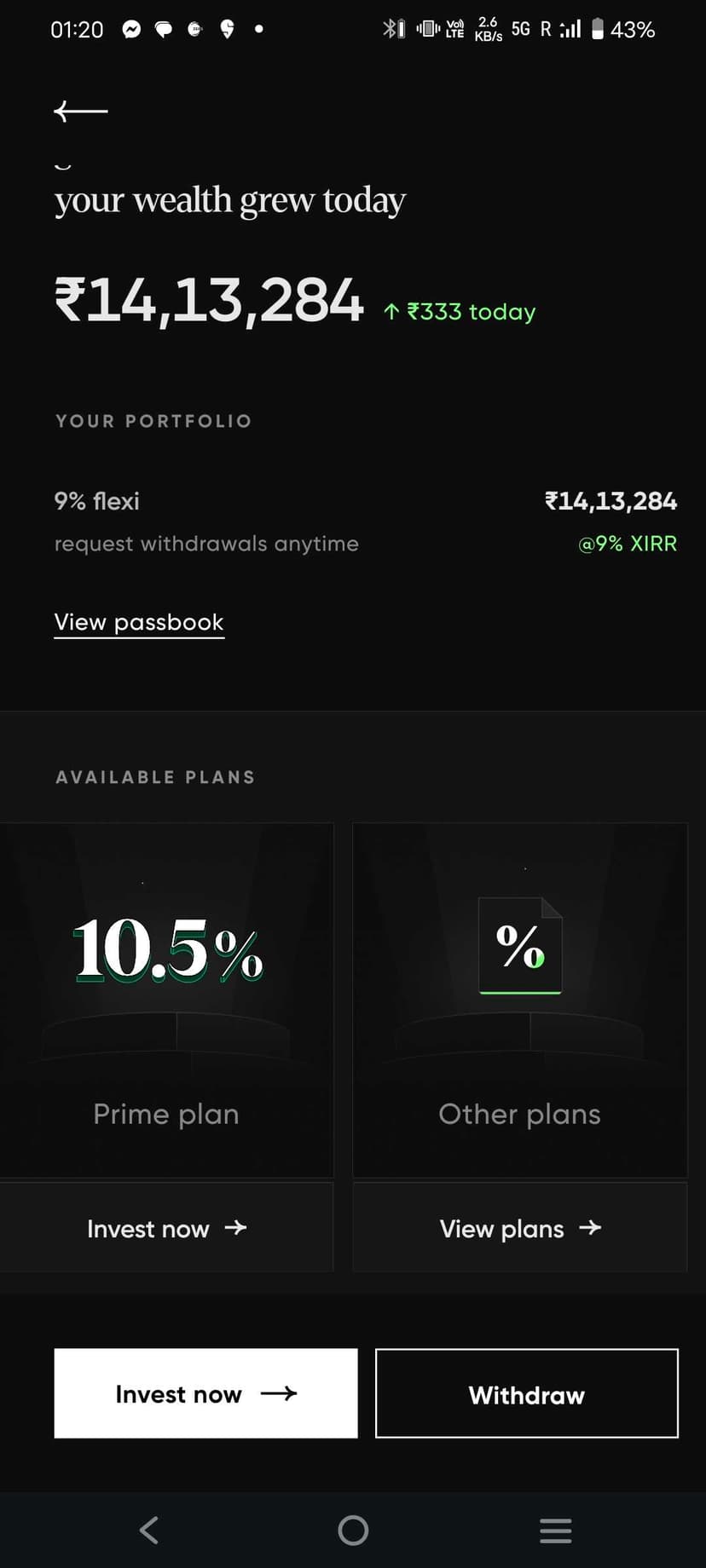

P2P Lending works like this.

- InvestorA invests money.

- That money will be lent to multiple people (to avoid concentration risk) by P2P Lending platform.

- BorrowerA pays back as EMI or full amount

- Investor gets only their share of money with interest that was lent to BorrowerA.

If the borrower doesn't pay the investor will not get money.

i2iFunding is one of the initial companies that started P2P Lending and they still operate correctly. I

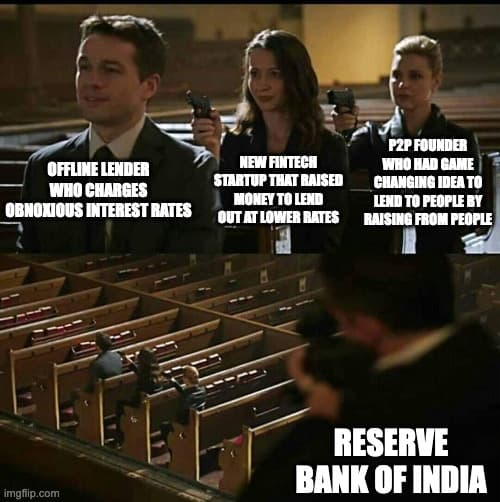

These VC funded companies like Liquiloans changed that by saying that return is guaranteed which is not the case. This might be become a Ponzi scheme when borrowers doesn't pay back.