Hi Grapevine,

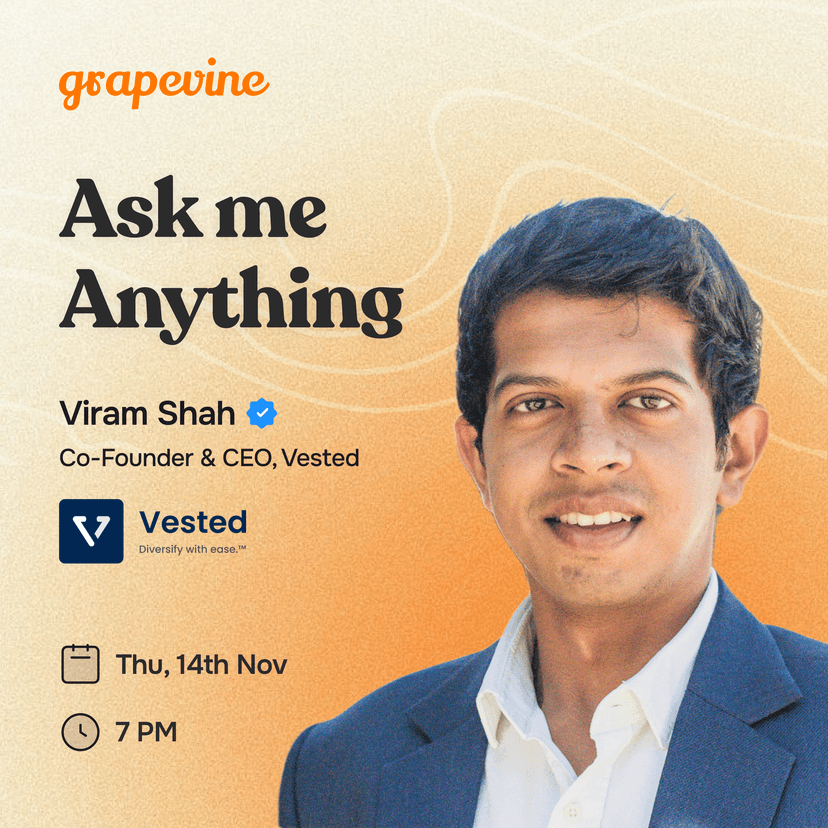

I'm Viram, currently building Vested Finance. I founded Vested in 2019 during my MBA at Haas, wanting to make global investing as easy and accessible for Indian investors as shopping online. Today, Vested empowers Indians to invest in global brands, theme-based ETFs, and custom portfolios known as Vests, all in a simple, affordable, and secure way.

Before launching Vested, I spent time in investment banking with J.P. Morgan and worked in fintech, analytics, and AI startups - experiences that ultimately shaped my vision for Vested. With an engineering background, an MBA, and SEC registration as an investment advisor, I landed in the world of international finance.

One quirky fact about me? I’m a big believer in parallel universes and the concept of rebirth! And here’s one bit about my name that never fails to come up when I meet someone new: "It’s Viram, not Vikram!”

Excited to talk about my journey, thoughts on global investing, and vision for Vested’s future. Whether you’re curious about international finance, doing your MBA abroad, or want to chat about startup life (or parallel universes!) – ask me anything!

I'll be back at 7 and begin answering :)