by CosmicTacoGrapevine

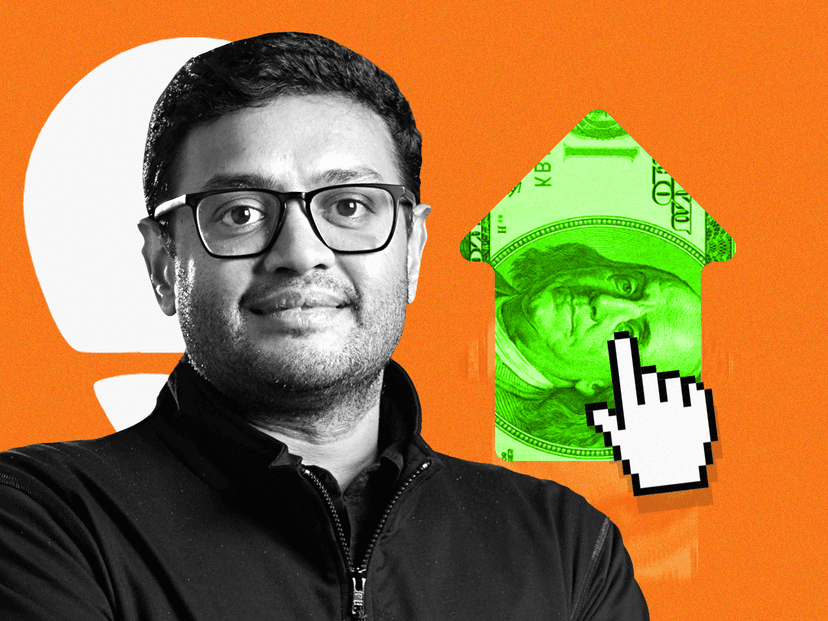

Swiggy Targets $12.7B Valuation for $1.4B IPO in November

- Swiggy is aiming for a valuation of $11.7 billion to $12.7 billion for its upcoming IPO, set to launch in early November.

- The IPO includes a fresh issue component of Rs 3,750 crore and an offer for sale of up to 182,286,265 equit...