Food for thought

Talking product sense with Ridhi

9 min AI interview5 questions

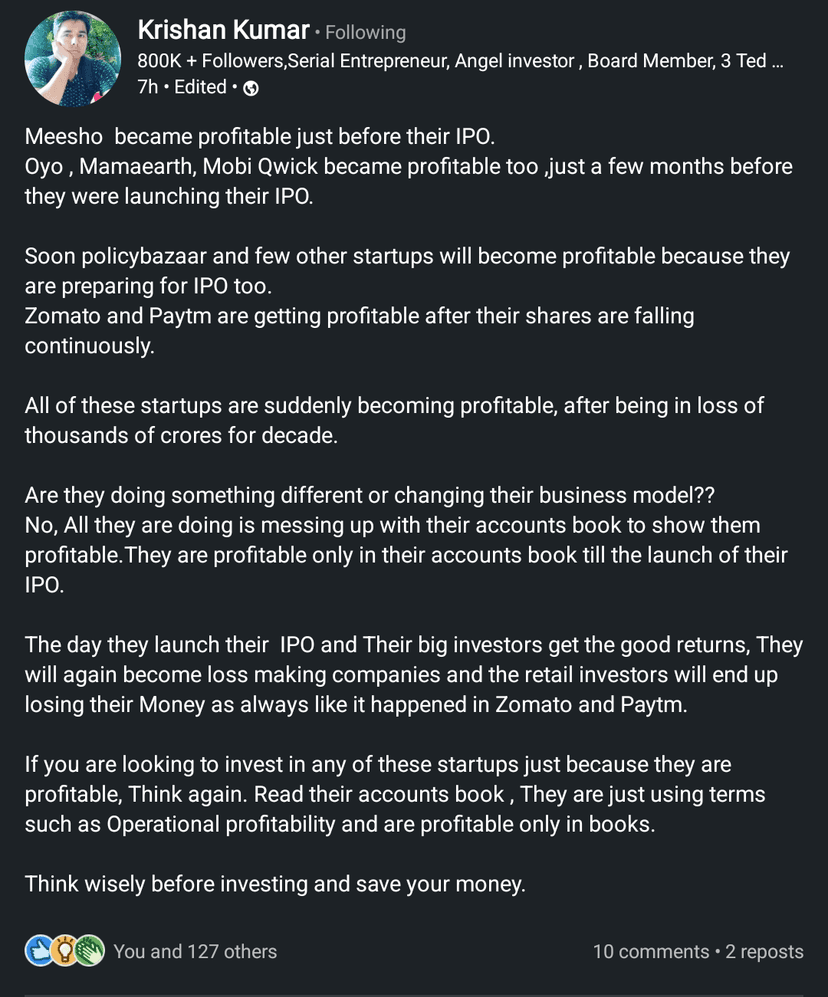

There is no proof or even symptoms to give these sweeping statements.

Now, for some of the companies profitability would have come at the cost of growth, then it is not sustainable. But companies like zomato are growing while not burning cash is a good sign.

People who are saying why sudden shift, because Market truimps every other strategy. When cost of capital is cheap, there is value chasing growth, when it become costlier, value chases profitability. It fluctuates. If zomato was showing 20 percent growth in 2021, they would have been punished by the investors by downgrading their value.

Zomato using unscientific terms like "Adjusted Ebitda" is all the proof you need. No wonder you chose to ignore it.

First understand what's the metric, then comment. People who doesnt know accounting should refrain from commenting on metrics. Period.

Ofcourse they reported 'scientific' PAT as per accounting standards then why not consider that? Why cherry pick whichever suits your narrative

It’s always better to invest in hardcore businesses than startup when it comes to IPO. Never know how much it is cooked. Here are my few cents:

-

During IPO, always need to check what the company would do raising that money through IPO. If it’s for expansion and all(great stuff). If it’s for paying back(better to stay away from the IPO).

-

Checking for investments from institutional investors. If they have heavily subscribed, you can probably take a bet, even if retail segment isn’t that subscribed. Institutional investors will have more information and do more due diligence. For eg. There was mankind IPO wherein retail was not fully subscribed. I had subscribed to it and got allotment as well and was a neat 80% profit(sold after some few days of listing when price went to near ~1900.

I have stayed away from PayTM, Zomato and such kinda IPOs and will do it for others as well.

Adjusted EBITDA se toh mei Fyre festival ko bhi profitable dikhadu

Zomato become profitable because of the interest they earned on the 10k cr money lying in the deposits

Don't invest in any ipo. Wait for a year , we will get to see how shitty each of these business are.

no one is forcing retail ipo investors to participate in these IPOs, it's all fair game if they're participating by their free will.

There's really no value in bashing in these "new age tech IPOs" it's about personal choice.

As someone who doesn't have full fledged research ability about company's tech, financials, whatnot I stay away for literally all IPOs.

The usual case is 2lkh blocked for week or two, get alloted 1-2 lots, even if 2x the listing gains the upside is Max 30k and you'll be anxious till it's live in the market.

If you wish to try luck by hni category, a 5-10lkh application doesn't realise to any significant allocation, so would any regular person really want to bet upwards of 50lkh in an IPO?

Zomato, PB, Paytm show growth while trending towards profitability. Thats good. From optics perspective, they may take help of accounting measures for some time, if they dont show profits within a few quarters, it will be sad. Free cash flow is another thing, though not touching that right now.

It’s not only account books profitability but additional cost cuts making the business stand still. For example - Oyo has reduced a significant tech talent and moved into maintenance phase. Is this sustainable? Not at all, these startups need to grow, build the revenue flywheels before all these cooked profitability stunts.

If only certain edtech was able to do it's ipo. It would have had the dubious distinction of ruining small customers with its products and ruining retail investors with it's ipo. Alas, we will never see that day.

Kinda true