This really hit to core

Talking product sense with Ridhi

9 min AI interview5 questions

We pay first world level taxes for a third world social security with 0 benefits.

It's been 75 years of taxes now. Why people are still crying about it? Are these guys stupid or what? If you really have such a problem with taxes, go ahead and open a business. No one forced you to do what you do. And it's not that suddenly one day the govt chose to implement taxes. It was always there since our country became independent. Just a PR stunt.

You work at Infosys, you don't know what tax slabs are yet.

Do you think people are complaining about taxes? How naive do you have to be?

People are saying, for the taxes they pay, they don't get much in return. Neither good nationalised Healthcare nor affordable good education. And apparently if you indeed are in bangalore, neither a good infrastructure

First time agree with a jutuber

Yea, I don’t follow his advice but here he made sense

Why are people forgetting that tax is limited for a Financial Year?

You just pay a tax for first time and think it'll be same till your death

CA's are like, bruh you didn't know I existed, your fault

And if someone paid 40% this year, he'd pay less than that next year, since he got his brain in his place 🤷

Ofc, it hit to core, but can't help

I agree but the system is not flexible. I was earning well last FY and shifted to new regime to save tax. Now the cash flow is low. I could have saved more if I was allowed to keep old regime but that's not the case. I pay tax irrespective of whether I'm earning good or not

Remember the Kaamwali that cleans your home, washes your utensils and cooks your food. The safety net is for them. Without this you will either be doing your own house chores or paying a much higher salary to these people so that they can pay the fees for private schools and hospitals.

The reason you are taxed is not to provide services to you. But to account for the fact that you are able to do those things because someone at the bottom of economic pyramid is doing the shit jobs and they need that safety net.

And even if those who benefit may not be working in your home but a mine in Bihar, their work ultimately creates either leads to comfort or economic benefits for you.

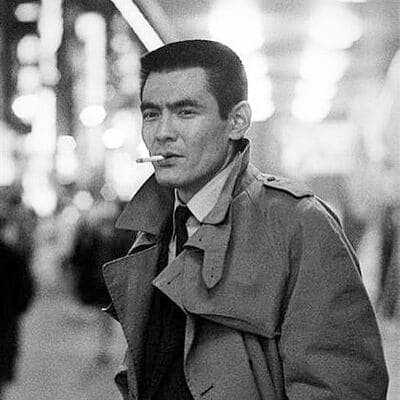

if you are honestly paying taxes in this country, you are mentally retarded.

tax kaise bachae sir jab salary 50lakh ho

So true... First they deduct taxes and then give the salary....

anyways, we all need to agree, double taxation is scam. you pay tax when credit and again when you r spending...

If you are earning 1lac, register yourself as a freelancer. This way you can claim 37.5L as expenses, without having to submit receipts. Talk to your company accountants. The rule is 50% of income till the cap of 37.5L (i might be paraphrasing). So taxable income is 62.5. You pay ~20L in tax.

Other way is to structure the pay package such that you get reimbursed for every small thing that is tax deductible. Eg: rent, office rent expenses, phone, car, etc. can be tax deductible if this is the part of your benefits. I don’t know the exact rule here, but many companies do it.

Meant 1cr. Sorry