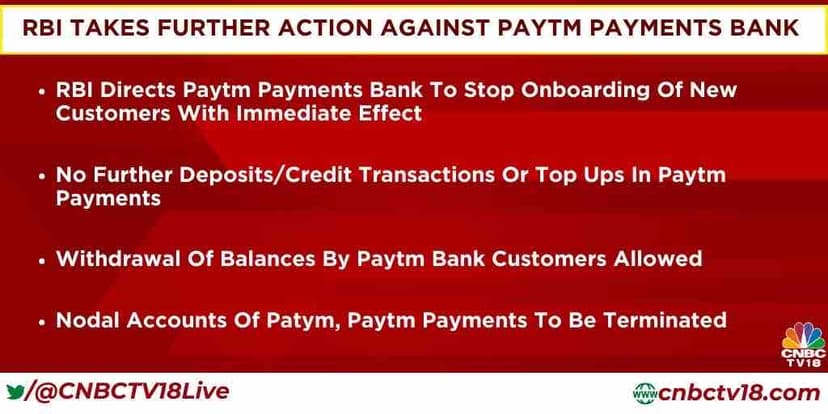

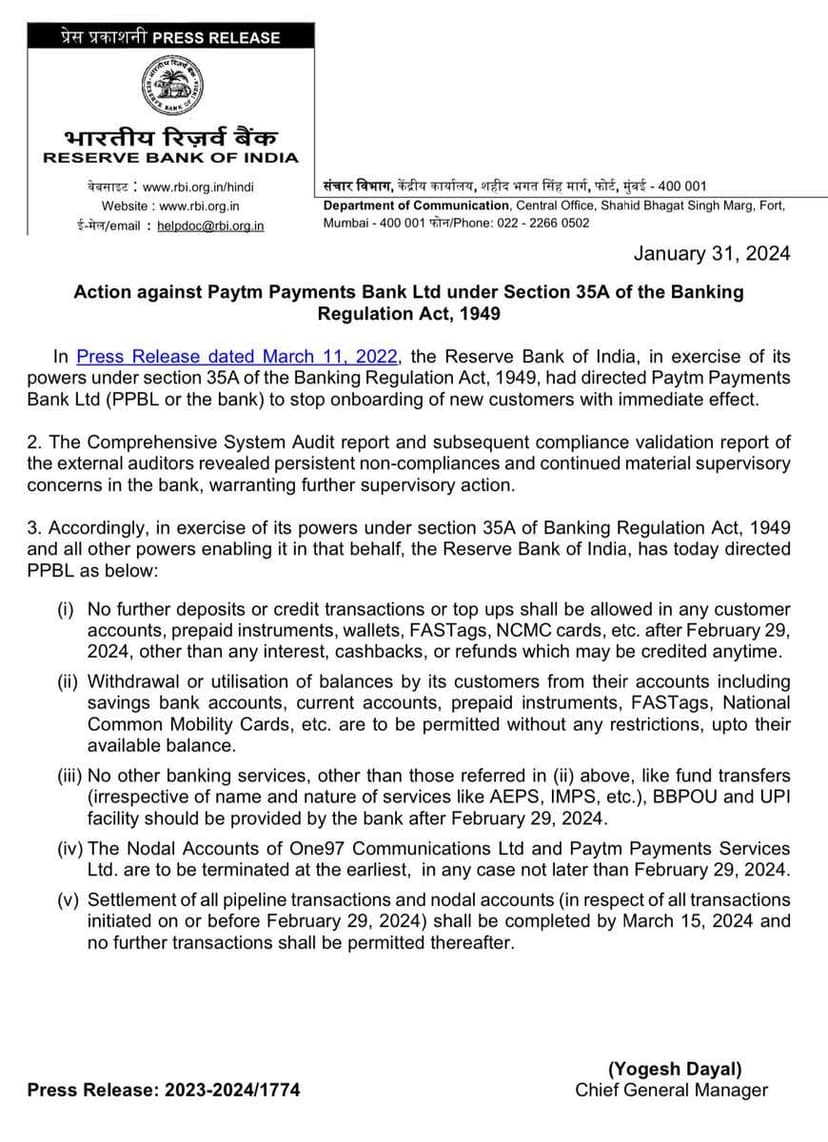

Paytm gets a shock from RBI

PAYTM Payments Bank essentially asked to shut shop.

Afaik here are the few implications

- Stock market will react in a bad way to them

- Worst affected are going to be FasTag users who bought from PayTM.

- No deposits / credits allowed in any account. Withdrawal is allowed.

- UPI not allowed after Feb

Talking product sense with Ridhi

9 min AI interview5 questions

This is eerily reminiscent of Razorpay debacle. Something similar has even happened to AmEx at some point in India.

Appears as though RBI has sensed something that has alerted them to it.

Wait what? So what will PayTM be effectively doing if UPI/deposits/credits aren’t allowed?

Isn’t this everything they do or am I over reading

No, I think it means UPI payments are banned only for the bank. If you have a Paytm Payment account and you're trying to do a UPI payment from that account, that won't be allowed from now on.

What the fuck?

Rules are simple but most seem to not comply . You should not behave as a bank by not having banking license

If you do that you will be In soup . Razorpay’s case was different . RBI is too strict on most aspect . Just check what they did to Kotak and also think why Ambani and Tata don’t have banking license

What is the Kotak story?

That just takes away their entire business model. Wallet and UPI was their end game. I doubt if their store or ONDC is making enough revenue.

I foresee PayTm too cutting jobs and retail investors facing a bloodbath starting tomorrow.

UPI is allowed, only trnxs from Paytm Bank are not allowed.. However, you can do UPI trnxs on paytm using other bank accounts

But to process and acquire upi transactions they use PPBL. So in effect upi is also banned till they figure out a new partner bank

They use Paytm banks infra, they don't make accounts of paytm users on Paytm Bank, so don't think it will be an issue. For example, to process UPI Gpay uses icici or axis banks infra to process but they don't do any deposit or such type of trnxs.

Tomorrow is gonna be a hectic day at the market. Paytm and Budget will have adverse implications and for God's sake of again any other major bank crashes, Investors are gonna get rekt

Paytm layoffs? Impact on job market

Given what RBI has gone today is effectively shut down 60-70% of Paytm’s business, to survive, Paytm will end up doing mass layoffs of a scale that we haven’t seen before in India. And potentially with limited severance (not as generous ...

PayTM, 31st Jan

Can someone explain what just happened to PayTM and if other FinTechs could be subject to something similar?