Value Investors

Which stocks according to you are undervalued and why(Ind and US stocks)

For me - Meta, Weibo and alibaba are significantly undervalued.(All US listed)

Which stocks according to you are undervalued and why(Ind and US stocks)

For me - Meta, Weibo and alibaba are significantly undervalued.(All US listed)

Quick question folks: What apps are you using for US stocks? How do taxes work? Will really appreciate a reply 🙏

Really

Indimoney

GSFC, BF Investment, Brightcom Group : My future finds, please analyse them and tell if there are any red flags(if any).

Brightcom Group? Do you track news by any chance?

BCG Seriously,I lost my 30k there 😂😂😂

Almost all top private sector banks are in deep value category. You can do an equal allocation SIP to top 5

Any analysis you can share to back this?

@SoloLeveler look at the PE ratio of Hdfc, Axis, ICICI. Look at the results they are delivering qoq. They are undervalued. It's just that PSUs are giving them a tough competition for capital allocation. But their time will come for sure. SIP is the best route if you wanna capture it.

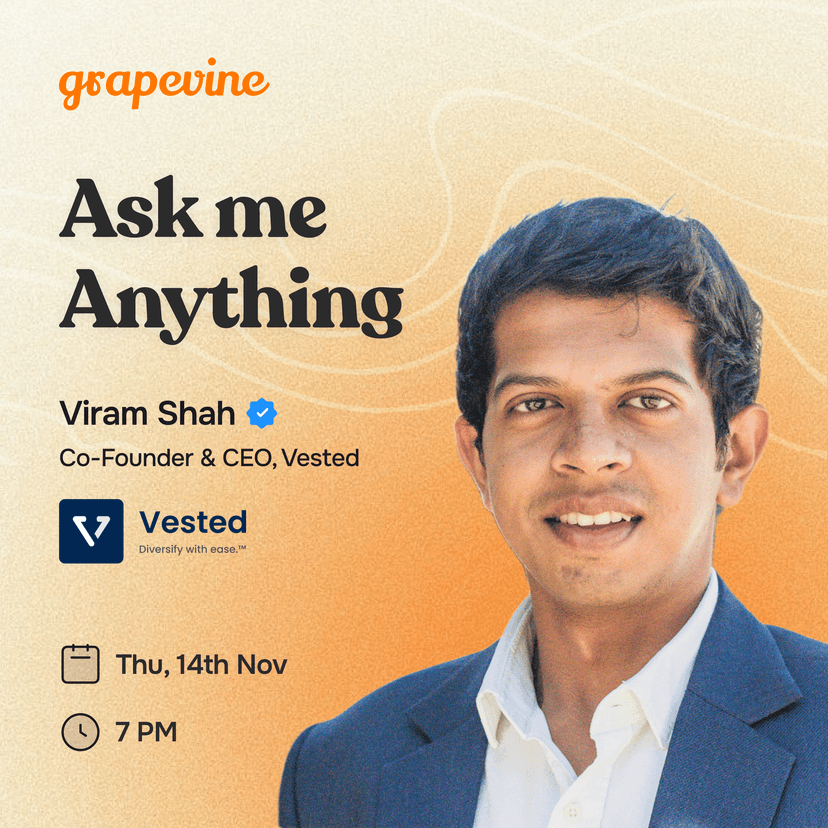

Hi Grapevine,

I'm Viram, currently building Vested Finance. I founded Vested in 2019 during my MBA at Haas, wanting to make global investing as easy and acces...

Hi @ViramShah I’m @salt Wanted to ask you two questions: 1. Would you recommend moving to the US, if...

Which are the best US / global stocks to invest in right now? I have installed IndMoney and looking to invest in attractive global companies... Looking forward to some awesome insights🙂