New to old tax scheme?

Hey folks, I opted for the new tax regime when my CTC hardly touched the tax bracket. Now I earn 22LPA and my heart almost collapes after seeing the tax paid. 2 ques: -Is it possible to move to the old scheme to save taxes?

- Given my salary, what are the best avenues to save tax? Thanks 🙏

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

I don't know exactly how you are planning to save taxes in the old regime, but yes you can move to old regime at the time of filing taxes. But again, you can switch to old from new only once and then you can't switch ever.

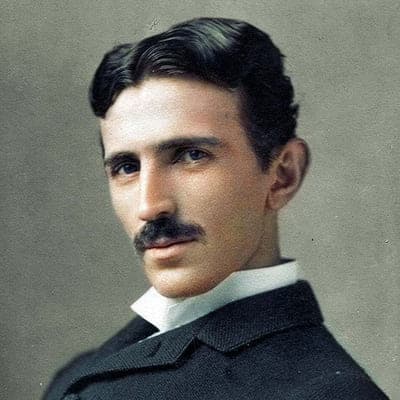

Nirmala when I pay my taxes ☝🏼

Old scheme is best. New is a scam.

When you file the return for the end of this financial year in June 2024 - while filing choose the ‘old regime’ yourself, and for the tax accumulated deducted, submit proofs. The money will be refunded (old regime - new regime).

Move to old scheme. You can save taxes by investing in long-term investments such as PPF (or EPF), NPS (Personal and corporate), etc. Your in-hand will still be low but at-least you won’t be paying for statues and shitty roads.