Someone please explain how exactly valuation of a company is done. Curious!

I mean if I give you revenue data, Adjusted EBITDA , debt, management detail, industry trend, profit margin, discounted cash flow, expansion opportunities, macro economics data ; will you be able to gauge market capitalization of that particular company?

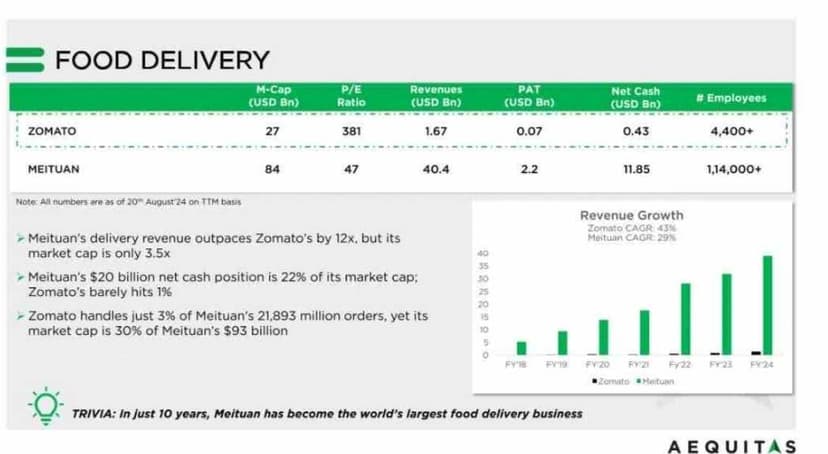

I truely feel Indian stock market is running on sentiments with no correlation with fundamentals whatsoever....

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

Couple of things:

- People are baking a lot more growth for Zomato than they are for Meituan.

- Valuation typically is done with a sum of the parts (SOTP) approach. Building projections for the next couple of years for each business unit, and then imagining how it's EBITDA, revenue scale, growth would be at that point of time (lots of assumptions there)

- Also, might be that China markets have been much more conservative this year. I am not sure though.

I do agree though, that's too much of a disparity in valuation, and I imagine the truth is closer to Meituan's multiples. The moment Zomato stops showing growth and improving EBITDA QoQ, they will be hit.

Market capitalisation is the most useless number imo. All that really matters is revenue and profit margins.

Valuation only comes from what someone is actually willing to pay for a stake in the company. Everything else is theoretical until then and even after that.

Companies can and do go bust despite the best teams and investors. Stock market and startup ecosystem is not immune to any of it.

The market can remain irrational for as long as it likes, even if it's disconnected from ground reality, simply because it can afford to. There's enough money floating in the system.