Savings thread: Share your total savings, asset, age!

Let’s make this thread for savings related discussion:

Age: CTC: Total savings: Asset (if any):

For example, Age: 28 yrs Male CTC: 35 LPA Total Savings: 45 Lakhs Asset: 2 BHK in Bangalore

Share yours!

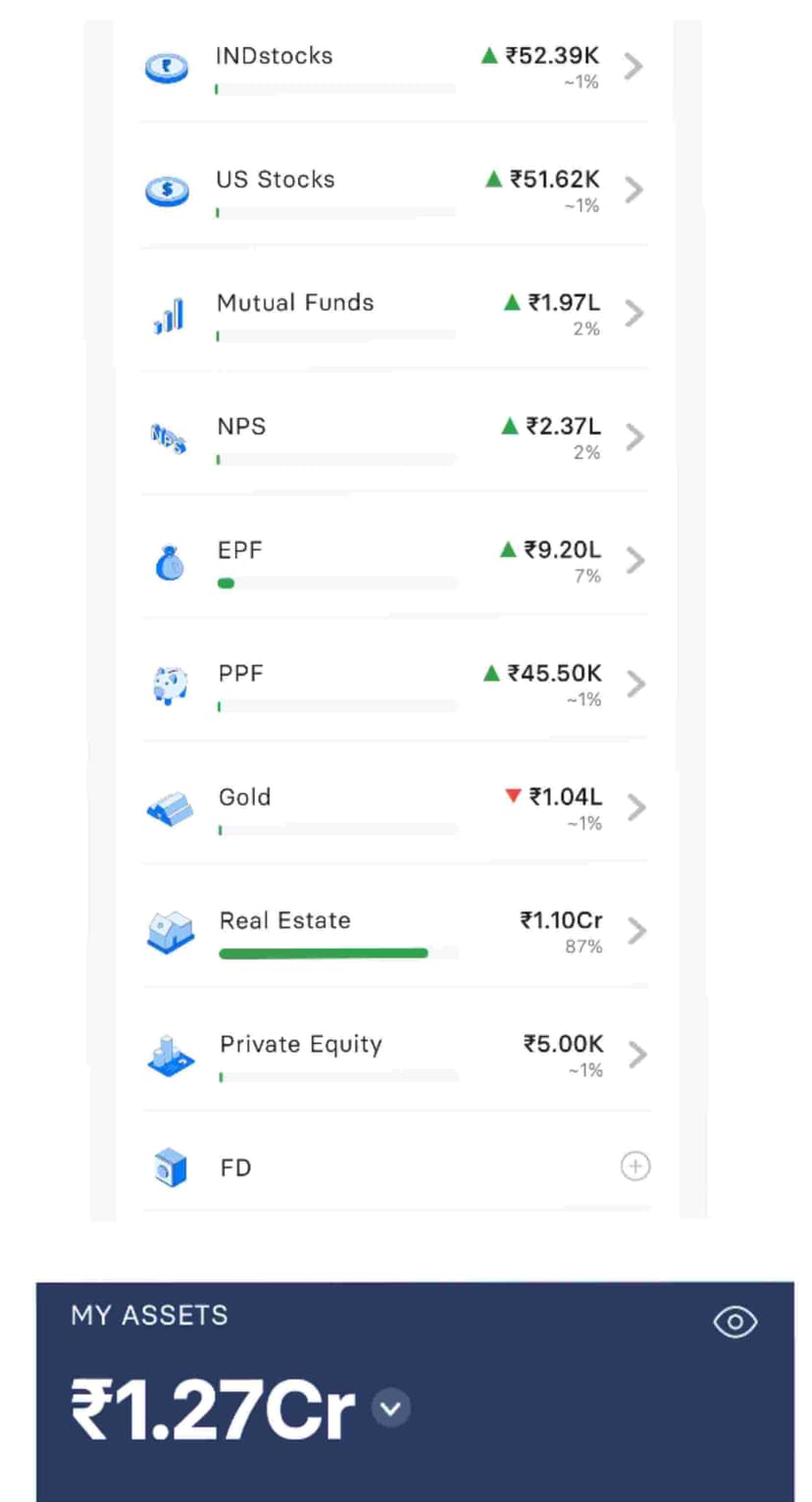

Age: 28M CTC: Enough for 30% tax bracket, not enough for tax surcharge Savings: 1.2Cr Asset: My friends and family