Jobs

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑+322 new users this month

SillyBiscuit

Stealth19mo

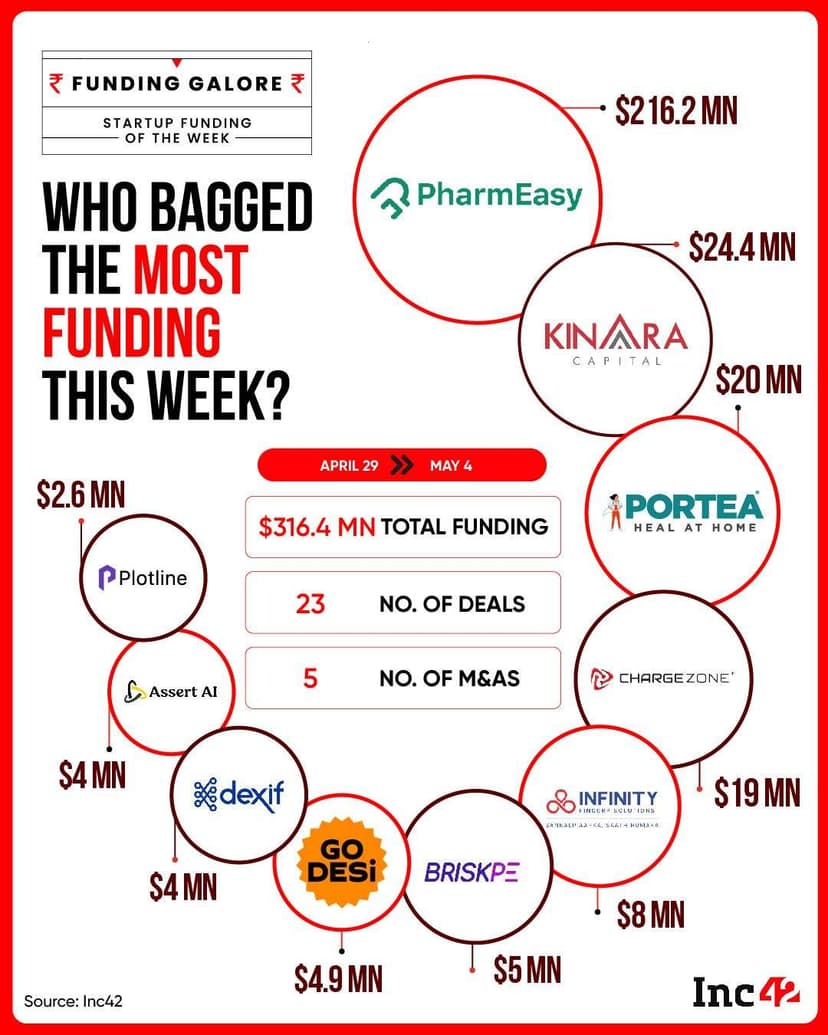

It's (API Holdings) getting funded at 90% de-value. Their parent company is pulled down in terms of profitability only because of its B2C arm i.e PharmEasy which is doing better than ever before (although has much lesser set of orders fulfilled - gotten rid of bad discount hungry customers).

The diagnostics arm is also a profitable one, given the margins in diag are crazy high.

PharmEasy has gotten rid of folks who were overpaid (which is continued in startups in general).

B2B folks know to make dhandha here. Hopefully works out for B2C soon.

- an ex-employee

SillyMochi

Stealth19mo

How is culture with Kinara Capital? Somehow it's not in anyone's talk so far

SquishyBanana

Freelancer19mo

🧢

Discover more

Curated from across