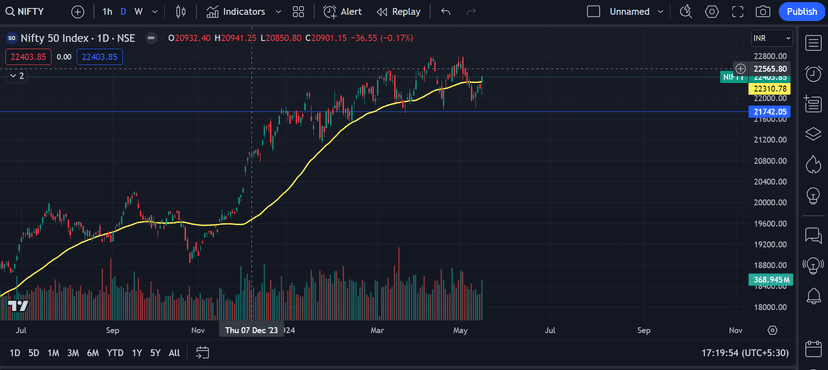

[TRADING] OPPORTUNITY TO BUY OR OPPORTUNITY TO SELL ?

This was my last market update. I built a portfolio in real-time, explaining what I'm doing and why I'm doing it.

https://share.gvine.app/VaSwtbqJVzF384YRA

I have given a list stocks in the comment section where i want to build newer positions. I have given some psychology related tips as well. Check them out.

Out of the list Jindal, ABB, Siemens, Colpal, ICICI B, TATA S I did cut down on ICICI Bank and Colpal last week as they were around 2-3% gain. I found another opportunity in Havells as well. Although I didn't make a post about it or update it here, I did discuss it with @TheOatmeal in the DMs when i got in. My avg Buy price is 1575.

I have certainly been very lucky in this cycle. Well it's not just pure luck i did identify leaders of the current run and have been doing this for quite some time now. But the moves in my portfolio have been amazing and pretty smooth during recent fall as well. My top 3 winners are -

Jindal - +23.14% ABB - +39% SIEMENS - +44.32% These 3 stocks have given me a lot of cushion to operate further. None of the above 3 stocks violated their trending pivot during the market fall.

I made a few posts about SBI and that trade is still on. Check it here. https://share.gvine.app/yXc9GETSiWn8c2Uz8

https://share.gvine.app/yYujDrw15CLsLxC59

Today's session was excellent. The Nifty moved around 300 points in just 20 to 25 minutes, potentially wiping out months of gains for option writers and cleared up all the short term bearish players out of the system.Such moves in a single day can decimate months and months of hardwork. Just stay away from options if you can.

VIX often rises during election years, as seen in 2014 and 2019. I will only be concerned if it crosses 30 and stays there. Otherwise, it's not worth overanalyzing.People link rise in VIX with Possibility of government changes but if the market senses a shift, 8-12% would just go in a few sessions. The market will not give us a lot of time to manage our positions.

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

Taking Inspiration from @salt . Tagging everyone who has ever interacted on my Market related post or in DM. If you don't want me to tag you in future posts let me know and i will remove you.

@salt @TheOatmeal

@Ambani007 @followthemoney @OblongFlood @Ironman30 @S077 @President_Trump @LowTeapot @AITookMyJob @YourManager @SarjapurDon @GallonMusk @RichDadsPoorSon @HugeCougar36 @FineReason @BinaryBillionaire @MaushichiTaang @UsefulTailor @LosingmakesnoCents @ModiMeloni @roct @Greyhat @InsidiousBruh @Elon_Musk @AlphaGrindset @Lootmaster @ChhotaBheem @ShinyGrey90 @BiryaniEnthu

Bro you are a badshah. 👑

This is some insane analysis. I will emulate some of these trades as well. The rationale is immaculate and super well thought out.

Just some risk management and I’ll be golden.

Very good @steppenwolf

You are the OG goat.

Hahaha Thanks @salt . This. Risk Management. The moment one gets it, no way the market can throw you out of the system ever. People think that the stock market is a money making business. It is not. The stock market is the Risk management business, if you are pretty good at it, Money follows.

Also look into Railways related stocks. They are moving together. Sister stock movement is happening. IRCTC and IRFC have given opportunities today.

@steppenwolf

This is crazy. How did you even learn all of this? Do you know about Molly mixed with Promethazine? You are just like that but even better. Good one

I had to use chat gpt to interpret it. Hahahaha. Thank You. I have a mentor who has helped me immensely. I have to read a lot of books as well. A lot of market screen time and weekend homework.

Lovely stuff @steppenwolf I'm gonna copy from your picks :) Thanks!

Thanks @AlphaGrindset . I will soon start explaining how to enter, it is a very important part. You can assess Risk : Reward and then enter. How many quantities one has to buy ?

If there are 4 opportunities and you can take 2, which one to go for?

All these things will get cleared.

Can you do one analysis on election results.

Hypothesis H1: BJP wins, what are some of the safe bets one can take before election (assuming person can put somewhere between 5-10L)

@Learningmind That time has gone. The market has already factored the BJP win.

I don't know if you have ever traded, but if you are not much experienced, wait for a fall to bring in fresh money.

You can look into the FMCG sector if you want to bring in fresh money at this stage. I will try to make a post about it.

Currently to bring in fresh money, Risk : Reward is in the FMCG sector only. Some eg. VBL, GODREJCP etc.

You can enter into other high beta sectors as well like banks, Metal, Auto but Risk: Reward there is limited.

Eagerly waiting 🙂

If you're worried about market fluctuations on the downside and you have a lot of outstanding Positions. Imagine a significant fall of 3-4% on the index and plan your response.

If it were to happen in the future, your brain will have already seen it and will be well equipped to follow your rules. You will keep your fat fingers in check and avoid impulsive decisions ensuring you don't end up selling stocks you shouldn't have.

This is the POWER OF VISUALIZATION and it works very well in the market.

Coming back to the market, apart from Nifty IT Index, not even one index has violated its trending pivot. Not even one index has gone into a downtrend. It's just that volatility has risen a lot and a lot of people come to the market with a short term mindset. So if they buy something and they see a sudden fall, they think that things are changing or the market is going into a downtrend.

Uptrend is still intact but with bouts of Volatility. We will move 2 steps up 1.5 steps down on a broad market level but some stocks are going to outperform massively.

I will keep buying and will only cut major positions if Nifty starts slipping below 21700-800 decisively.

I did trim some positions last week during the market fall but didn't touch my winnin stock or stocks still following their trending pivots. Rules matter. In TRADING , If a stock were to move from 100 to 200, you cannot capture the first 15, you certainly cannot capture the last 15.. The middle part, 70, is our bread and butter. Never sell a stock believing that the top has been made. Until the structure violates I don' sell my top performing stocks.

I don' have a lot of capital to deploy now, so i may book some profit in ABB, Siemens to build newer positions. I am monitoring the follo stocks. I have entered BhartiAirtel, Dixon already.

Large Cap - BHARTIAIRTEL, DIXON, M&M , GODREJCP, INDIGO, VEDL

Small caps -JYOTICNC, DEEP INDUSTRIES, MOIL, ANANTRAJ, AUTOMOTIVE STAMPINGS, GEOJIT FINANCIALS, WELSPUN CORP, HUDCO.

Polycab give me 290%Profit till now

Woah. Great 🔥