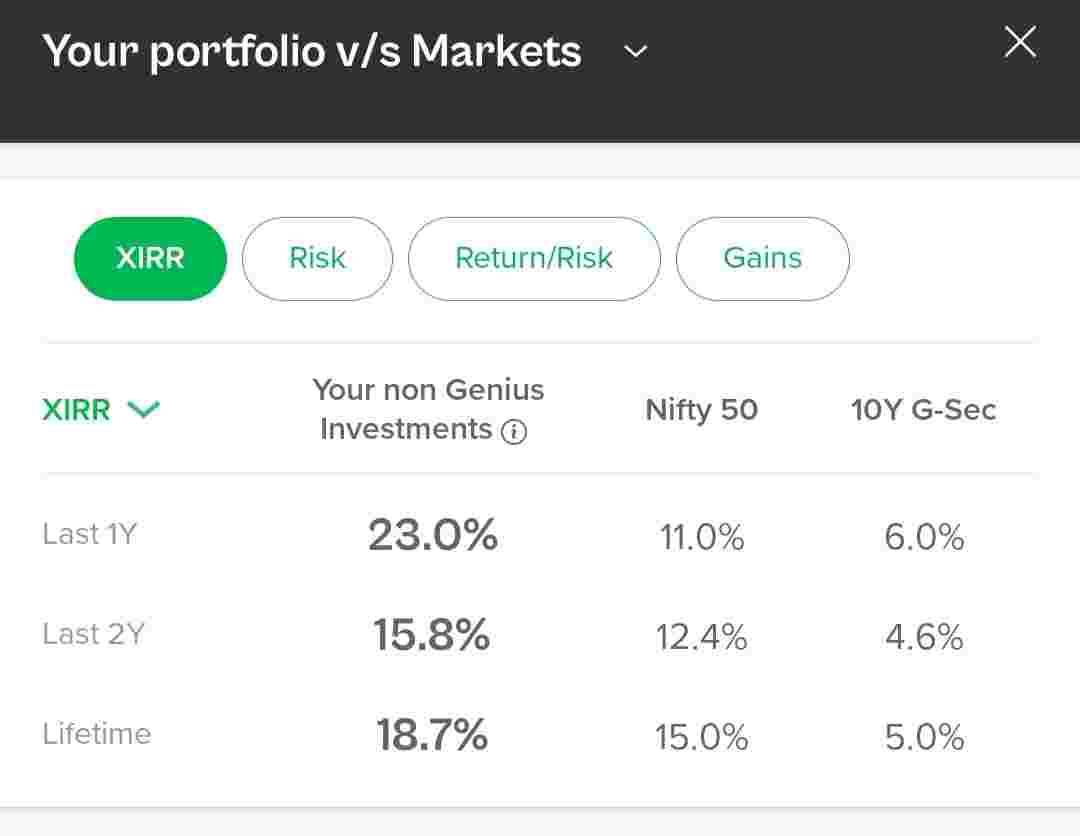

Gains

We have heard so many times that it's difficult to beat the index and people should stick to investing in index mutual funds.

Well I've been doing SIP in selected non-index funds for past 4-5 years and surprised to that I'm comfortably beating nifty 50 benchmark.

How are your gains looking and how long have you been investing?

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

Your XIRR is too good. Sharpe Ratio?

My risk is also lower than nifty 50 (8.2 vs 9.5). Return/Risk ratio is almost 2x of the benchmark.

Not every fund beats the index at all the time windows. Your outperformance is due to you being in the fund that outperformed the index and that might not be always true.

The above summary of the SPIVA report provides context. Read the full report, it has interesting data.

I'm aware of this. My SIP is not just in 1 fund.

Please provide the details of the funds you have and their percentages in your portfolio

Possible to check this in angel one app ??

Not sure. Never used angel one.

Consistency is the key to compounding.

Higher XIRR just makes you greedy and switch. Dont fall for the emotional traps.

Yeah. This is my passive investment portfolio. I just do SIP of fixed amount every month in this. Not going to touch it for another 10-15 years.

Good on you Kafkaa, The last 1Y, and 2Y have done well. Although you could have risked a bit more during the covid 1st wave, maybe pushed the lifetime returns to 20-25% perhaps.

But great returns nevertheless

Completely agree. Got a bit pessimistic during covid 1st wave and played safe.