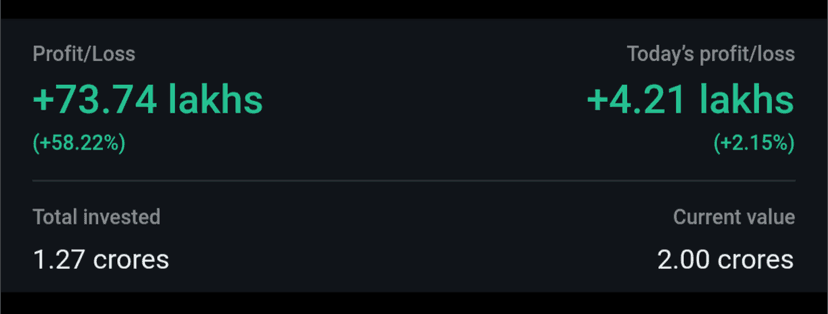

Equity Portfolio touched 2Cr this Friday!

A win in its own sense. I invest in mutual fund as well which is worth 27L but this is direct equity portfolio. AMA

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

How do you embrace volatility? A 10% down move is 20L loss. Does it sadden you, make you wish to take any actions?

Similarly, a 10% up move is 20L in the bank. Do you feel the itch to cash out a bit, or take out money to treat yourself after spending 10 long years building the folio?

Please answer this question op

I stay with my parents,I run my own business, don't own any personal loan on anything hence I save money here. My father has debt which needs to be paid in future as there is no compulsion to pay right away so I just focus on investing. I keep quite some amount (almost 40-50L) as cash in hand for emergencies at any given point of time.

Long term investor should not be worried about the short term loss or profits :) I sometimes forget my password & don't check portfolio for weeks.

What is your investment strategy roughly?

Investing since 2014. I invest 50% of income almost every month. Sometimes once in three months. Increased my investment since 2020 as my income grew in business. My dad advises me when it comes to stocks but I take the call on the amount.

Very 👌🏻

How do you secure your portfolio,

I think If you lost your mobile, somebody can just take your sim and install it on their mobile

Install Groww App, reset the groww pin

Add a bank account for withdrawal and withdraw the money

Thats a valid question. I didn't think through this yet but It would be difficult to bypass so easily right? We have pin + password on the app + if you change the emai passwordl & maybe freeze it with the securities, nobody can do anything.

withdrawal never happens without a penny drop validation

as a response of penny drop, customer’s name is validated, which will fail here

Aur yaha mai 65k ke loss pe dejected feel kar raha hu Ps - fresher hu, and f&o loss hai, stocks folio is 3% return from 1.4L and mf is 10% from 1.7L

@DaabaWubbaLubbLub FnO is gambling unless you are an institutional investor/trader. Whatever you put in there, expect to lose it, and enjoy the occasional gains.

Stock folio goes up over time. Even if you invested just before covid crash and braced for a while, you'd be in profit. Keep investing, and reap benefits over time!

I don't understand F&0 & I know I will lose if I do it. Hence, sticking where my mouth is: long term equity. You will do well, do invest for long term :)

- How many income streams do you have?

- What is your savings rate?

- What is the rough CAGR for you over the 10 years?

- One. My business

- 40%-50% on most months. Rarely 30% or below

- I haven't calculated this tbh

Interesting, since you have your own business, have you ever thought about the same money in the business itself? Did you consider doing the cost-benefit-risk analysis?

Congratulations on hitting 2 Cr mark! I have a question. You've mentioned that you invest high in your income every month, so how do you manage your immediate needs? How do you save liquid cash in case of emergencies or some urgent needs.

I do keep liquid cash for emergencies. Out of my total NW of close to 3cr, 40L is cash. This is the same at any given point of time since last 4 years. I don't overinvest or let this amount go down & in covid I actually stopped investing for 6 months as my business income took a hit. . I also need to keep cash in bank to run my own firm so thats that.