Deposits and Credit cards from HDFC, but borrow only from SBI

I have avoided SBI always in the past. Even few days back, someone here on GV bashed SBI when he had to wait 3hr for account opening. But the prospect of being defrauded and shortchanged for loans, with random charges added and preclosure being a pain, I am dreading to interact with Private banks and NBFC's.

I haven't had the experience of servicing home loans/personal loans with HDFCs or other banks yet. But I was planning on getting a personal loan this month and HDFC is offering very competitive rate of 11%.

Do you guys have any reviews on their service whenever you have needed something adhoc?

Talking product sense with Ridhi

9 min AI interview5 questions

Interesting. Usually it is a function of bad luck. Most top Banks are run better than government banks.

It is just that recourse might be easier in a government bank because they don’t operate with the same capitalist mindset.

My HDFC experience:

- Corporate credit card (never used & closed in 2016) still appears in my CIBIL

- Was given Lifetime free CC (entire office received it), but they started charging annual fee after 3Y without intimation Axis Bank: They gave Forex card at a University event. They had opened bank account, demat, trading, brokerage, insurance and started charging after 2Y.

These are one off experiences from few bad apples of their sales team.

But loans are sensitive. A friend's house (rented) is still frequented by different collection agents for an old paid off loan which was mistakenly marked as delinquent. These events are traumatizing

I took car loans from SBI twice. Both times they forgot to deduct the hypothecation fee of ₹50, which should happen automatically between bank and dealer.

Because of this, for 4 months my EMI was shown as overdue and it messed up my entire Credit score. SBI didn't have any representative nor they acknowledged the mistake.

Ohh. That's sad.

See that's the dark side of loans. It's not the personal finance reasons, but these fuckups from even the best of institutions which I am scared of. I have a very credit friendly attitude, but I don't trust servicing from their side.

Don't expect any service from SBI. They don't need you as a customer. We need them for their lower interest rates. This dynamic is not very customer friendly.

I guess experience can be subjective or localised. Can’t make a blanket statement in such case. Still I agree SBI has most stringent process for home loans so it’s less risky.

I agree that this one incidence is anecdotal.

But in general, how much a company focuses on compliance and practices... should be top-down, right? Is a bank/NBFC sales driven, risk driven or process or reputation driven?

In the era of core banking where most credit decisions and servicing are driven by a centralized back office, sales is the only localised aspect. Rest everything is Company top-down.

Had a HDFC loan, prepaid and went debt free a few years back. They are very underhanded about interest rate changes.

The RBI rate goes up, your rate goes up in lockstep. They sometimes raised rates every quarter. But when RBI reduced rates, there would be a significant lag , sometimes 1-2 quarters before rates were brought down. The rate reduction would also be nominal, 0.25 % when the RBI had gone down by 0.50-0.75 % even. Sometimes, you had to pay a “processing fee” to get the rate reduced!

RBI actually doesn’t allow this, but back then HDFC was separate from HDFC bank and they slipped under the radar as a NBFC not under RBI’s ambit.

Was so happy to be able to prepay and get out of this sh!tshow.

That's so fucked up!

Recently went through homeloan: Tbh most of us dont read terms and conditions. I used ai and read through the condition to find flaws. When enquired to hdfc/Axis they were not ready to mend term. Even Sbi had some of the terms. I can share email threads where they don't respond and just call and say to just sign the contract we will manage And when the seniors hit the changes as per rbi. You feel cheated but it was you who signed your death note.

. Only Navi had very transparent and flexible terms.

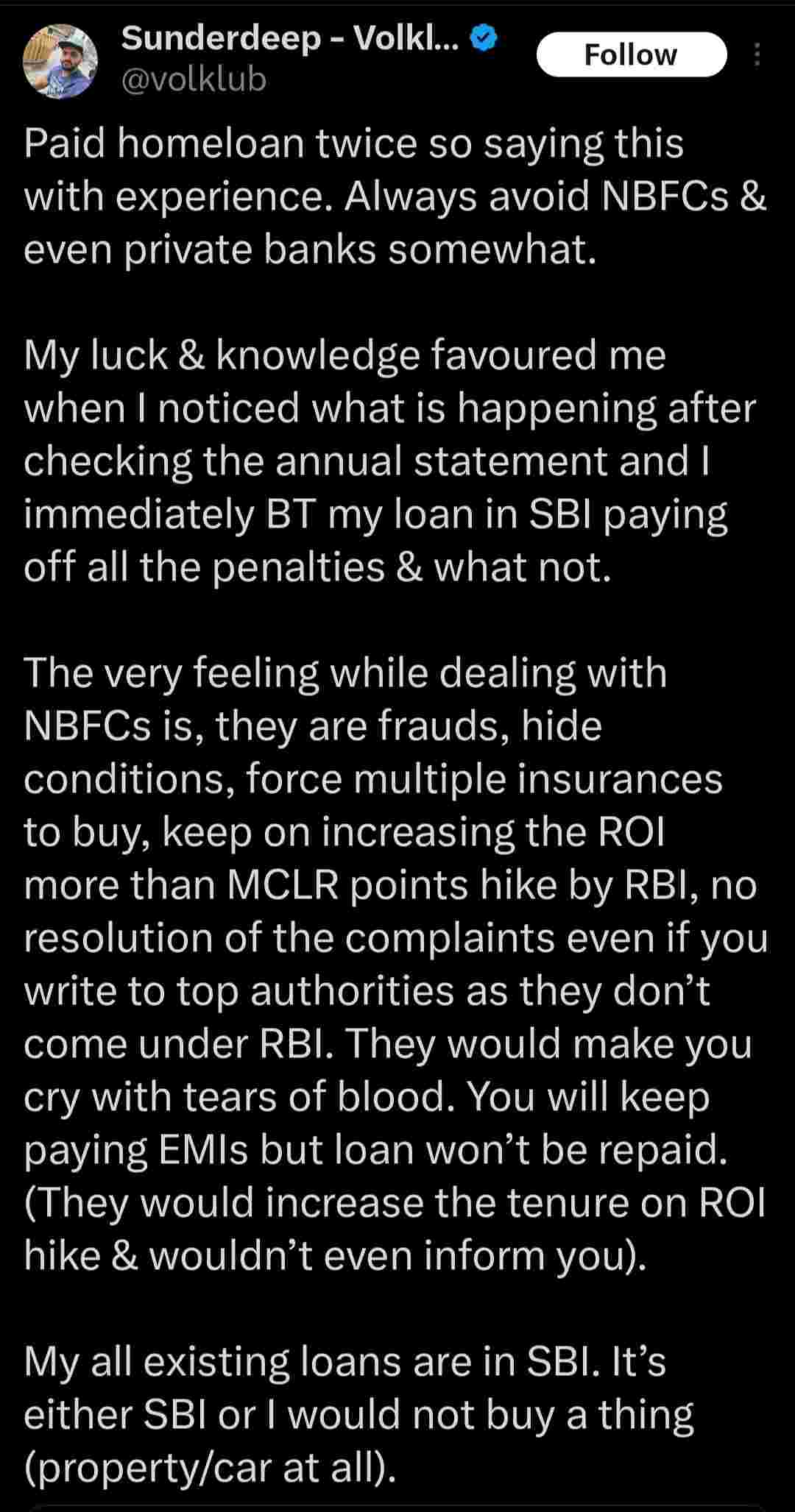

Absolutely agree 100%. Always take loans from sbi.

This november I've got a home loan from at private bank at 8.4% intrest, while the lowest quoted by a beloved govt bank was 8.65% intrest plus the added adventure of manual paperwork.

Being a sane person I took the best available loan.