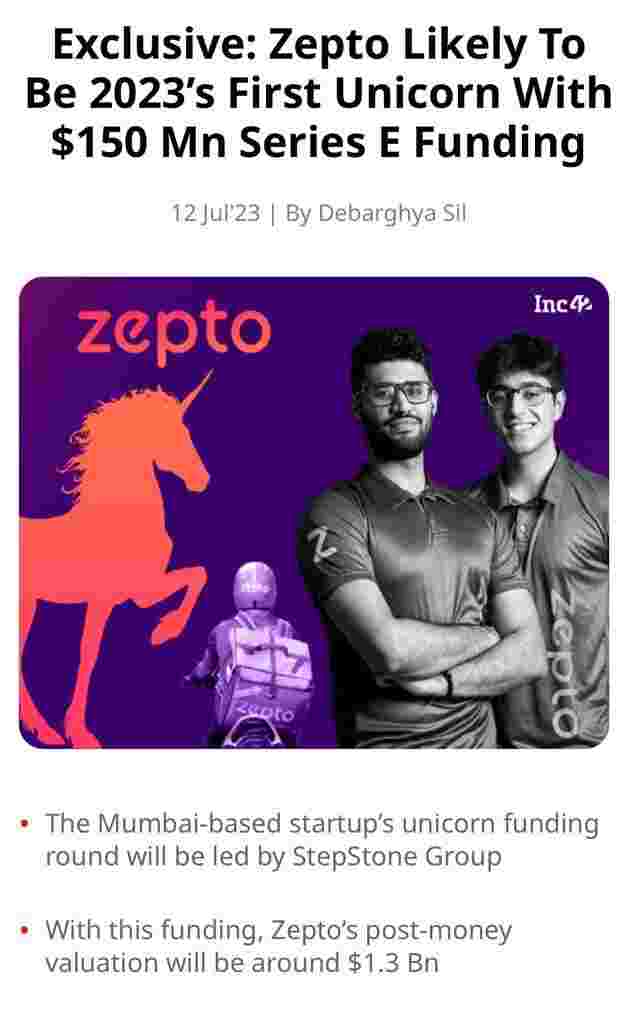

Zepto becomes a unicorn

Despite the funding winter environment, higher management woes and business model doubts they raised a colossal $200mn. Any inside beans to spill here?

I had heard Waycool was also talking to raise at unicorn valuation, but they've fired like 300 people on Monday, so that's pretty uncertain. What to make of Zepto, though?

Oh boy here we go again!

Okay thoughts: what can Zepto do better than Instamart and blinkit? What am I missing??

Write me off for being biased but their app and UI is ancient when compared to Blinkit or Instamart.

There’s a clear lack of thought behind designing an experience that increases CTR and cart checkouts.

Moat is not the UI. If one were to go with UI or UX then bigbasket had a pretty bad one and still is in business😅

As long as they stick to quick delivery without too much of service or delivery charge and can make bucks in the process they should be fine. But yeah surprised that they managed to raise money in a bear market esp since they don't seem to be profitable or close to it if am correct.

Reminds of this article. Forget every damn metric. It is easy common sense. No way Zepto or any other hyper local delivery company could become profitable.

As a founder myself, I don't want startups to fail. But atleast they can avoid misleading narratives.

I've seen more PR from these poster boys than any sensible contribution.

Either this is a money lobby or over inflated IPOs in the next 2 years stating healthy unit economies on the cards.

All this unicorn play is non-sense. I recently spoke to a B2B SaaS founder who have helped Zepto, that company is cash flow positive in <2 years of operations.

I just don't get it, these investors keep on putting money into loss making businesses. They just find a new way to shoot themselves in the foot. Zepto has been closing down their dark stores in Bangalore. Hugely loss making with money crunch yet being funded without any accountability

Notice that it's a pretty unknown investor. There are a lot of reasons money flows into certain places. Sometimes it's for financial returns, sometimes it isn't.

Despite the funding winter environment, higher management woes and business model doubts they raised a colossal $200mn. Any inside beans to spill here?

Paying exorbitant salaries was going to bite them sooner or later, feel sad for those who will loose their jobs. But ...

Everything kept aside, it’s genuinely awe-inspiring that they’ve been able to do this in a market with close to zero ...