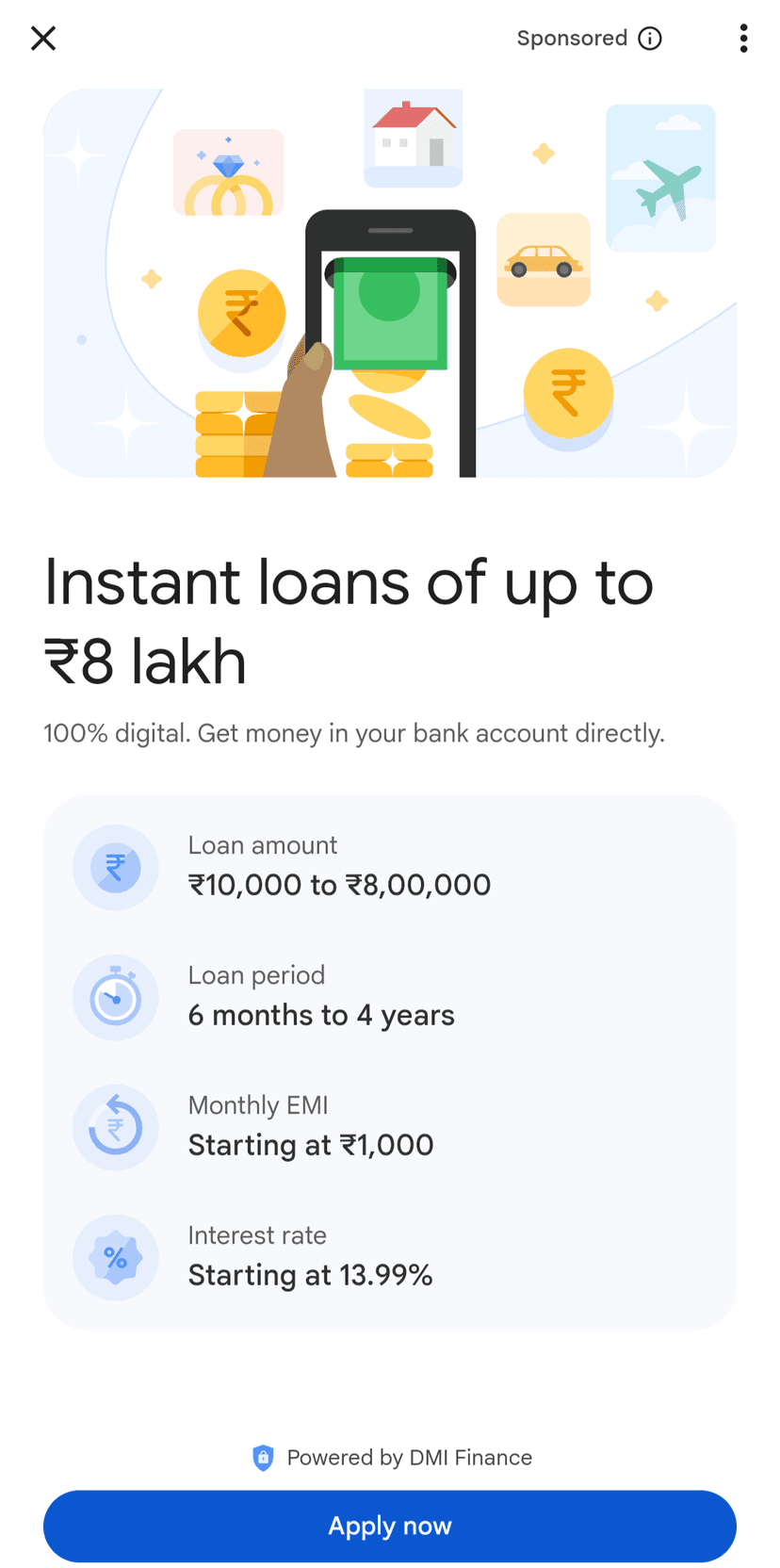

Gpay offering loans now.

I tried Paytm payments Bank but payment options were fairly limited. Deactivated after a few months.

Has anyone tried this one? Is there even a point to such loans apart from emi/big purchases?

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

This mentions powered by DMI finance, it is very very sketchy company they didn't close the loan account created by slice app even after told to deactivate the slice account, I emailed the slice support multiple times to coordinate with their nbfc to close the loan account but they repeatedly kept asking cibil reports and it took a total of almost 6 months for them to eventually close the loan account so that it doesn't reflect active in cibil report.

I had opened slice account back in 2019, asked to close the account at time of RBI ppi credit ban.

Yeah, I've never heard of it before

14% interest is a lot

I got my first loan on GPay but it was offered by my bank. I paid my loan EMIs directly to bank. Now they have many companies and banks offering loans.

I availed this loan offer last year. The interest rate was very high but otherwise I didn’t have any issue

Never noticed this. But offering loans is one popular way to make money. Google pay team has also been hiring for some time (noticed a lot of LinkedIn openings).