Discuss: Union Budget 2024

Creating this for all budget thoughts and reactions. This was an election year, hence the late union budget.

My pointers:

- Expectations that middle class will not be happy, taxes will get steeper (it's been a trend with the current govt). Let us see

- In the last 7 years, except for 2021 (anomaly), 1 month into the budget announcement: markets have always fallen in the range of 1 to 7%. Expect some portfolio damage.

- Expected that there will be push towards renewables, friend suggested buying renewable stocks like Adani, Tata Power (I don't do shorter term stuff tho)

- There's an appeal to include Bangalore in the list of cities with 50% HRA exemption. So far it hasn't been.

Just some things I read. Let's talk tomorrow as it unfolds.

PS: Bit excited cuz in college I remember our finance teacher had live streamed it and made us take notes, giving me those vibes again :D

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

Will be honest here: stay away from Adani Green and Adani Power.

Interesting, why?

@AlphaGrindset Let's talk one by one. Adani Green has a PE ratio of over 250, while the sector PE is 33. Now, I know that when a company has a good future, PE doesn't make much sense in the short term, but that is only applicable if the company has a monopoly. However, that is not the case for Adani. Adani's total renewable energy portfolio is less than 15 GW, and there are other companies with similar portfolios, like ReNew, Greenko, NTPC, and many more. If you look at the PE ratios for others, it is less than 50, and they are also growing with a good future. Even if Adani Green increases their portfolio by 5-10% CAGR, it will still take years to justify its stock prices.

One of the major red flags is that less than 2% of mutual funds are invested, while FIIs hold more than 21%. So, who are these FIIs? Have you ever seen such a pattern in any other stock? I don't want to talk about it much; if you know, you know.

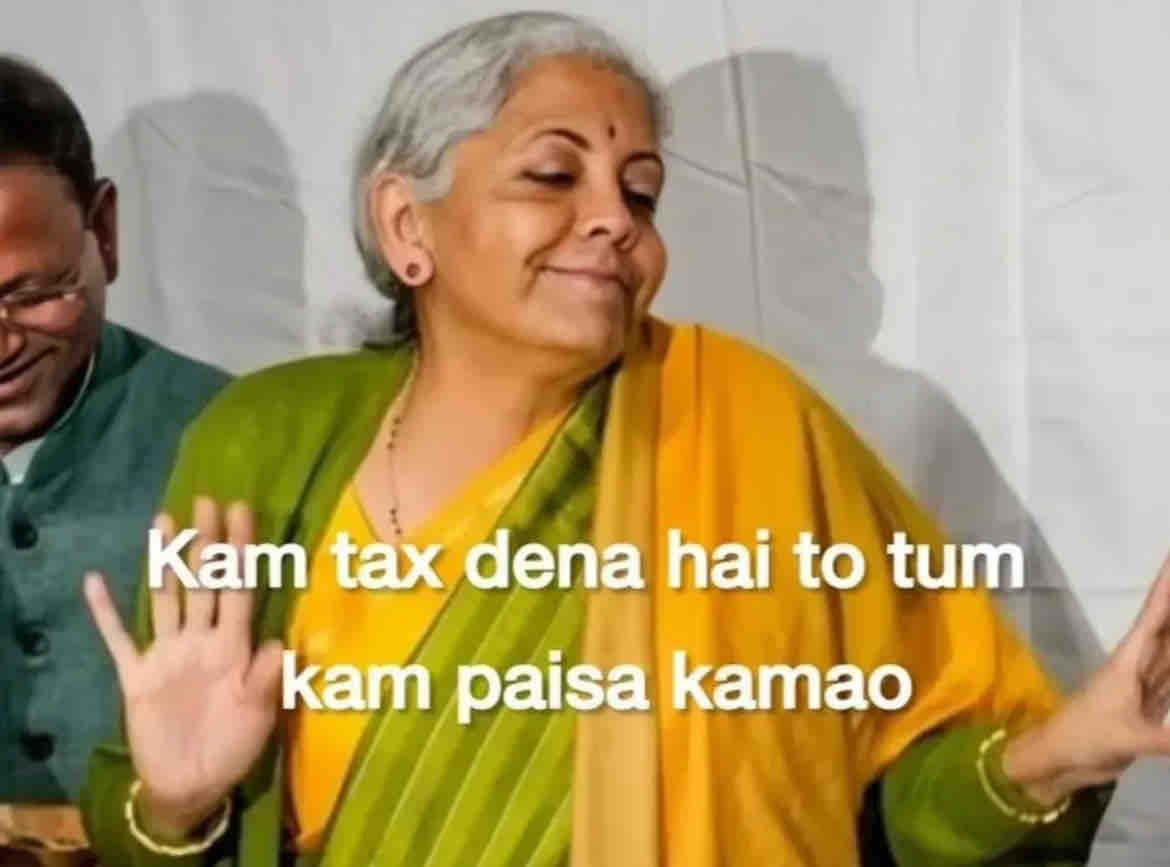

The salaried middle class is a cash cow, and further this is a selfish category, they don't protest, don't do dharna or raise a voice firmly against the govt. They can't take a leave from the job for these stupid things unless it directly impact them. Salaried middle class are meant to be exploited and they will be going to be exploited. So pay your taxes before 31st July and don't ask for any free healthcare, free education or any govt schemes.

Salaried middle class is both a minority - less than 7% and also the biggest voter for BJP and as a result BJP will take them only for granted. If you want a budget that benefits you then you must organise

I just wanted to understand one thing (might be a noob question), people are saying the salaried middle class are paying more tax, but the people with income more than 15 lakh will have to pay 30% tax. So who comes in this bracket?. Middle class only?

-

Deduction of expenditure of employers towards NPS to be raised to 14% from 10% of salary.

-

Short -term capital gain on some financial assets (details awaited) to be taxed at 20%.

-

Long-term on financial and non-financial assets to be taxed at 12.5%. Limit raise on exemption of capital gains on some financial assets (Details Awaited) to Rs 1.25 lakh per year.

-

Credit of TCS proposed to be given in TDS to be deducted in salary. (Idk what this means - more to be looked/studied in the details)

-

Corporate tax rate on foreign companies reduced to 35% from 40%

-

Internships in top companies is the theme: 500 top companies to offer internships to 1 cr. youth. (internship allowance of 5000 per month, one time 6000. 10% of internship costs can come from CSR).

-

Digitization of terrestrial maps! This is a game changer for land. Huge for RE/agri lending, for urban land records. They will get across the country GIS mapping.

As usual: Rich get richer, poor get poorer

Middle class are meant to be exploited as per this budget.. we just pay taxes everywhere

@DaringTrain we pay taxes and never grow out of the middle class

budget as usual, absolute 💩

for the new guys, not too long ago tax on stock gains was 0%

Wait how long ago😭

It's always been on off but during 2004-2014 LTCG was 0 the sometime after current bjp govt came it was hiked to 10%

In not too distant future be ready to shell out 30-40% tax on any kind of capital gains, already indexation benefits are removed.

😆 so funny

Not funny at all !

Special budget for Bihar and AP. Explains why Nitish and Naidu were okay with non cabinet ranks.

@AlphaGrindset Yeah, makes sense now. 26K Cr and 15K Cr.

Bihar is more than that. New expressways have been announced, tourism support, flood relief. Total is around 1L cr