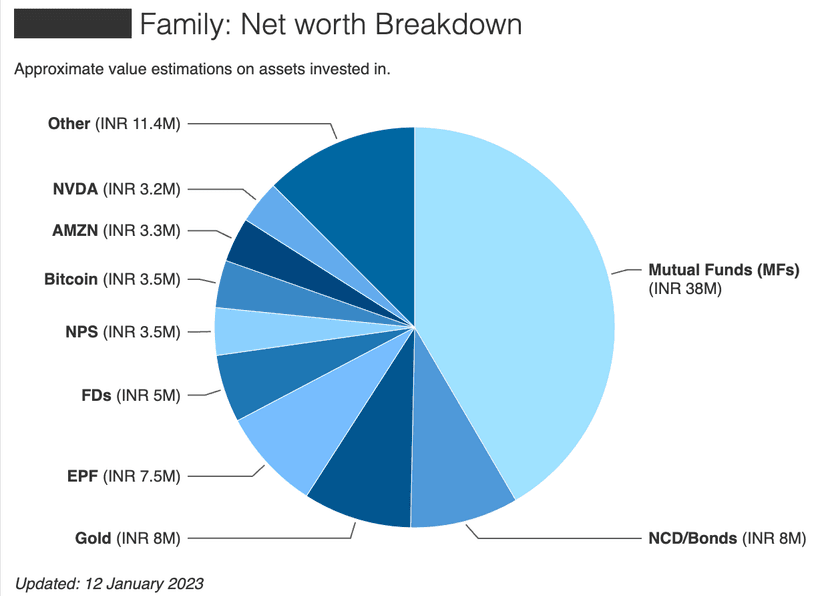

Milestone crossed 1M USD combined networth (~9.15Crore Household Net-Worth)

46 M (Software Engineer/Founder) + 37F Wife (Lawyer) + 1 Kid (3 Year Old) based out of Delhi.

So last week me and my wife finally reached this milestone, >1M USD networth. Here is our portfolio. I hope people here can recommend what I should do next.

This chart was made by our Wealth Manager.

Rough Net Worth Breakdown:

- Provident Fund and National Pension Scheme (EPF + NPS): 1.1 Cr

EPF: 75L

NPS: 35L

- Savings Account and Fixed Deposits: 20 L

Savings Account: 12L

Fixed Deposits: 8L

- Mutual Funds (MFs): 3.8 Cr (Breakup Below)

Index Funds: 25%

Mid Cap: 15%

Contra: 10%

Small Cap: 20%

Flexi Cap: 30%

- Fixed Income: 1.3Cr

FDs: 50L (Spread in segments of 5L across 10 banks)

NCD/Bonds: 80L

-

SGB (Gold): 80L

-

Crypto: 46L

Bitcoin: 35L

Solana: 6L

XRP: 3L

other cryptos: <1L

International Investments: 1.49Cr

QQQ: 30L

NVDA: 32L

AAPL: 28L

AMZN: 33L

GOOGL: 26L

We may get a good inheritance in the future, ~8Cr from my parents + ~15Cr from my wife's parents, but we are not planning on that.

Our primary goals are education for our kid(+planning another 1), their marriage, 2x vacations a year(1 domestic+1 abroad), a decent lifestyle, and a good car(we have a SKODA Slavia right now, planning an SUV as we are extending our family).

Please share your financial journey and any advice, we look forward to reading your comments.