How to save income tax when you for a US based startup and pays you in dollars?

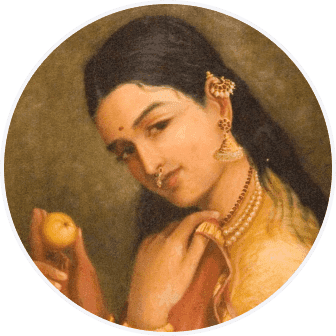

Talking product sense with Ridhi

9 min AI interview5 questions

Does your employer deduct tds based on Indian tax laws?......if not then well....... It's your shraddha to pay modiji or not

Haha and wait for ITD to catch hime one fine day with all those foreign remittances ?

You can probably slide under the radar if you pay some tax and don't look fishy. Not sure if it will work but someone more pro in gaming the system is welcome to comment

File a W-8 with your employer. India-US have a DTAA, so you won't be double taxed.

File your advance taxes in India per the slab - quarterly. A good CA should be able to help you with this.

Don't even think of not paying the appropriate tax - you'll be in a lot of trouble. Every remittance in India is reported and scrutinised. There is no escape.

File as a consultant, or register a proprietorship. Speak with a CA, terms might vary based on your situation.

@Createlife95 please share how to find such opportunities, once I start earning in dollars I will tell you how to save taxes.

Do we have a deal?