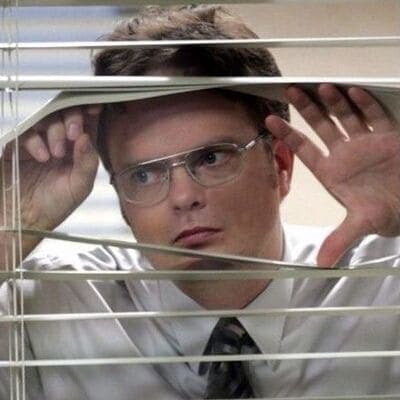

Moonlightning: has anyone been involved in Multiple jobs

I have two offers and I am planning to do both of them: 8LPA and 9LPA. In what case company could know this. And what are tax implications? Should I choose new or old regime. This is cash components.

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

I have been doing it for quite some time. There isn't any issue. The only way you can get caught is if you have opted for PF in both the companies.

Don't opt for PF in one company. Companies can check your entry and exit date through PF. All of us have option to opt in or opt out of PF.

CEOs can work for multiple companies but we can't, why?

Most companies won't even take any action if they know you are working with multiple companies cause even they have trained and invested in you but the condition is never fail to ship/deliver.

And never working with companies in same industry or domain or competitors. It's a conflict of interest.

I recently started with a second job. The second job is startup based, they don't have pf registration. But in the same domain, i am hoping for no issues.

I want to ask how you manage tax. You opted for nps in both or one? Are you showing other income as consultant?

True Ambani spotted

Ask one of the company to join as consultant Instead . 8Lpa one here since the other pays you more. As a consultant your money would be send directly to the bank account with 10% TDS.

I figure if someone looks at your ITR they will be able to figure it out. But a relative of mine has managed to do this since 3 years. Rolling in dough by doing two shifts a day

Noob, Epfo service history.

No, can be found out by EPFO Portal by employers

I personally know 2 guys who has done it and they got fired from both companies. They catch you somehow via your PF contributions (not sure how). So quit messing around and pick one offer.

Nobody can figure any thing about moonlighting through Background verification. The company asked the previous company about the time period one worked, designation and if there are any dues left. That's it .

I recently started with a second job. The second job is startup based, they don't have pf registration. But in the same domain, i am hoping for no issues.

I want to ask how you manage tax. You opted for nps in both or one? Are you showing other income as consultant?

If you’re clever enough then there’s no issue at all. One my friend is CURRENTLY working for 3 companies. 1 is Indian and rest two are USA based. He’s been doing it since 2 years. Didn’t get caught managing things efficiently and earning money like anything.

Join them as a freelancer or something

I tried once. I even had permission from my officer (govt officer). I went for the interview, got selected but it was a night shift. The distance was a 2.5 hour travel in metro between both offices and I didn't do the math correctly. 5 hours in travel, 10 hours in night shift, 8 hours in the day job. I did the night job for one day and my boss sent me back home to sleep the next day.