It’s not just about the numbers or the investments; it’s about the work that’s already been done—money moving, building wealth, and generating returns without having to clock in every day.

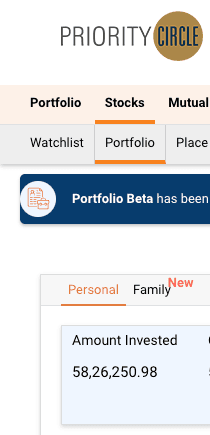

For a long time, I thought my monthly in-hand was the main metric of success. I was focused on the number that hit my bank account at the end of each month. But over time, as I began to pay attention to my investments, something remarkable happened: my portfolio started to move more, sometimes much more than what I made through my 9 to 5.

It’s important to note that this didn’t happen overnight.

The journey hasn't been without challenges, and there have been days(DeMo and Covid) when my investments burnt like hell. But knowing that my portfolio has the potential to grow beyond my monthly earnings keeps me motivated and focused.