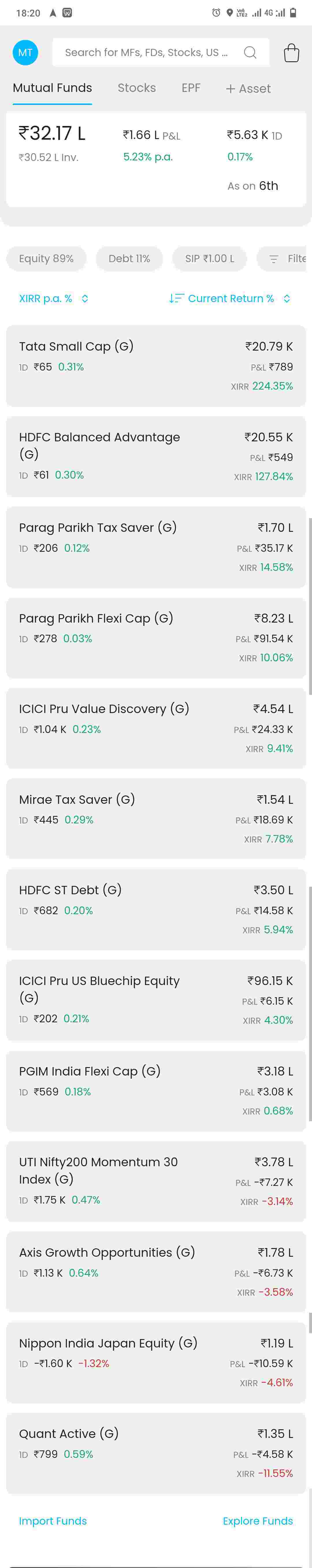

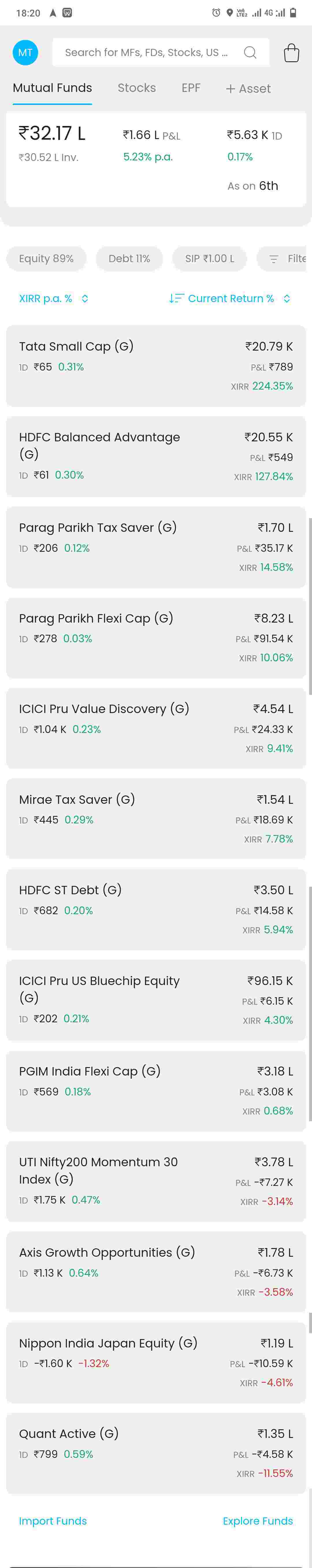

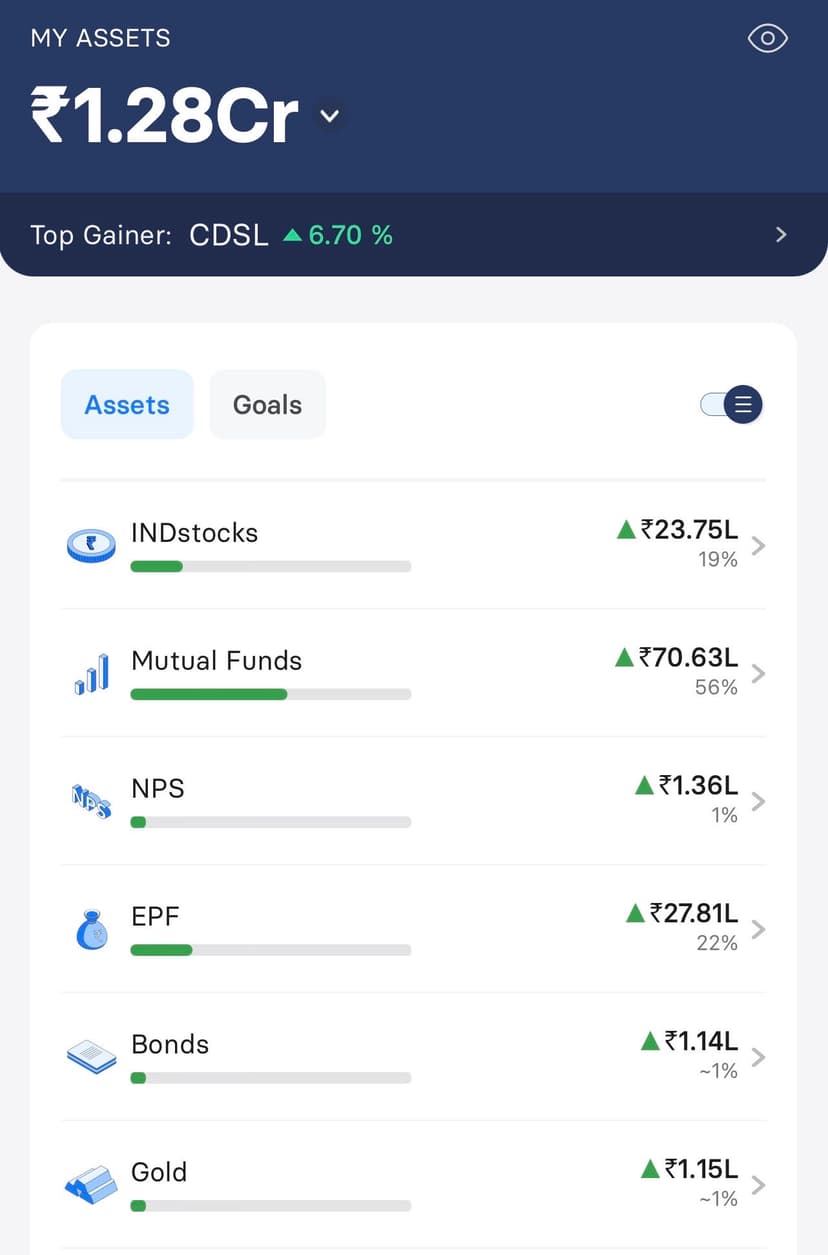

Current Portfolio review - Anything that I should consider selling? (Shared my current SIPs desc/ratio in another post due to single image/post limitation, I've done 35k/70k/1L LTCG Profit harvesting in last 3 years)

Probably, your investments are all in regular funds. Switch them to direct to get better returns.

Parag Parikh Flexicap and Parag Parikh tax saver kind of have similar portfolio, invest in one and not the other.

I would suggest just one flexicap fund, not multiple. My personal bias is towards Parag Parikh Flexicap.

I am not a big fan of ICICI prudential value discovery. Parag Parikh Flexicap is value oriented in philosophy, so that works for me.

UTI Nifty 200 Momentum 30, I stay away from random indexes.

Short term fund is good for parking emergency funds.

Thank you, for your inputs!

Yea put some fund in FD considering 7.5-8% return availability for next 2-3 years FD tenure also diversify in GOld as well like SGB

Put 15-20% in GOlD

Remove Axis fund, worst AMC. I have tried 2-3 of their funds and I found all of them lagging significantly behind its peers. Now I have stopped all Axis MFs. btw, is it your entire investment, or you have put money elsewhere too (fd/liquid/land…)

Yes, I'm planning to redeem Axis MF(already stopped SIPs) especially after the scam that surfaced in the last quarter. I'm not sure if it would be wise to wait for a year for LTCG profit or not. I know it makes more sense to book a loss and deploy the money at a better performing asset.

The current value in direct stocks is ~5L, EPF is ~4L, auto-sweep savings account/Flexi FD is ~15L.

I am paying an EMI of ~50k/month for a house that my parents(they did the down payment) and I bought two years ago. We have not got the possession right now - so no rental income.

I currently live in my parents' house.

Cool, pretty impressive saving you have at such young age. Are you from Tier1 Colleges?

btw, that flexi FD amount you can start moving to selective Banks which give high interest rates. Some Banks give close to ~8% interest rate now (IndusInd Bank, DBS Bank etc)

Too many investments , my suggestion would be have 1 nifty index , 1 small cap and 1 flexicap(which you have like Parag parikh flexicap). 1 sectoral fund.For tax saver there are other avenues like 80c ppf . Unless under Stcg you might wanna exit

Hi all awesome people, I have been investing for 7 years now, since I started my job and below is the break down of my current SIPs:

Category Fund Amount Small cap Nippon India Small Cap Fund 15000 ELSS Quant Tax Plan 7000 Flexi cap Par...

Hey guys! So i have recently started a SIP of 5k in Nippon Large Cap fund for my short term goal. Also, i have been investing in 3 other mutual funds 5k each listed below.

Age - 33 YOE - ~ 10 years in Marketing

Zero exposure to US stocks. Zero exposure to Crypto. Have a house (~45 lacs) for parents in a Tier 2 city which I haven’t added here. No liabilities (finished an education loan and a home loan)

...

Hi guys, I have around 4L cash lying around which I wanted to invest. Currently, I think I am in a position to take maximum risks, and see where things go. I also haven’t redeemed the 1.5L tax deduction on Section 80c so PPF and ELSS ar...