F*** your calls and F*** your puts: Insane Volatility in NIFTY

I wonder if buying Calls and Puts at the same strike price will work really well 🤔

My Recommendation:

Let me know your thoughts.

I hope 2025 turns out better.

Man, not one month of 2024 has completed, and hoping for a good 2025. Tough times!

Tough times in the job market especially for entry level talent and certain skill sets that have suddenly become over valued owing to the excesses of 2021 and 2022. The Indian economy however is booming and will in all likelihood continue to do so for most of this decade as we make the most of our demographic dividend.

It is fine, you don't need to end on a positive note. We all know how well we are using the demographic dividend.

Whether to cash out small and mid cap or not depends on your horizon, if your horizon is 3-5 yrs, stay invested and take benefit of correction.

However i dont agree with this analysis totally, this scare is going on from a long time. Market has its own cyvle and it's hard to predict with current macro and micro economic situations. So stay safe but wait and watch before making a call.

I would incline on this framework. I started investing in direct equities from the bear market of 2012 and this time is never different. What makes the market interesting is the different views of the participants. At the end of the day it's our money, our conviction. :)

The least I can do is to book the overvalued pockets and move my money to safety. When the correction comes, I can deploy patiently. :)

Not listening to anybody who predicts market movement.

Nothing is happening till elections 🙂

FIIs have initiated the profit booking. Inflows are negative.

That happens because FIIs have Jan-Dec cycle. They create liquidity in Jan for the remaining year.

Agree Agree Agree

There has been over optimism which has led to the recent rally. We need to temper down

I don't agree with your analysis. The era of easy borrowing and low interest rates has ended. This may impact startups who depend on easy access to funds. However the economy is growing in the range of 6-7%. Top companies in many industries are growing at twice that rate. Valuation should be seen in the context of profit growth. It is completely incorrect to say stocks are trading at a "historical premium" Quite the opposite. In certain sectors like financial services the P/E ratios of most large companies are currently lower than during the bottom of the COVID induced crash. Markets will experience volatility but in the next 12-24 months they will inevitably rise. One can certainly play safe by avoiding small caps.. However, if one has the appetite to deal with a bit of volatility (max -20%) one should stay invested rather than try to time the market / move to debt funds.

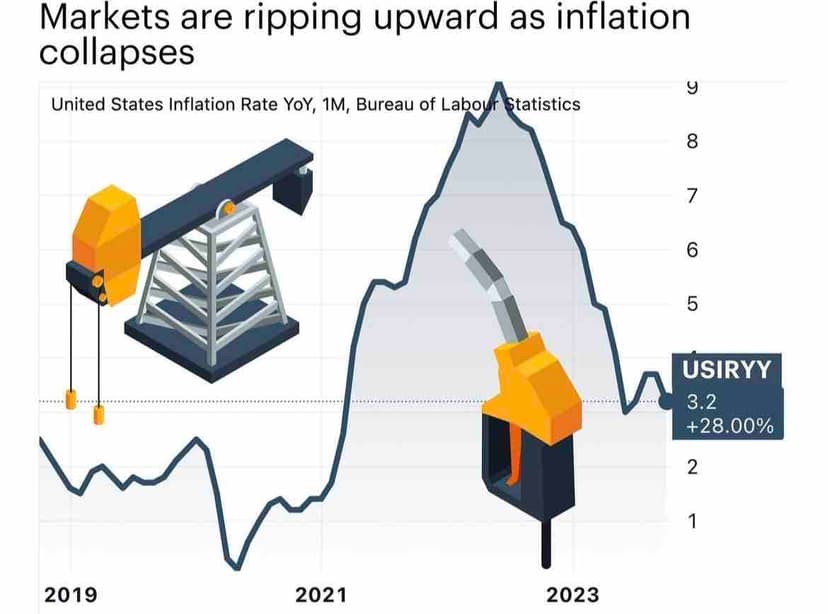

As far as the US economy is concerned, analysts have been shouting about impending recession for the last two years! Nothing of the kind is evident In spite of the rise in interest rates brought about by the Federal Reserve (worried about inflation), the US economy continues to grow at a healthy pace. Last year the US probably showed higher real GDP growth than China.

What % of your portfolio is in direct stocks ex mutual funds?

Financial services should be looked at from a PB perspective not PE. Secondly, look at the slippages and S1, S2, S3 loans you will know how fragile the loan book is and NPAs will arrive later. Tread carefully on financial services companies. Good luck with your investing journey!

Any particular large cap? Nifty index is also made of large cap only. If market corrects, doesn't that too will be affected?

Yes, it will be impacted. You will fall in line with the market and not more. Index is the safest bet and many studies have confirmed that 90% of active funds don't outperform the index benchmark.

Bhai, it's not a market for SIP. It's a stock pickers market. As simple as that

I read a similar post in 2021, saying COVID wave 2 will come, lockdowns, widespread losses and destroy valuation by 50%. SENSEX was at 36K and it mentioned going down to 20-25k.

Guess what, that never happened, Sensex is 71k now. I did not invest and booked profit at 35k Sensex.

You never know, when the bottom hits and growth starts.

I wonder if buying Calls and Puts at the same strike price will work really well 🤔

Look at my today's loss & I am overall 5% down since the start of the month.

Show off karne ka tarika thoda kezual hai 😱 haaaye daiiiya, paaaaanch laakh !!

I was 15% up overall, I'm at 5.56% today 😪😪😪

My first thought is that, inflation adjusted returns will soon become lucrative for investors as some amount of capital returns to VC Funds.

Any other thoughts/differing PoVs?

So recently all major FMCG companies have corrected by almost 25-30%. Do you think this might be a good time to invest some money and buy the dip? Or is there a possibility of a further fall?