I'm Saurabh Jain, Co-Founder & CEO at Stable Money. Ask me anything!

Hi Grapevine,

I'm Saurabh, currently building Stable Money, India’s largest platform for fixed return investments.

I'd love to chat with you folks about my ...

Hi Grapevine,

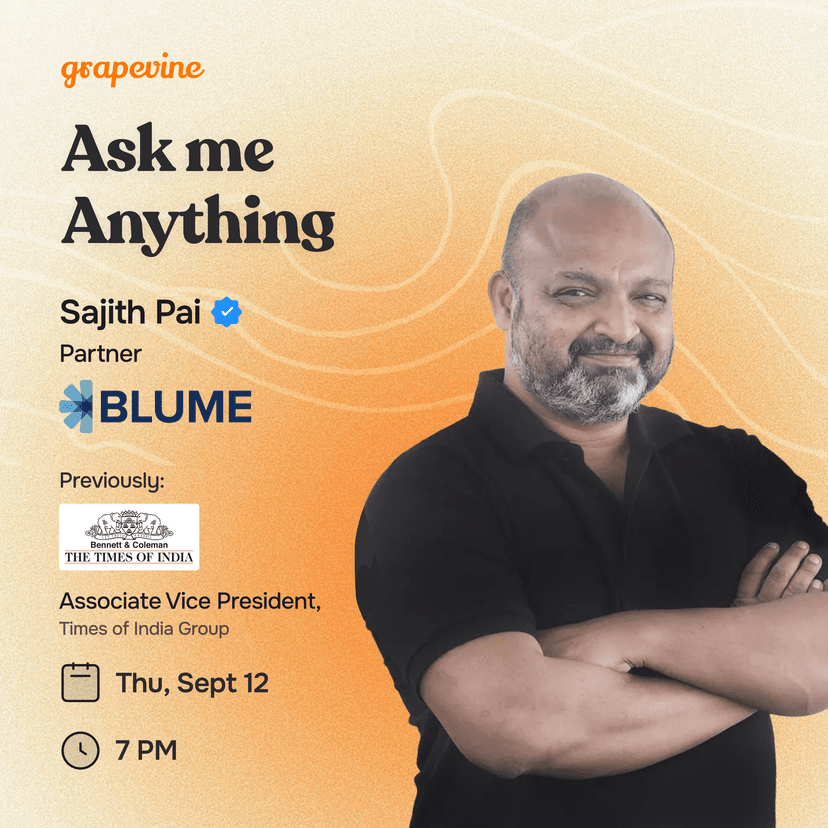

I'm Sajith, Partner at Blume Ventures, where I oversee consumer and India B2B investments.

I am a long-time media executive turned VC. After a two-decade-long stint in Media & Entertainment, much of it in The Times of India Group, across Strategy & Corp Dev roles, I moved to Blume Ventures in 2018.

Outside of work, I like to read, think about, and write on tech, business, culture, and their intersections.

I'd love to chat with you folks about my journey from media to VC, my thoughts on startups & venture investing, PMF, amongst other things.

Ask me anything. I'll be back at 7 PM to begin answering! :)

Hey Sajith, Great to see you here and very much thanks for doing this.

What factors does Blume consider while investing in a Tier 3 College founder with early product traction.

For B2B and B2C companies What are the approximate revenue and metrics to be called as an startup eligible for Preseed Funding.

Does Blume invest in Indian Startups wanting to serve primarily in U.S Markets whose problem statements also based in U.S Market.

How important is founder market fit. If a first time Tier 3 college founder is going to a unrelated sector and has early traction, will Blume fund them ?

Does Blume have a plan of starting an Incubator on the lines of YC.

@DarlesChickens

Hey, for our fund ($290m) and stage of investing (advanced seed / preSeries A where we invest $2-4m for 12-17%) and our profile, we do get a lot of high quality inbounds, and have access to top tier plays. We dont differentiate between founders on academic pedigree. Corp pedigree and where they worked (high growth startup experience primarily) does matter and to some extent it is tied but not exclusively dependent on acad pedigree. That said, if you are a first time founder we would like to see some significant product love and early market traction. I dont think acad pedigree matters at all.

Criteria mentioned on the site. But essentially / realistically if you are referred to us, $250k upwards of annualised rev for B2C plays and at least $100k upwards of ARR for B2B cos.

Ideally no....but if it begins in India and then sees a lot of traction from US (ultrahuman for instance) it is fine.

Again, acad pedigree doesnt matter, but we like to see some evidence of right to win / founder market fit. Great traction can make up for everything - no acad pedigree, no founder market fit:)

No!

a huge opportunity missed for #3. Hope some VCs explore this sooner.

Hey Sajit, I always wanted to understand. Why are most investors more likely to invest into founders from IIT/IIMs v/s from lower tier colleges? Thanks in advance

@PracticalThrust Essentially signals of higher probability of success. I think it is a bit misplaced and i dont give it much importance, but from one angle it makes a bit of sense. IIT/IIM/BITS/ISB are proxies for high opportunity cost (higher pay) and hence starting up means a founder is giving up a higher opp cost, and hence it is a signal that this opportunity is more valuable. YMMV but to me this is the only logical explanation, and perhaps that other downstream investors will give more value to acad pedigree....but i suppose good traction will overcome all that.

Hi @SajithPai! Glad to have you at GV. Enormous respect for your content and the public good you do sharing in-depth reports, thought pieces and podcast transcripts.

Wanted your thoughts on a quick question I had: You consider WHJ as one of your top Anti-portfolio companies and you have said that several times. While I understand the sentiment you have wrt an early investor. It would have made you and Blume millions of dollars (post sale to Byju's). And obviously, Anti-portfolio is an after thought - i.e. If you were to do it all over again, you would go ahead with the investment. But another fact about WHJ that one shouldn't ignore is the rampant misselling done by the product including the much acclaimed and infamous Wolf Gupta. Several parents (not all of them privileged like the two of us) were scammed(FOMOed? / bullied?) into subscribing for a product that didn't make financial sense for them or educative sense for their kids. So, while the returns on Sale of WHJ were largely from existing (or new) investors of Byju's, they were also from hard earned money of naive parents who went beyond their means to provide good quality education to their kids and fulfil a dream that was just a marketing gimmick and never existed in the first place. With this context, would you still want to go back in time and invest in WHJ? And would you still consider it at the top of your Anti-portfolio?

Disclaimer: I have nothing but respect for Karan Bajaj in his past life as an acclaimed author and media person)

@DaringTrain Great Q! This is something i have thought abt, and my team members have asked me too. No easy answers here.

It is true that my regret / antirportfolio misery was a bit mitigated by WHJ's later challenges.

I do feel that experience of passing because of a mistaken low TAM taught me a lot....and hence i consider it my antiportfolio but i feel less guilt / regrets with passing months given what happened.

Hi Sajith,

Blume Ventures is a dream for many. Here's a simple question:

How do you know when a portfolio company is underperforming? Founders can sometimes hide the truth, and with a large portfolio, it's not feasible to check on every startup and consumer personally.

@ebuHatela We see it from the MIS and one thing i always tell my founders is that there is no pressure on them to grow / crank up rev for the sake of it. We do look for high quality rev - rev growth w good retention and good unit econ - and do not encourage growth sans retention / repeats / good contribution margins etc. I never stress only 1 metric (like rev); i always push for a check metric on the north star metric which is a quality metric. Early days it is rev + engagement / retention usually.

What you are saying is true and it does scare me a bit as to a mojocare or gomechanic situation in my portfolio. So far havent had and i do encourage my founders to not worry abt growth for the sake of it or do short-term things. Ultimately it is their co, and i am only a temporary but long-term steward of the co.

Thanks for the insight

Hey Sajith,

Really great to meet you Your portfolio consists of Edtech startups, but unfortunately we have seen a lot of poor outcomes here.

Had two questions:

Thanks in advance :)

@AlphaGrindset Classplus, Virohan, Uolo and Leverage are all doing well for us. But yes, edtech has been a tough space. I like skilling, super early education (ideally w some daycare linkage), English-learning leveraging AI, adult lifelong learning (as we all seek to live longer and work longer) etc.

Re Byju's ya, what to say, so much has been said abt it ha ha. I suppose (early) investors need to push back on governance early when they see signs of founders not paying attention to it is one way....but perhaps there are other factors at play as well here.

Hi Grapevine,

I'm Saurabh, currently building Stable Money, India’s largest platform for fixed return investments.

I'd love to chat with you folks about my ...

Hi Grapevine,

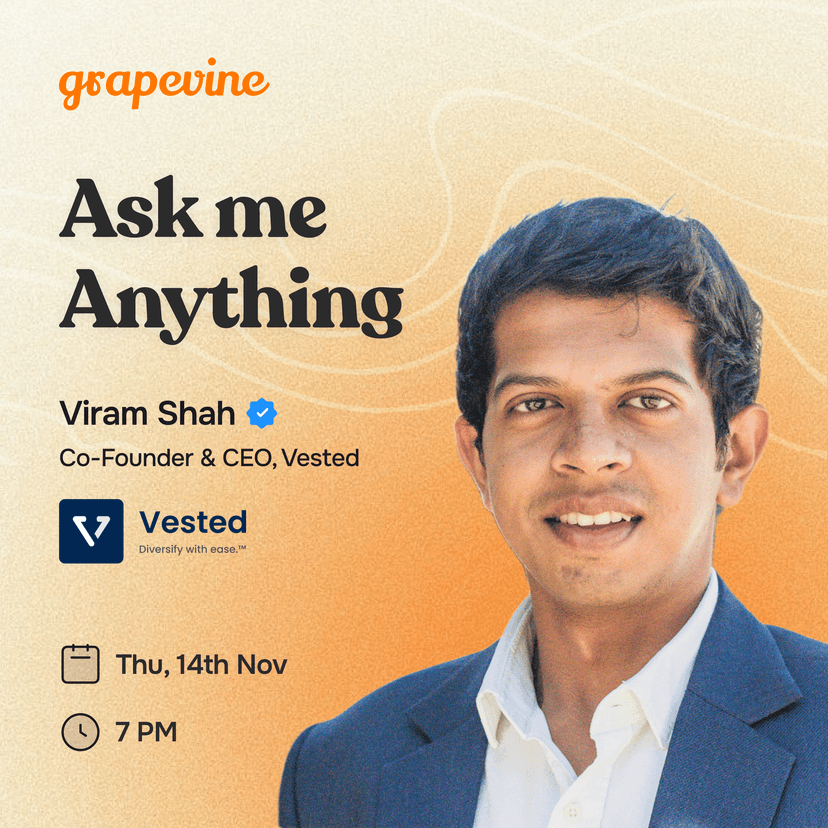

I'm Viram, currently building Vested Finance. I founded Vested in 2019 during my MBA at Haas, wanting to make global investing as easy and acces...

Hey Everyone,

I'm Vaibhav Vardhan, Co-Founder & CEO at Inc42. We are India’s #1 startup media & intelligence platform that informs, educates and empowers startup leaders & operators through our incisive reporting and industry-leading ...