Investing in NPS

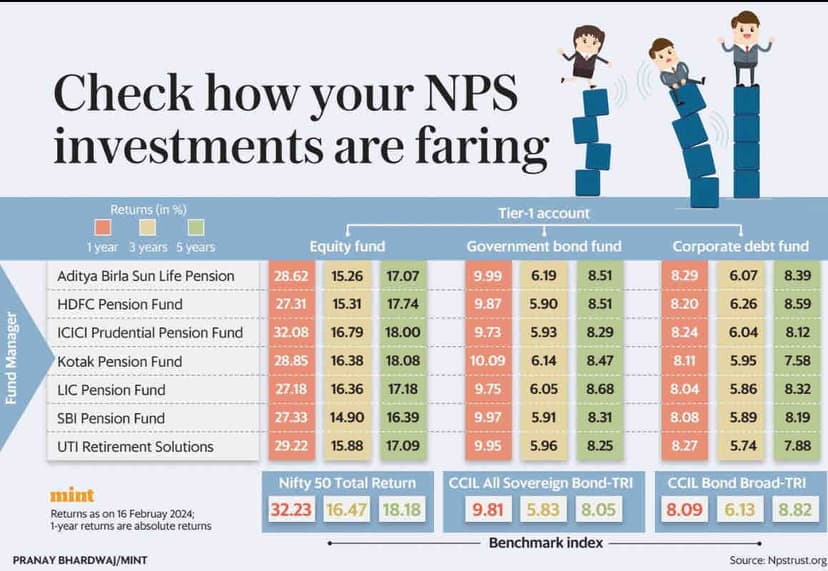

I am planning to invest in National Pension Scheme. Is it a wise decision or any better options for retirement planning? And if you have already invested pls suggest which one to invest in.

Please let me know your views if you have inv...