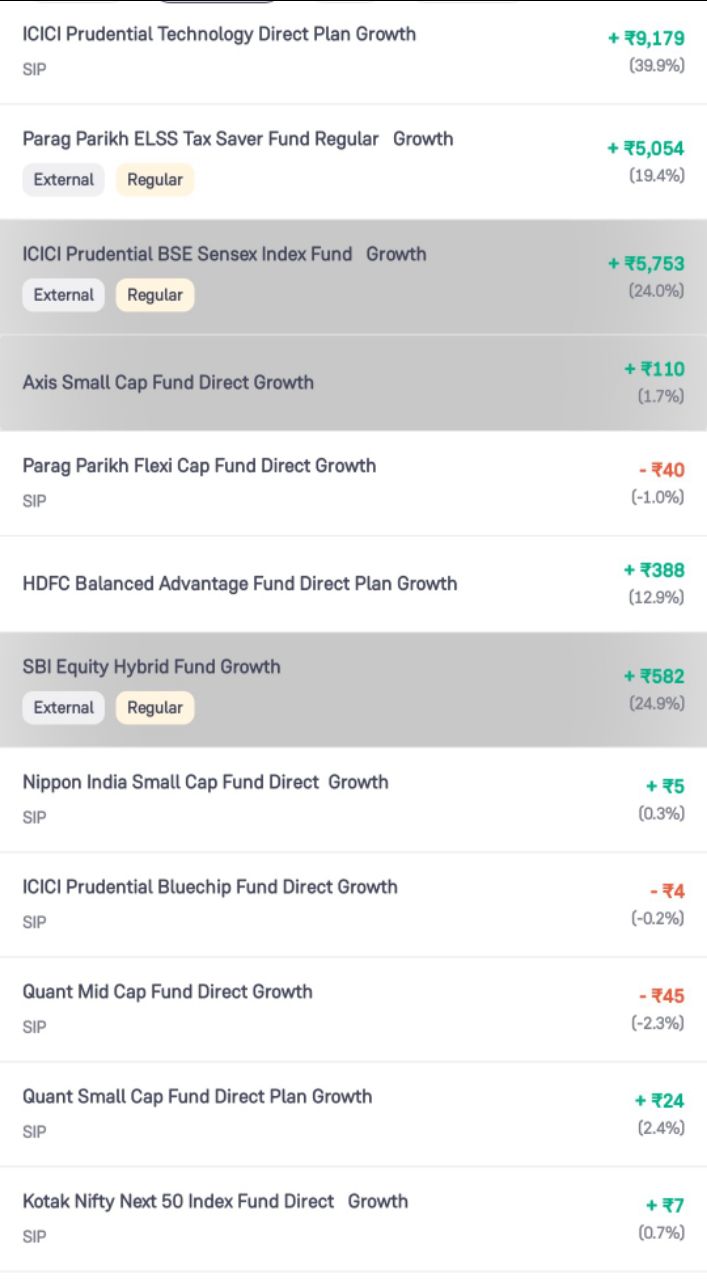

Stop SIP in Parag Parikh Flexi

Parag guys have AUM of 75K Crore have not performed well as compared to the hype. Time to move on from them. Let me know if your Parag Flexi MF is performing good.

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

18% is pretty good. I am happy with 15% only. Don’t rush behind too high promising returns. Well established, well reliable firms, 15+ return, good enough.

Firstly you are mistaking a lot of things. Parag Parikh fund style is Value oriented. There are funds that are either growth oriented, or value. Nowadays fund houses are doing blending, both value and growth. So before investing read the god damn investment strategy of a fund house.

Funnily, your fund cycle has seen a bull cycle of a meager 3 years, and when bear cycle hits, you will be the first one happy about how this fund saves from extreme volatility. Something called "Beta".

Man kids these days 😒

During market down it worked like anchor to my portfolio and now at 18 percentage

I think 2% exit load is on the higher side. People who invested in this MF, what are your thoughts on exit load?

Investment advise please

Age 34

Monthly - 20K

Current SIP

Give it one more year