[HELP] Investing Nifty50, is it rational to assume a 15% rate of return?

So yesterday I was thinking about investments. My friend, who's also a techie, was like, "Dude, just put your money in Nifty 50 and chill for 20 years." He said we could expect around 15% returns annually. I was like, "Bro, are you sure?"

I did some quick math using the compound interest formula. If you invest in Nifty 50 now, and leave it for 20 years, it needs to hit 392,796 from its current 24,000 to give us that 15% return. That’s crazy high, right?

Anyway, we debated a bit. He says it's possible, given India's growth story and all. But honestly, getting a 15% return consistently over two decades is ambitious. It’s better to have a balanced expectation, maybe around 10-11%, and be pleasantly surprised if it does better.

Reactions?

- 15% is Nifty Total return which includes dividend. That doesn't mean Nifty will reach 393K in 20Y.

- Current Nifty 50 total return (2004-2024) is nominal and came during a period of high inflation, huge positive demographic change, formalisation of economy and period of historically lowest interest rates. These factors are less likely to keep on improving or sustaining for next 20y. So returns are likely to be lower.

- Most Nifty 50 cos in 1990s were operating like midcaps operate today. (Governance, regulations, access to capital markets, foreign competition and partnerships). Also, the sectors in N50 were different back then than today's Nifty (35% weight in Financial sector). So even if the Indian economy grows by 8% real rate, that might not translate to Niftys TR 15% CAGR.

My recommendation is to keep investing in N50 till you have corpus of 3X of your annual pay and then increase allocations to other avenues (Next 50, Midcap, small caps, International, Real Estate)

Also, on returns: Do not have an expectation number in mind (like X% over next 15-20Y), especially for Equity. These long term numbers are very dependent on 100 odd factors out of anyone's control.

What you want is savings to beat inflation meaningfully to sustain a particular standard of life. What you can control is your contributions and your standard of life. If returns are lower than expected, increase your savings or reduce your expenses.

Don't aim for X% returns.

Hard to assume such a high return but not out of the realm of possibility

12% should be reasonable expectation

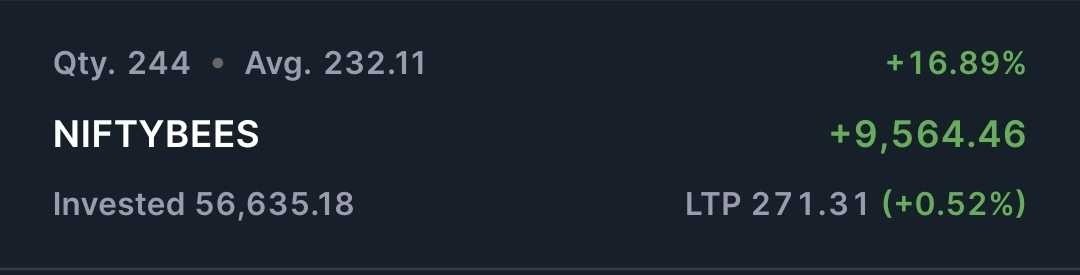

Got 16%

Do you think growth happens linearly ? Or let’s think in a way 15% of 2L mark at Nifty is similar to 15% of 24k.

What do you think>