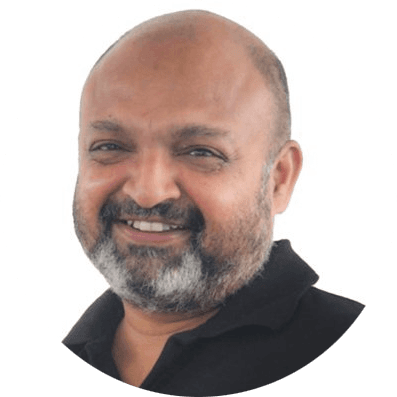

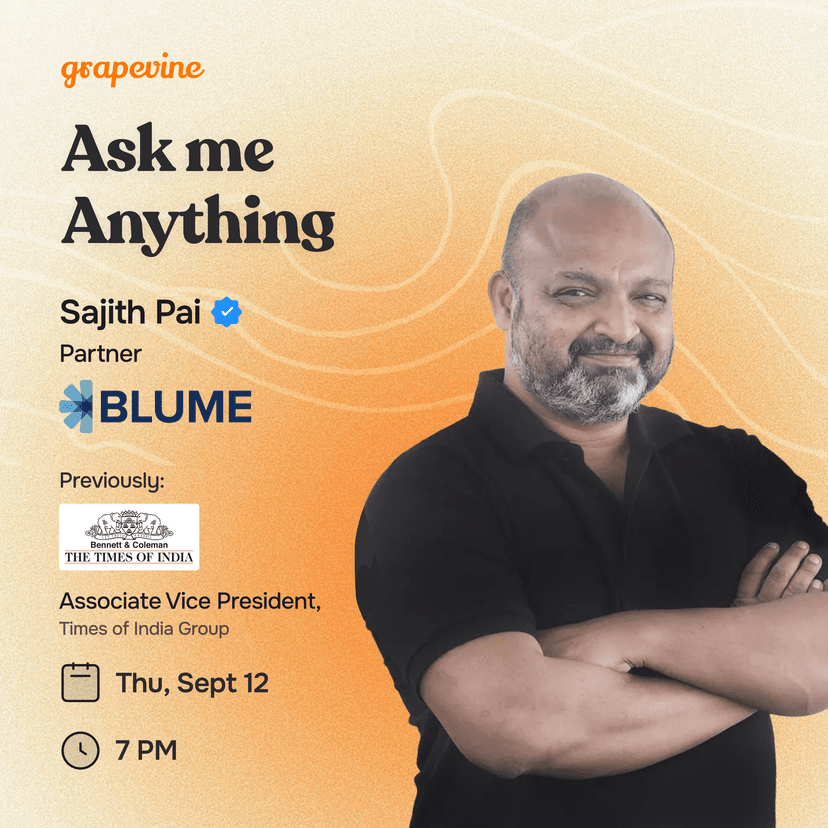

I'm Sajith Pai, Partner at Blume Ventures. Ask me anything!

Hi Grapevine,

I'm Sajith, Partner at Blume Ventures, where I oversee consumer and India B2B investments.

I am a long-time media executive turned VC. After a two-decade-long stint in Media & Entertainment, much of it in The Times of India Group, across Strategy & Corp Dev roles, I moved to Blume Ventures in 2018.

Outside of work, I like to read, think about, and write on tech, business, culture, and their intersections.

I'd love to chat with you folks about my journey from media to VC, my thoughts on startups & venture investing, PMF, amongst other things.

Ask me anything. I'll be back at 7 PM to begin answering! :)

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

Hey Sajith, Great to see you here and very much thanks for doing this.

-

What factors does Blume consider while investing in a Tier 3 College founder with early product traction.

-

For B2B and B2C companies What are the approximate revenue and metrics to be called as an startup eligible for Preseed Funding.

-

Does Blume invest in Indian Startups wanting to serve primarily in U.S Markets whose problem statements also based in U.S Market.

-

How important is founder market fit. If a first time Tier 3 college founder is going to a unrelated sector and has early traction, will Blume fund them ?

-

Does Blume have a plan of starting an Incubator on the lines of YC.

@DarlesChickens

-

Hey, for our fund ($290m) and stage of investing (advanced seed / preSeries A where we invest $2-4m for 12-17%) and our profile, we do get a lot of high quality inbounds, and have access to top tier plays. We dont differentiate between founders on academic pedigree. Corp pedigree and where they worked (high growth startup experience primarily) does matter and to some extent it is tied but not exclusively dependent on acad pedigree. That said, if you are a first time founder we would like to see some significant product love and early market traction. I dont think acad pedigree matters at all.

-

Criteria mentioned on the site. But essentially / realistically if you are referred to us, $250k upwards of annualised rev for B2C plays and at least $100k upwards of ARR for B2B cos.

-

Ideally no....but if it begins in India and then sees a lot of traction from US (ultrahuman for instance) it is fine.

-

Again, acad pedigree doesnt matter, but we like to see some evidence of right to win / founder market fit. Great traction can make up for everything - no acad pedigree, no founder market fit:)

-

No!

a huge opportunity missed for #3. Hope some VCs explore this sooner.

Hey Sajit, I always wanted to understand. Why are most investors more likely to invest into founders from IIT/IIMs v/s from lower tier colleges? Thanks in advance

@PracticalThrust Essentially signals of higher probability of success. I think it is a bit misplaced and i dont give it much importance, but from one angle it makes a bit of sense. IIT/IIM/BITS/ISB are proxies for high opportunity cost (higher pay) and hence starting up means a founder is giving up a higher opp cost, and hence it is a signal that this opportunity is more valuable. YMMV but to me this is the only logical explanation, and perhaps that other downstream investors will give more value to acad pedigree....but i suppose good traction will overcome all that.

Hi Sajith,

Blume Ventures is a dream for many. Here's a simple question:

How do you know when a portfolio company is underperforming? Founders can sometimes hide the truth, and with a large portfolio, it's not feasible to check on every startup and consumer personally.

@ebuHatela We see it from the MIS and one thing i always tell my founders is that there is no pressure on them to grow / crank up rev for the sake of it. We do look for high quality rev - rev growth w good retention and good unit econ - and do not encourage growth sans retention / repeats / good contribution margins etc. I never stress only 1 metric (like rev); i always push for a check metric on the north star metric which is a quality metric. Early days it is rev + engagement / retention usually.

What you are saying is true and it does scare me a bit as to a mojocare or gomechanic situation in my portfolio. So far havent had and i do encourage my founders to not worry abt growth for the sake of it or do short-term things. Ultimately it is their co, and i am only a temporary but long-term steward of the co.

Thanks for the insight

Hey Sajith,

Really great to meet you Your portfolio consists of Edtech startups, but unfortunately we have seen a lot of poor outcomes here.

Had two questions:

- What spaces within Edtech still make you bullish about it's future?

- How do we as an ecosystem avoid another Byju's situation?

Thanks in advance :)

@AlphaGrindset Classplus, Virohan, Uolo and Leverage are all doing well for us. But yes, edtech has been a tough space. I like skilling, super early education (ideally w some daycare linkage), English-learning leveraging AI, adult lifelong learning (as we all seek to live longer and work longer) etc.

Re Byju's ya, what to say, so much has been said abt it ha ha. I suppose (early) investors need to push back on governance early when they see signs of founders not paying attention to it is one way....but perhaps there are other factors at play as well here.

Hey Sajith

@salt here. the og grapeviner.

Need your most candid response to this query:

What’s the criterion for being seriously considered for a startup idea? How hard do you index on pedigree; (undergrad/masters + workexp)?

@salt I have talked abt the pedigree aspect (not at all) above so wont dwell on it. I invest in idea stage usually for second-time founders / L1s from high growth startups. Otherwise happy to pay up for traction. Founder-market fit / right to win and past experience as founder / elite operator is the criteria i use for funding startup ideas.

Hey Sajith, do you agree with the following statement?

"When you have PMF, you'll know it for sure. If you are in doubt, you don't have PMF"

@MT_Ego Hmmm....i think there is some truth to this, but not always true. You can have crazy growth with retention and weaker unit econ and mistake it for PMF.

Do you think it’s a high integrity act when VCs build up companies from their own portfolio as great/exciting companies without disclosing they have a vested interest? How do you think these interests be disclosed while pumping/promoting the said startups?

(Not saying you do it, just in general)

@Umadbro hmmm....i think whenever a VC mentions a co you can take it for granted that there is a vested interest / portfolio co. Just the nature of comms. Maybe this is a signal for me to praise / highlight / talk abt non portcos more!

Hey @SajithPai thanks for doung this.

- What advice would you give to a startup in the early stages of fundraising especially when they haven’t fully achieved PMF yet?

- what are the most common mistakes startups make when pitching to VC and how to avoid them?

- what are the earliest signs you look to determine whether a company has achieved or is in the verge of achieving PMF?

Hi Sajith, lucky to have interacted multiple times with you - welcome to Grapevine!

For the audience here, can you share the inspiration behind the Indus Valley Report and how it has evolved since its inception? What has been the most rewarding aspect of authoring a report that has become such an anticipated fixture in the Indian startup ecosystem?

One of my favourite reports out there ❤️

@jinyang Thank you! I had read the Mary Meeker reports and thought there was a space for a similar report from India, interpreting India to the world. I thought the report could not only help provide a true picture of India, warts and all, in all its nuanced glory, to the world, but could also market Blume to the wider world. The most rewarding aspect has been how it is slowly growing to be a leading reference point for India non-tech abt the tech / startup world (heard from a WSJ journalist that an Indian minister pointed him to the Indus Valley Report!). Long way to go, and lots of pressure to keep making it better every year!

Have three questions:

-

How would you evaluate a startup like Grapevine: pre-revenue+some arbitrary monthly burn+extreme user love? How do you evaluate price discovery mechanisms for valuing such a company?

-

Do you think that Grapevine has an edge over other incumbents in the space to garner more mind share? If yes, what are your thoughts on Grapevine and have you heard about the app from your latent social circle (trying to understand its reach)?

-

Do you look at other funds and wonder what made them invest in a company? Does that bring a sense of FOMO on certain hot investments?